Data, the New Liquid Commodity

In the era of smartphones, data emerges as the most fluid commodity globally. Without rigorous precautions, every move, conversation, and interaction becomes quantifiable in the vast spectrum of information goods markets. These goods, existing as intangible data bits, can be conceived, produced, distributed, and consumed solely in digital form. The internet, alongside digital technologies for computation and communication, acts as a robust e-commerce infrastructure, facilitating the entire lifecycle of various information goods. The seamless transition from traditional to digital formats is easily achievable, with media formats now feasible in the analog world.

Economic Evolution of Information Goods Markets

Diving into the information goods industry, one finds that these products, being pure information, are uniformly impacted by technological advances. However, each market undergoes distinct economic transformations influenced by product characteristics, production methods, distribution channels, and consumption patterns. The separation of value creation and revenue processes can lead to opportunistic scenarios, leaving established players with unprofitable bases and costly value-creation processes.

Emergence of New Markets

Technological advancements give rise to novel organizational structures in response to evolving conditions, reshaping traditional markets overnight. The value chains undergo radical redesigns as digital production, distribution, and consumption influence conventional data propositions. For instance, the rise of mass surveillance as a service is a consequence of technological advancements making data collection and transmission more accessible and cost-effective.

The Location Intelligence Industry

The market for location data services is booming, with companies like Near curating vast amounts of intelligence on individuals and places. This new industry is driven by smart devices, IoT investments, and network services, reflecting the front-running role of technology in shaping e-commerce markets. The COVID-19 pandemic further accelerated the adoption of location intelligence solutions for business adaptability.

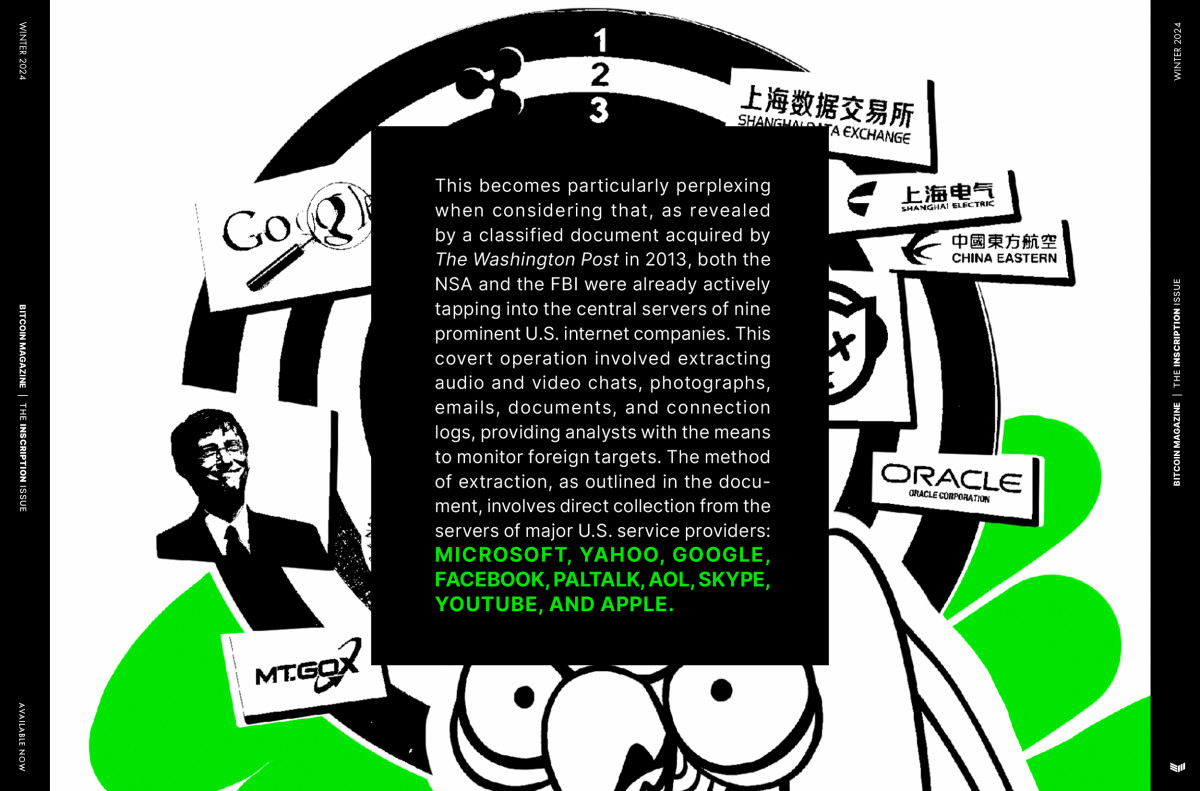

State-Backed Data Markets

China's Shanghai Data Exchange illustrates a state-owned monopoly on data from a highly surveilled population. The evolution of modern data markets traces back to initiatives like Oracle Corporation in the 1970s, highlighting the intertwining of government, private sector, and intelligence community in data markets.

Undersea Cables and Data Ownership

The ownership of submarine fiber-optic cables by tech giants like Google and Facebook showcases a shift in internet infrastructure development. These cables play a crucial role in facilitating rapid data transfers for various applications, shaping new dynamics in the industry.

Bitcoin's Role in Data Markets

The utilization of Bitcoin for data publishing and inscription introduces innovative data markets. Projects like Ord and ReQuest aim to create secure, immutable platforms for data storage and dissemination. Bitcoin's blockchain offers durability and immutability, reshaping information goods markets.

Redefining Data Ownership

The fight for data ownership and privacy unfolds through innovative approaches like precursive inscriptions and bounties for coveted data. Initiatives like Durabit incentivize data distribution while safeguarding content integrity and permanence within the blockchain.

Empowering Individuals in the Data Age

Individuals can take control of their data by leveraging encryption, VPNs, and open-source tools to limit data harvesting. By increasing the cost of data collection through obfuscation methods, users can protect their privacy and challenge intrusive data practices.

Embracing Decentralization and Free Markets

Bitcoin's decentralized nature and incentivization mechanisms offer a pathway to free information markets. By embracing decentralized platforms and actively managing data ownership, individuals can play a vital role in shaping the future of data economies.

Frequently Asked Questions

How much gold should your portfolio contain?

The amount of capital required will affect the amount you make. You can start small by investing $5k-10k. As your business grows, you might consider renting out office space or desks. Renting out desks and other equipment is a great way to save money on rent. Rent is only paid per month.

It is also important to decide what kind of business you want to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. You may get paid just once every 6 months.

Decide what kind of income do you want before you calculate how much gold is needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

What is a Precious Metal IRA (IRA)?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These metals are known as “precious” because they are rare and extremely valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals are sometimes called “bullion.” Bullion refers simply to the physical metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. You'll get dividends each year.

Precious Metal IRAs don’t require paperwork nor have annual fees. You pay only a small percentage of your gains tax. Plus, you get free access to your funds whenever you want.

Is gold a good investment IRA option?

Gold is an excellent investment for any person who wants to save money. It is also an excellent way to diversify you portfolio. But gold is not all that it seems.

It has been used throughout the history of currency and remains a popular payment method. It is often called “the most ancient currency in the universe.”

Gold, unlike other paper currencies created by governments is mined directly from the earth. That makes it very valuable because it's rare and hard to create.

The supply and demand for gold determine the price of gold. The economy that is strong tends to be more affluent, which means there are less gold miners. The result is that gold's value increases.

On the other hand, people will save cash when the economy slows and not spend it. This means that more gold is produced, which reduces its value.

This is why it makes sense to invest in gold for individuals and companies. You will benefit from economic growth if you invest in gold.

In addition to earning interest on your investments, this will allow you to grow your wealth. If gold's value falls, you don't have to lose any of your investments.

How is gold taxed within an IRA?

The tax on the sale of gold is based on its fair market value when sold. You don't have tax to pay when you buy or sell gold. It's not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

Loans can be secured with gold. Lenders seek to get the best return when you borrow against your assets. For gold, this means selling it. This is not always possible. They may just keep it. They may decide to resell it. In either case, you risk losing potential profits.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. Otherwise, it's better to leave it alone.

How do I Withdraw from an IRA with Precious Metals?

First, you must decide if you wish to withdraw money from your IRA account. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, figure out how much money will be taken out of your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Before choosing one, consider the pros and disadvantages of each.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. You will need to count each coin individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some people prefer to keep coins safe in a vault. Others prefer to place them in safe deposit boxes. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

Can I purchase gold with my self directed IRA?

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contract are financial instruments that depend on the gold price. These financial instruments allow you to speculate about future prices without actually owning the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

investopedia.com

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Gold IRAs: A Growing Trend

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

The gold IRA allows owners to invest in physical gold bullion and bars. It can be used as a tax-free way to grow and it is an alternative investment option for people who are not comfortable with stocks or bonds.

Investors can manage their assets with a gold IRA without worrying about market volatility. They can also use the gold IRA as a protection against potential problems like inflation.

Investors also have the benefit of physical gold, which has unique properties such durability, portability and divisibility.

A gold IRA provides many additional benefits. One is the ability for heirs to quickly transfer ownership of gold. Another is the fact that gold is not considered a currency or a commodities by the IRS.

Investors who seek financial stability and a safe haven are finding the gold IRA increasingly attractive.

—————————————————————————————————————————————————————————————-

By: Mark Goodwin

Title: Decentralized Information Markets: Redefining Data Ownership

Sourced From: bitcoinmagazine.com/technical/random-access-markets-the-free-market-of-information

Published Date: Wed, 20 Mar 2024 13:30:00 GMT