Bitcoin sceptics often argue that bitcoin lacks intrinsic value, stating that investments like real estate, with their tangible cash flows, are superior.

The myth of intrinsic value

The concept of intrinsic value, influenced by the labor theory of value (LTV), is a misconception. This belief extends to real estate, with the notion that its ability to generate cash flow imbues it with intrinsic value. However, value is subjective and determined by individual perception rather than inherent qualities.

Subjectivity of value

In a free market, value is subjective, influenced by personal perceptions rather than inherent qualities. The value of assets like bitcoin and real estate fluctuates based on individual perceptions rather than predetermined factors.

Bitcoin's value proposition

The value of bitcoin comes from the protection the network provides to stored value and its scarcity. Bitcoin's scarcity, limited supply, and network security drive demand for the digital asset.

Real Estate’s value proposition

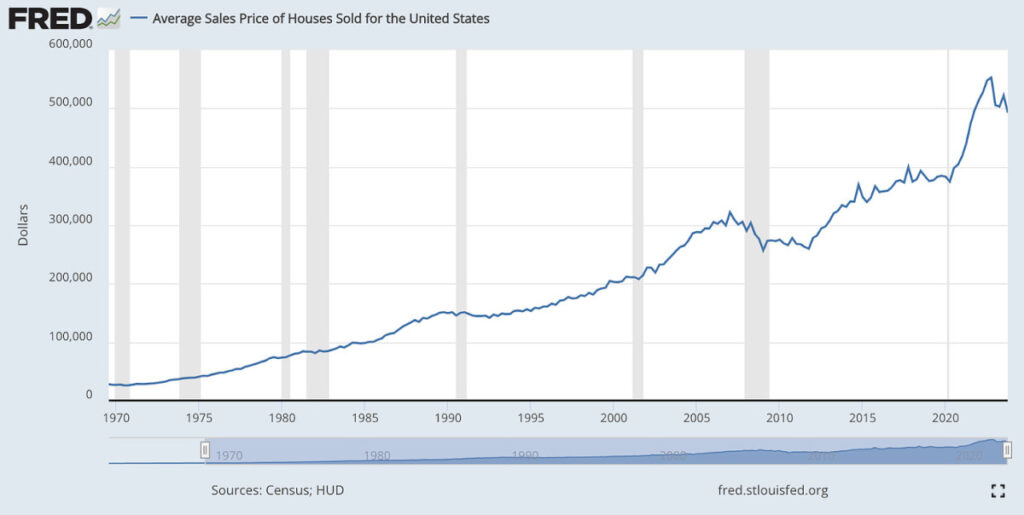

Real estate's high valuation is less about immediate income and more about scarcity and inflation hedging. The increase in housing prices since 1971 is closely tied to the expansion of the U.S. money supply, reflecting the financialization of real estate.

Real Estate vs. Bitcoin

Real estate's popularity as an investment choice is influenced by financing options and cash flow for debt repayment. Bitcoin's unique advantages, including rarity, ease of maintenance, liquidity, and security, position it as a powerful contender in wealth preservation.

Conclusion

The narrative of cash flow and intrinsic value in investments is evolving with the emergence of Bitcoin. As we navigate this paradigm shift, lessons from comparing real estate and Bitcoin will shape our approach to investment and wealth preservation in the future.

This guest post by Leon Wankum explores the changing landscape of investment strategies and the role of Bitcoin in reshaping the global financial system.

Frequently Asked Questions

How much do gold IRA fees cost?

A monthly fee of $6 for an Individual Retirement Account is charged. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

If you want to diversify, you may be required to pay extra fees. These fees vary depending on what type of IRA you choose. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

Most providers also charge an annual management fee. These fees can range from 0% up to 1%. The average rate is.25% each year. These rates are usually waived if you use a broker such as TD Ameritrade.

Is buying gold a good retirement plan?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

The most popular form of investing in gold is through physical bullion bars. However, there are many other ways to invest in gold. It's best to thoroughly research all options before you make a decision.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. If you are looking for cash flow from your investment, buying gold stocks will work well.

ETFs are an exchange-traded investment that allows you to gain exposure to the market for gold. You hold gold-related securities and not actual gold. These ETFs can include stocks of precious metals refiners and gold miners.

How to Open a Precious Metal IRA?

First, decide if an Individual Retirement Account is right for you. If you do, you must open the account by completing Form 8606. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form should not be completed more than 60 days after the account is opened. Once this has been completed, you can begin investing. You may also choose to contribute directly from your paycheck using payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. Otherwise, the process is identical to an ordinary IRA.

To qualify for a precious Metals IRA, there are specific requirements. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. And, you have to make contributions regularly. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

You can invest in precious metals IRAs to buy gold, palladium and platinum. You can only purchase bullion in physical form. This means you can't trade shares of stock and bonds.

Your precious metals IRA may also be used to invest in precious-metal companies. This option can be provided by some IRA companies.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they're not as liquid as stocks or bonds. This makes it harder to sell them when needed. They don't yield dividends like bonds and stocks. Therefore, you will lose money over time and not gain it.

How is gold taxed within an IRA?

The fair market price of gold when it is sold determines the tax due on its sale. When you purchase gold, you don't have to pay any taxes. It is not income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

Loans can be secured with gold. Lenders will seek the highest return on your assets when you borrow against them. This usually involves selling your gold. There's no guarantee that the lender will do this. They might just hold onto it. They may decide to resell it. In either case, you risk losing potential profits.

If you plan on using your gold as collateral, then you shouldn't lend against it. Otherwise, it's better to leave it alone.

What is a Precious Metal IRA?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These are “precious metals” because they are hard to find, and therefore very valuable. They are great investments for your money, and they can protect you from inflation or economic instability.

Precious metals are often referred to as “bullion.” Bullion is the physical metal.

You can buy bullion through various channels, including online retailers, large coin dealers, and some grocery stores.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. This ensures that you will receive dividends each and every year.

Precious metal IRAs have no paperwork or annual fees. You pay only a small percentage of your gains tax. Plus, you can access your funds whenever you like.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

cftc.gov

irs.gov

investopedia.com

How To

3 Ways to Invest in Gold for Retirement

It's essential to understand how gold fits into your retirement plan. You can invest in gold through your 401(k), if you have one at work. You might also be interested to invest in gold outside the workplace. One example is opening a custodial accounts at Fidelity Investments if an IRA (Individual Retirement Account), if you already own one. You might also consider purchasing precious metals directly from a trusted dealer if they are not already yours.

These are three simple rules to help you make an investment in gold.

- Buy Gold With Your Cash – Do not use credit cards to purchase gold. Instead, instead, transfer cash to your accounts. This will help to keep your purchasing power high and protect you against inflation.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. Physical gold coins can be sold much faster than paper certificates. There are no storage fees for physical gold coins.

- Diversify Your Portfolio. Never place all your eggs in the same basket. Also, diversify your wealth and invest in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————-

By: Leon Wankum

Title: Dismantling The Cash-flow Narrative: Real Estate vs. Bitcoin

Sourced From: bitcoinmagazine.com/markets/dismantling-the-cash-flow-narrative-real-estate-vs-bitcoin

Published Date: Tue, 21 May 2024 17:00:00 GMT