Hey there, crypto enthusiasts! Exciting news ahead! Bitcoin made quite a buzz, closing last week at $115,390 and hinting at a potential surge towards $130,000. Buckle up as we dive into what's happening and what to expect in the world of cryptocurrencies.

Bitcoin's Recent Performance

Market Speculations and Federal Reserve's Influence

Last week, Bitcoin experienced a bullish trend, fueled by market optimism surrounding the Federal Reserve's rate cut decision. The anticipation of a 0.25% interest rate cut has set the stage for potential market shifts. With the Federal Reserve's upcoming FOMC Meeting, all eyes are on how their decision will impact Bitcoin's trajectory.

Key Levels to Watch

Resistance and Support Markers

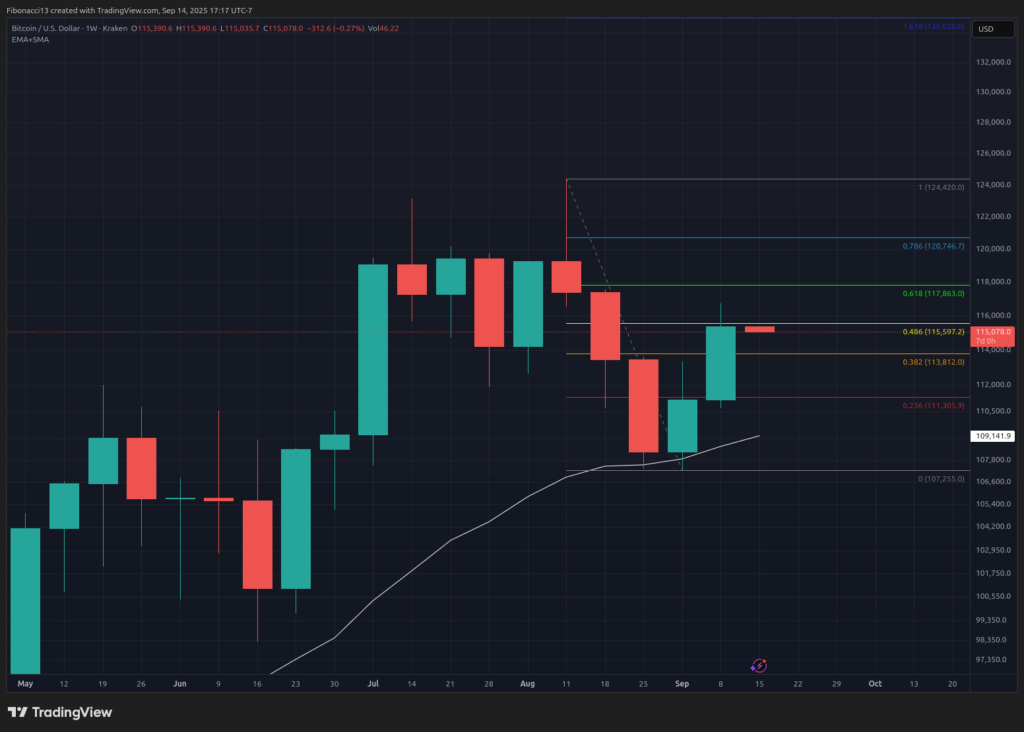

As we navigate this week, pay close attention to Bitcoin's movement around the $115,500 resistance level and the looming $118,000 mark. A breakthrough above $118,000 could pave the way for further gains, while a retreat might test support levels at $113,800 and $111,000.

Predictions for the Week

Chart Analysis and Market Sentiment

Examining the daily chart, Bitcoin's current stance appears slightly bearish, but a shift to bullish territory is possible with positive US stock market trends. The upcoming Federal Reserve announcement is poised to trigger market reactions, impacting Bitcoin's journey.

Market sentiment is bullish, with expectations of testing the $118,000 threshold this week, setting the stage for potential upward movements.

Looking Ahead

Future Projections and Market Dynamics

Bitcoin's momentum above $118,000 will be vital in the coming weeks, potentially propelling its value towards $130,000. Market reactions post the Fed's rate cut decision will shape Bitcoin's trajectory, with supportive data and ongoing rate cuts fueling bullish trends.

However, any unforeseen bearish events or surprising Federal Reserve decisions could lead to price corrections, testing Bitcoin's support levels once again.

Understanding the Crypto Jargon

A Quick Guide to Market Terms

- Bulls/Bullish: Investors anticipating price hikes.

- Bears/Bearish: Traders expecting price drops.

- Support Level: Price threshold expected to uphold asset value.

- Resistance Level: Price level likely to hinder further increases.

- SMA: Simple Moving Average, an indicator of average closing prices.

- Oscillators: Indicators fluctuating within set levels, like RSI and MACD.

- MACD: Moving Average Convergence-Divergence, indicating trend momentum.

- RSI: Relative Strength Index, measuring price speed and momentum changes.

Exciting times lie ahead for Bitcoin enthusiasts, so stay tuned for further updates and market insights. Get ready to ride the crypto wave and witness the fascinating journey of Bitcoin!

Frequently Asked Questions

How much gold can you keep in your portfolio

The amount of capital that you require will determine how much money you can make. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, you can move into an office and rent out desks. So you don't have all the hassle of paying rent. Only one month's rent is required.

Also, you need to think about the type of business that you are going to run. My website design company charges clients $1000-2000 per month depending on the order. You should also consider the expected income from each client when you do this type of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. You may get paid just once every 6 months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I suggest starting with $1k-2k gold and building from there.

What are the fees for an IRA that holds gold?

An Individual Retirement Account (IRA) fee is $6 per month. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

To diversify your portfolio you might need to pay additional charges. These fees vary depending on what type of IRA you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Many providers also charge annual management fees. These fees range from 0% to 1%. The average rate is.25% each year. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

How is gold taxed within an IRA?

The fair value of gold sold to determines the price at which tax is due. If you buy gold, there are no taxes. It isn't considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

Loans can be secured with gold. Lenders try to maximize the return on loans that you take against your assets. This often means selling gold. This is not always possible. They may just keep it. They might decide to sell it. The bottom line is that you could lose potential profit in any case.

To avoid losing money, only lend against gold if you intend to use it for collateral. You should leave it alone if you don't intend to lend against it.

Should You Invest in Gold for Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. You can invest in both options if you aren't sure which option is best for you.

Gold offers potential returns and is therefore a safe investment. It is a good choice for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. This causes its value to fluctuate over time.

However, this does not mean that gold should be avoided. It is important to consider the fluctuations when planning your portfolio.

Another benefit to gold? It's a tangible asset. Gold is more convenient than bonds or stocks because it can be stored easily. It is also easily portable.

You can always access your gold if it is stored in a secure place. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold tends to rise when the stock markets fall.

Investing in gold has another advantage: you can sell it anytime you want. Just like stocks, you can liquidate your position whenever you need cash. You don’t even need to wait until retirement to liquidate your position.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

Do not buy too much at one time. Start by purchasing a few ounces. Next, add more as required.

Keep in mind that the goal is not to quickly become wealthy. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

How much money should my Roth IRA be funded?

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. You cannot withdraw funds from these accounts until you reach 59 1/2. If you decide to withdraw some of your contributions, you will need to follow certain rules. First, you can't touch your principal (the initial amount that was deposited). This means that you can't take out more money than you originally contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule states that income taxes must be paid before you can withdraw earnings. Withdrawing your earnings will result in you paying taxes. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. This would mean that you would have to pay $3,500 in federal income tax. That leaves you with only $6,500 left. Since you're limited to taking out only what you initially contributed, that's all you could take out.

The $4,000 you take out of your earnings would be subject to taxes. You'd still owe $1,500 in taxes. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

There are two types of Roth IRAs: Traditional and Roth. Traditional IRAs allow you to deduct pretax contributions from your taxable income. You can withdraw your contributions plus interest from your traditional IRA when you retire. You can withdraw as much as you want from a traditional IRA.

Roth IRAs do not allow you to deduct your contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal limit, unlike traditional IRAs. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

Is it a good idea to open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. There is no way to recover money that you have invested in precious metals. This includes any loss of investments from theft, fire, flood or other circumstances.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items have been around thousands of years and are irreplaceable. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

Consider a reputable business that offers low rates and good products when opening an IRA. You should also consider using a third party custodian to protect your assets and give you access at any time.

If you decide to open an account, remember that you won't see any returns until after you retire. Keep your eyes open for the future.

What are some of the benefits of a gold IRA

It is best to put your retirement money in an Individual Retirement Account (IRA). It's not subject to tax until you withdraw it. You control how much you take each year. There are many types and types of IRAs. Some are better suited for college students. Others are intended for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. But once they start withdrawing funds, those earnings aren't taxed again. So if you're planning to retire early, this type of account may make sense.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. For people who would rather invest than spend their money, gold IRA accounts are a good option.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. That means you won't have to think about making deposits every month. Direct debits could be set up to ensure you don't miss a single payment.

Gold is one of today's most safest investments. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in times of economic turmoil gold prices tend to remain stable. It is therefore a great choice for protecting your savings against inflation.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

bbb.org

How To

Gold IRAs are a growing trend

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

The gold IRA allows investors to purchase physical gold bars and bullion. It can be used as a tax-free way to grow and it is an alternative investment option for people who are not comfortable with stocks or bonds.

A gold IRA allows investors the freedom to manage their wealth without worrying about volatility in the markets. The gold IRA can be used to protect against inflation or other potential problems.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

Additionally, the gold IRA has many benefits. It allows you to quickly transfer your gold ownership to your heirs. The IRS doesn't consider gold a commodity or currency.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————-

By: Ethan Greene – Feral Analysis

Title: Bitcoin's Potential Soars to $130,000 Amid Federal Reserve's Policy

Sourced From: bitcoinmagazine.com/markets/bitcoin-eyes-130000-if-fed-signals-dovish-policy

Published Date: Mon, 15 Sep 2025 20:56:26 +0000