A Shift in Trading Volume

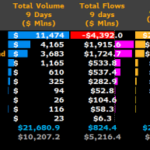

BlackRock's spot Bitcoin ETF is currently surpassing the Grayscale Bitcoin Trust (GBTC) in terms of trading volume, according to Bloomberg ETF analyst James Seyffart. This marks the first time since its launch that BlackRock's ETF has outpaced GBTC in trading volume.

Significance of the Shift

This shift in trading volume suggests a potential slowdown in outflows for Grayscale's ETF. Since its launch, GBTC has experienced over $5 billion in outflows. On the other hand, the other spot Bitcoin ETFs have seen total gross inflows of over $5.8 billion.

This trend indicates that the selling pressure on GBTC may be weakening, which could potentially ease the massive selling pressure on Bitcoin. Notably, BlackRock and Fidelity, two other spot Bitcoin ETFs, have seen significant inflows, accumulating a combined 98,264 BTC worth over $4.1 billion for their respective ETFs.

Continued Impact on BTC Market

As the outflows from GBTC decrease and inflows into other spot Bitcoin ETFs continue to rise, more BTC will be taken off the market at a record pace. To provide context, BlackRock alone has accumulated over 52,026 BTC since its launch earlier this month. Meanwhile, MicroStrategy, known for their aggressive Bitcoin accumulation strategy, has accumulated 189,150 BTC over the last four years.

Anticipation for Future Movement

Market participants eagerly await the final numbers at the end of the day to see if the inflows on BlackRock's spot Bitcoin ETF can maintain their lead over the outflows of GBTC. Currently, Bitcoin is experiencing a price increase, pumping over $43,000.

Frequently Asked Questions

Is gold a good choice for an investment IRA?

Gold is an excellent investment for any person who wants to save money. You can also diversify your portfolio by investing in gold. But gold is not all that it seems.

It has been used as a currency throughout history and is still a popular method of payment. It is often called “the most ancient currency in the universe.”

Gold, unlike other paper currencies created by governments is mined directly from the earth. This makes it highly valuable as it is hard and rare to produce.

The price of gold fluctuates based on supply and demand. If the economy is strong, people will spend more money which means less people can mine gold. The value of gold rises as a consequence.

On the flip side, people save cash for emergencies and don't spend it. This means that more gold is produced, which reduces its value.

This is why it makes sense to invest in gold for individuals and companies. If you have gold to invest, you will reap the rewards when the economy expands.

Also, your investments will earn you interest which can help increase your wealth. Plus, you won't lose money if the value of gold drops.

How much of your portfolio should be in precious metals?

To answer this question we need to first define precious metals. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them valuable in investment and trading. Gold is currently the most widely traded precious metal.

However, many other types of precious metals exist, including silver and platinum. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also unaffected significantly by inflation and Deflation.

All precious metals prices tend to rise with the overall market. That said, they do not always move in lockstep with each other. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. Investors expect lower interest rates which makes bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. Because they are rare, they become more pricey and lose value.

You must therefore diversify your investments in precious metals to reap the maximum profits. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Should you open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. If you lose money in your investment, nothing can be done to recover it. This includes investments that have been damaged by fire, flooding, theft, and so on.

This type of loss can be avoided by investing in physical silver and gold coins. These items have been around thousands of years and are irreplaceable. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

Consider a reputable business that offers low rates and good products when opening an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Remember that you will not see any returns unless you are retired if you open an Account. So, don't forget about the future!

How is gold taxed within a Roth IRA

The tax on an investment account is based on its current value, not what you originally paid. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

The rules that govern these accounts differ from one state to the next. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York allows you to wait until age 70 1/2. To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

Can I have a gold ETF in a Roth IRA

A 401(k) plan may not offer this option, but you should consider other options, such as an Individual Retirement Account (IRA).

A traditional IRA allows for contributions from both employer and employee. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions to IRAs can be made without tax.

Should You Invest Gold in Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. If you're unsure about which option to choose then consider investing in both.

In addition to being a safe investment, gold also offers potential returns. Retirees will find it an attractive investment.

Although most investments promise a fixed rate of return, gold is more volatile than others. Because of this, gold's value can fluctuate over time.

This doesn't mean that you should not invest in gold. You should just factor the fluctuations into any overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold is much easier to store than bonds and stocks. It's also portable.

Your gold will always be accessible as long you keep it in a safe place. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

Also, you'll reap the benefits of having some savings invested in something with a stable value. Gold usually rises when the stock market falls.

You can also sell gold anytime you like by investing in it. Just like stocks, you can liquidate your position whenever you need cash. You don’t even need to wait until retirement to liquidate your position.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start with just a few drops. Add more as you're able.

Don't expect to be rich overnight. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

While gold may not be the best investment, it can be a great addition to any retirement plan.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

bbb.org

cftc.gov

investopedia.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

How To

Tips for Investing with Gold

Investing in Gold remains one of the most preferred investment strategies. Because investing in gold has many benefits. There are several options to invest in the gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

Before buying any type gold, it is important to think about these things.

- First, you must check whether your country allows you to own gold. If it is, you can move on. You can also look at buying gold abroad.

- You should also know the type of gold coin that you desire. You can go for yellow gold, white gold, rose gold, etc.

- Third, consider the cost of gold. It is best to start small and work your way up. It is important to diversify your portfolio whenever you purchase gold. You should invest in different assets such as stocks, bonds, real estate, mutual funds, and commodities.

- Remember that gold prices are subject to change regularly. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: BlackRock's Spot Bitcoin ETF Volume Surpasses GBTC, Indicating Market Shift

Sourced From: bitcoinmagazine.com/markets/blackrocks-spot-bitcoin-etf-volume-topping-gbtc-today-signaling-market-shift

Published Date: Mon, 29 Jan 2024 16:40:09 GMT

Related posts:

GBTC Outflows: Analyzing Bitcoin Selling Pressure and Market Impact

GBTC Outflows: Analyzing Bitcoin Selling Pressure and Market Impact

Grayscale’s Bitcoin Trust Sees a Decline in its NAV Discount to 16.59%

Grayscale’s Bitcoin Trust Sees a Decline in its NAV Discount to 16.59%

Grayscale’s GBTC Sees Significant BTC Reduction Amid Bitcoin ETF Competition

Grayscale’s GBTC Sees Significant BTC Reduction Amid Bitcoin ETF Competition

Spot Bitcoin ETFs Record Lowest Volume Since Jan. 11; Grayscale Sells Over 13,000 Bitcoin, New ETFs Hold $4.91B in Assets

Spot Bitcoin ETFs Record Lowest Volume Since Jan. 11; Grayscale Sells Over 13,000 Bitcoin, New ETFs Hold $4.91B in Assets