Bitcoin, often referred to as the "Exponential Gold," has caught the attention of Jurrien Timmer, Fidelity’s Director of Global Macro. Timmer recently shared his perspective on Bitcoin, highlighting its role as an emerging contender on the "store of value" team. Through a series of posts, he delved into Bitcoin's evolving position in the financial landscape.

Bitcoin's Unique Position in the Market

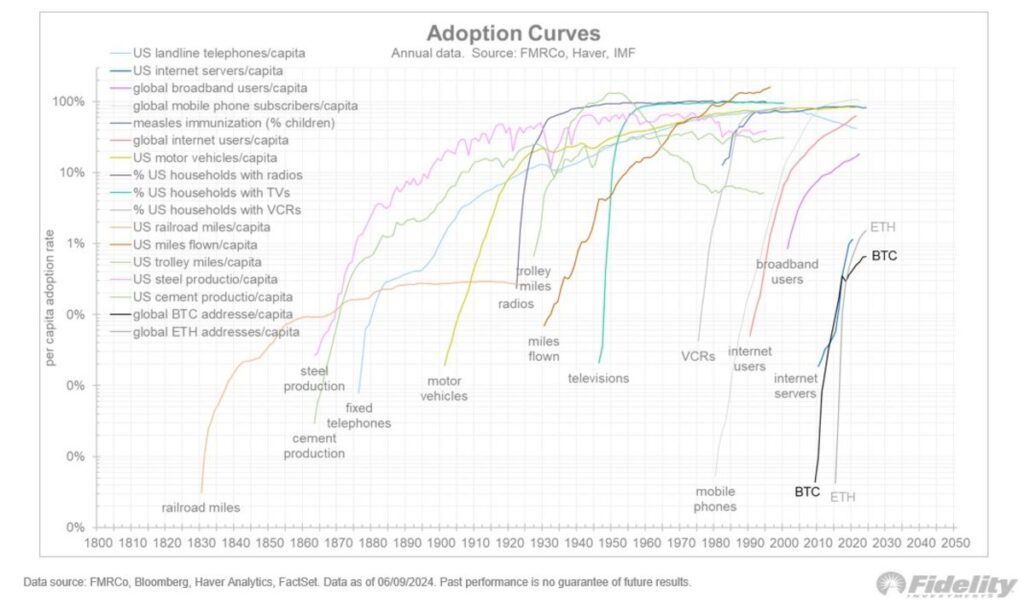

Timmer drew parallels between Bitcoin's growth trajectory and the exponential adoption curves witnessed in revolutionary technologies such as the internet and mobile phones. He underscored the significance of Bitcoin's scarcity and its increasing recognition as a digital asset, positioning it as a potential long-term store of value comparable to gold.

The Role of Adoption Rate and Network Growth

In his analysis, Timmer emphasized the importance of Bitcoin's adoption rate and network expansion in determining its value. While acknowledging that Bitcoin is still in its nascent stages compared to traditional assets, he observed a rapid acceleration in its adoption rate. This trend supports the notion that Bitcoin could establish itself as a significant store of value in the future.

Bitcoin's Network Growth Dynamics

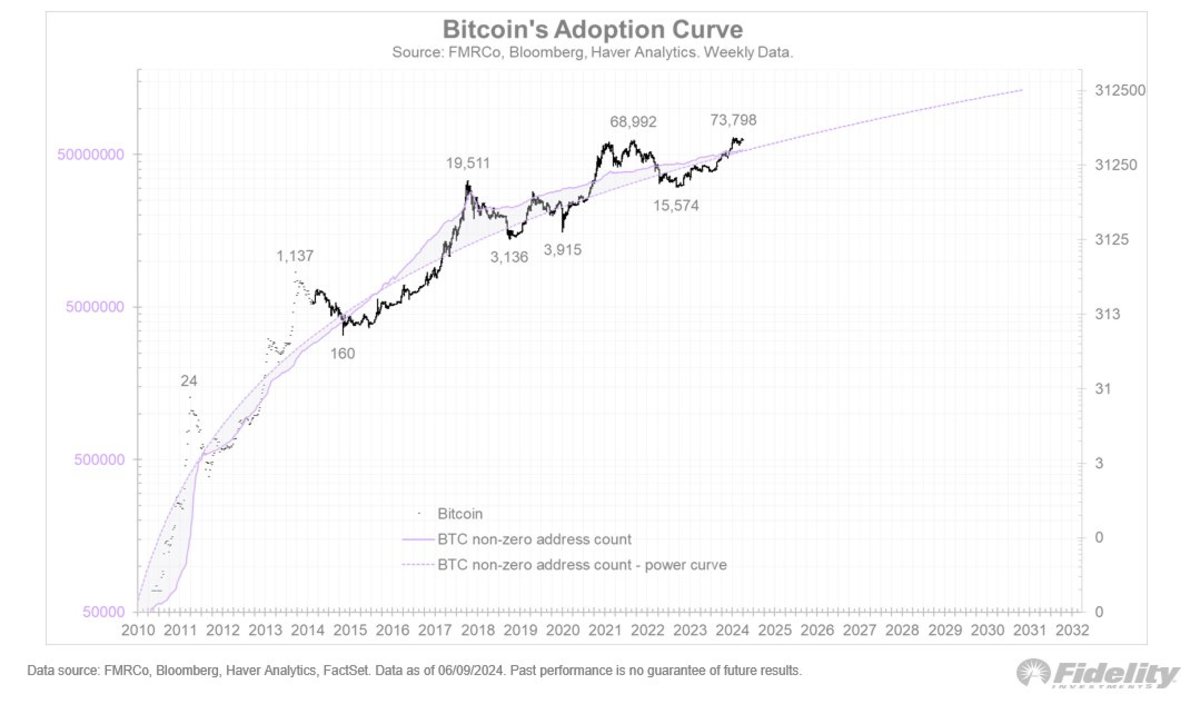

Timmer illustrated Bitcoin's network growth through a power curve, showcasing the convergence of non-zero addresses around this curve. He likened Bitcoin's price fluctuations to a pendulum swinging around this curve, marking the cryptocurrency's distinctive pattern of boom-bust cycles.

Institutional Recognition of Bitcoin's Potential

Timmer's endorsement of Bitcoin aligns with a broader trend among institutional investors who are beginning to acknowledge the cryptocurrency's potential. His insights reinforce Bitcoin's growing legitimacy within the financial sector, hinting at its possible role in shaping future investment strategies.

The Future Trajectory of Bitcoin

As Bitcoin's network growth has moderated in recent months while its price continues to ascend, Timmer highlighted a divergence between adoption and price trends. This discrepancy may explain the temporary slowdown in Bitcoin's journey towards potential new all-time highs. Timmer suggested that for Bitcoin to sustain its upward momentum, a resurgence in network acceleration may be necessary.

Frequently Asked Questions

Can I have physical gold in my IRA

Not only is gold paper currency, but it's also money. It is an asset that people have used over thousands of years as money, and a way to protect wealth from inflation and economic uncertainties. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

One reason is that gold historically performs better than other assets during financial panics. The S&P 500 dropped 21 percent in the same time period, while gold prices rose by nearly 100 percent between August 2011-early 2013. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. You still have your shares even if your stock portfolio falls. Gold can be worth more than its investment in a company that defaults on its obligations.

Finally, gold provides liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows for you to benefit from the short-term fluctuations of the gold market.

How much gold should your portfolio contain?

The amount you make will depend on the amount of capital you have. A small investment of $5k-10k would be a great option if you are looking to start small. Then as you grow, you could move into an office space and rent out desks, etc. So you don't have all the hassle of paying rent. Rent is only paid per month.

Also, you need to think about the type of business that you are going to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. Therefore, you might only get paid one time every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

Can I buy gold using my self-directed IRA

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts are financial instruments based on the price of gold. You can speculate on future prices, but not own the metal. Physical bullion, however, is real gold and silver bars that you can hold in your hand.

What should I pay into my Roth IRA

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. These accounts are not allowed to be withdrawn before the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, you cannot touch your principal (the original amount deposited). This means that you can't take out more money than you originally contributed. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule is that you cannot withdraw your earnings without paying income taxes. Withdrawing your earnings will result in you paying taxes. Let's suppose that you contribute $5,000 annually to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. You would owe $3,500 in federal income taxes on the earnings. You would have $6,500 less. Because you can only withdraw what you have initially contributed, this is all you can take out.

The $4,000 you take out of your earnings would be subject to taxes. You'd still owe $1,500 in taxes. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs won't let you deduct your contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. Unlike a traditional IRA, there is no minimum withdrawal requirement. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

Is the government allowed to take your gold

Because you have it, the government can't take it. You earned it through hard work. It is yours. There may be exceptions to this rule. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. Also, if you owe taxes to the IRS, you can lose your precious metals. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

How do I open a Precious Metal IRA

First, decide if an Individual Retirement Account is right for you. You must complete Form 8606 to open an account. To determine which type of IRA you qualify for, you will need to fill out Form 5204. This form should not be completed more than 60 days after the account is opened. After this, you are ready to start investing. You can also choose to pay your salary directly by making a payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS says you must be 18 years old and have earned income. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Additionally, you must make regular contributions. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can use a precious metals IRA to invest in gold, silver, palladium, platinum, rhodium, or even platinum. You can only purchase bullion in physical form. You won't have the ability to trade stocks or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. This option is available from some IRA providers.

There are two major drawbacks to investing via an IRA in precious metals. First, they're not as liquid as stocks or bonds. It is therefore harder to sell them when required. They don't yield dividends like bonds and stocks. So, you'll lose money over time rather than gain it.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts

investopedia.com

How To

Investing In Gold vs. Investing In Stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. This is because most people believe that it is no longer economically profitable to invest gold. This belief is based on the fact that gold prices are being driven down by global economic conditions. They think that they would lose money if they invested in gold. In reality, though, gold investment can offer significant benefits. Below are some of them.

Gold is the oldest known form of currency. Its use can be traced back to thousands of years ago. It is a valuable store of value that has been used by many people throughout the world. It's still used by countries like South Africa as a method of payment.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. You could contact a local jeweler to find out what their current market rate is.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. Although gold's price has fallen, its production costs have not.

Another thing to remember when thinking about whether or not you should buy gold is the amount of gold you plan on purchasing. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. It is worth considering if you intend to use it for long-term investment. You can profit if you sell your gold at a higher price than you bought it.

We hope you have gained a better understanding about gold as an investment tool. It is important to research all options before you make any decision. Only after you have done this can you make an informed choice.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: Bitcoin: The Next Evolution of Gold in the Financial Ecosystem

Sourced From: bitcoinmagazine.com/markets/bitcoin-is-exponential-gold-says-fidelitys-director-of-global-macro

Published Date: Thu, 13 Jun 2024 19:09:57 GMT