Bitcoin's recent price action has been a rollercoaster of highs and lows. However, even though bitcoin has set a new all-time high and had two years of a near-constant positive trajectory, we're yet to see a consistent influx of retail investors. The potential for a surge in retail participation and the possibility of elevating the bitcoin price to unprecedented levels are prospects that many investors are anxiously anticipating. In this article, we're going to explore when we might see these retail investors dive back into the bitcoin pool and whether their return could indeed propel BTC to even greater heights.

Active Address Growth and its Impact

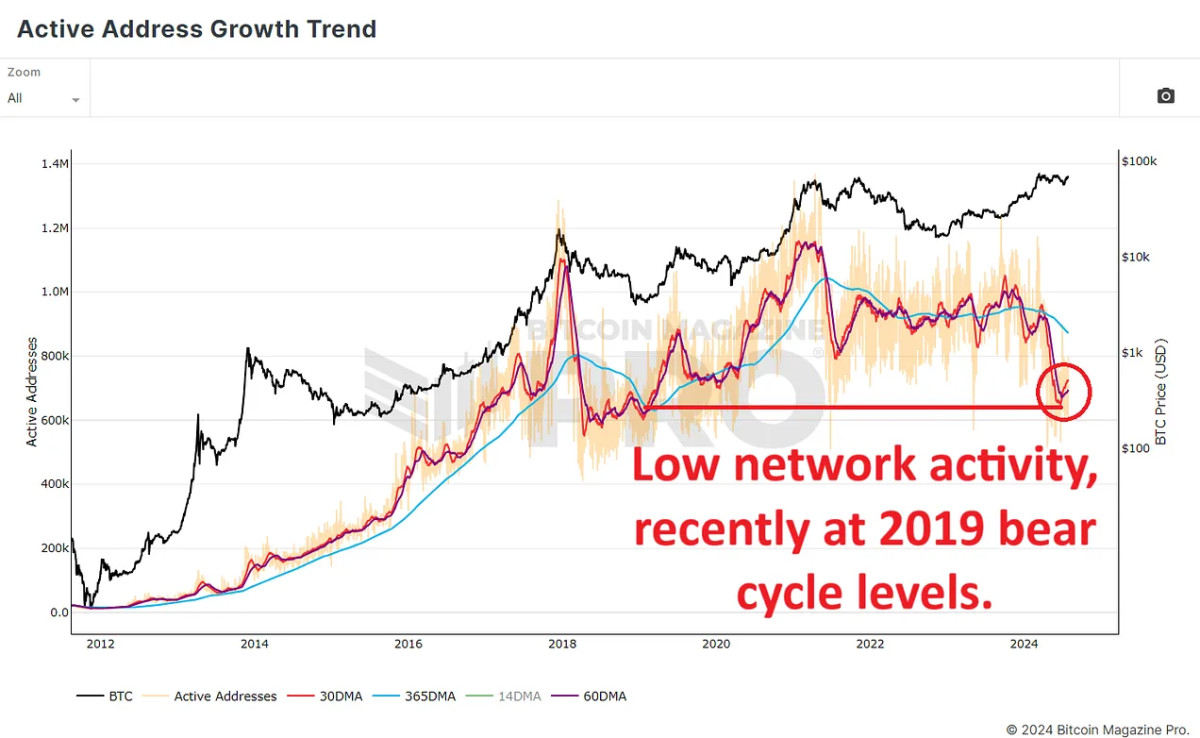

To anticipate this potential retail wave, it's important to scrutinize the trend of active address growth. Data sourced from Bitcoin Magazine Pro suggests a downward swing in the number of active network participants in recent months. The 365-day moving average (blue line), along with the 60-day (purple line) and 30-day averages (red line), tell a tale of decreased network activity. This drop takes the count of active users back to levels reminiscent of early 2019, following bitcoin's bear cycle, when prices hovered between $3,500 to $4,000.

This decline in active network users raises eyebrows about bitcoin's upside potential in the current cycle. Interestingly, despite bitcoin hitting a new record of roughly $74,000, there was no corresponding sustained uptick in network users, a stark departure from previous cycles.

The Necessary Inflow of New Capital

This trend could be a reflection of Bitcoin's evolving identity. Originally a digital peer-to-peer currency, Bitcoin is increasingly seen as a store of value. As a result, fewer people are using it for everyday transactions and are instead pouring capital into bitcoin as a long-term asset.

The Bitcoin HODL Waves & Realized Cap HODL Waves shed light on this shift. These metrics group Bitcoin network users based on the duration they've held their coins, as well as showing their influence on the accumulation price of BTC. Recent data reveals that about 20% of bitcoin has been held for three months or less, indicating that new users are entering the market, but as we can see from the average active addresses in the above data, not using Bitcoin as frequently as before.

Understanding Market Forces and Retail Involvement

A look at Bitcoin’s past cycles shows that a surge in retail activity often precedes market peaks. For example, in the 2017 and 2021 bull runs, retail interest spiked around 6 months before the price peaks. The current absence of a significant increase in retail interest, as evidenced by Google Trends, suggests we’re experiencing a more measured, and more sustainable market growth.

Another key consideration is the Bitcoin Open Interest chart, which measures the total value of open bitcoin futures contracts. Since late 2022, this metric hasn't shown a significant increase; in fact, we’ve seen a steady decline since the bear cycle lows (indicated by the declining red line in the chart below). Revealing that investors are now preferring to trade actual bitcoin rather than merely participating in derivatives trading. This indicates a shift in narrative where investors are more interested in holding bitcoin for the long haul rather than chasing short-term speculative gains.

Given current trends, the lack of a retail frenzy could be seen as a positive sign for the market's long-term prospects. As bitcoin approaches new record highs, keeping a close eye on the arrival of retail investors will be essential. If retail investors start entering the market in large numbers, will they fall back into old habits of pure FOMO buying, or will they continue to favor long-term holding?

In short, despite a fall in Bitcoin's active user metrics, the market shows signs of stability and long-term investment. The absence of immediate retail interest might seem bearish, but it's more likely to be bullish as it indicates a more measured and sustainable growth trajectory.

For a more in-depth look into this topic, check out a recent YouTube video here:

Frequently Asked Questions

What is the benefit of a gold IRA?

Many benefits come with a gold IRA. It is an investment vehicle that can diversify your portfolio. You control how much money goes into each account and when it's withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This makes for an easy transition if you decide to retire early.

The best part about gold IRAs? You don't have to be an expert. They're available at most banks and brokerage firms. Withdrawals are made automatically without having to worry about fees or penalties.

But there are downsides. Gold has historically been volatile. Understanding why you invest in gold is crucial. Is it for growth or safety? Is it for insurance purposes or a long-term strategy? Only once you know, that will you be able to make an informed decision.

If you are planning to keep your Gold IRA indefinitely you will want to purchase more than one ounce. One ounce doesn't suffice to cover all your needs. Depending upon what you plan to do, you could need several ounces.

You don't need to have a lot of gold if you are selling it. You can even get by with less than one ounce. But you won't be able to buy anything else with those funds.

Can I hold physical gold in my IRA?

Gold is money. Not just paper currency. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

One reason is that gold has historically performed better than other assets during periods of financial panic. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Gold is one of the few assets that has virtually no counterparty risks. Your stock portfolio can fall, but you will still own your shares. Gold can be worth more than its investment in a company that defaults on its obligations.

Finally, gold offers liquidity. This means you can easily sell your gold any time, unlike other investments. You can buy gold in small amounts because it is so liquid. This allows you to profit from short-term fluctuations on the gold market.

How much should I contribute to my Roth IRA account?

Roth IRAs allow you to deposit your money tax-free. You cannot withdraw funds from these accounts until you reach 59 1/2. If you decide to withdraw some of your contributions, you will need to follow certain rules. First, your principal (the deposit amount originally made) is not transferable. No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

You cannot withhold your earnings from income taxes. You will pay income taxes when you withdraw your earnings. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's say you earn $10,000 each year after contributing. The federal income tax on your earnings would amount to $3,500. That leaves you with only $6,500 left. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

There are two types: Roth IRAs that are traditional and Roth. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs don't allow you deduct contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal amount, unlike traditional IRAs. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

Can the government take your gold?

You own your gold and therefore the government cannot seize it. You earned it through hard work. It belongs to you. But, this rule is not universal. You could lose your gold if convicted of fraud against a federal government agency. Additionally, your precious metals may be forfeited if you owe the IRS taxes. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

finance.yahoo.com

irs.gov

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

How To

Three ways to invest in gold for retirement

It is crucial to understand how you can incorporate gold into your retirement plans. If you have a 401(k) account at work, there are several ways you can invest in gold. You may also be interested in investing in gold beyond your workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. Or, if you don't already own any precious metals, you may want to consider buying them directly from a reputable dealer.

These are three easy rules to remember if you invest in gold.

- Buy Gold With Your Cash – Do not use credit cards to purchase gold. Instead, cash in your accounts. This will protect you from inflation and help keep your purchasing power high.

- Physical Gold Coins You Should Buy – Physical gold coins should be purchased over a paper certificate. Physical gold coins can be sold much faster than paper certificates. Physical gold coins are also free from storage fees.

- Diversify Your Portfolio. – Do not put all your eggs into one basket. This is how you spread your wealth. You can invest in different assets. This reduces risk and allows you to be more flexible during market volatility.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Bitcoin's Anticipated Retail Resurgence

Sourced From: bitcoinmagazine.com/markets/bitcoins-anticipated-retail-resurgence-

Published Date: Fri, 02 Aug 2024 16:34:26 GMT