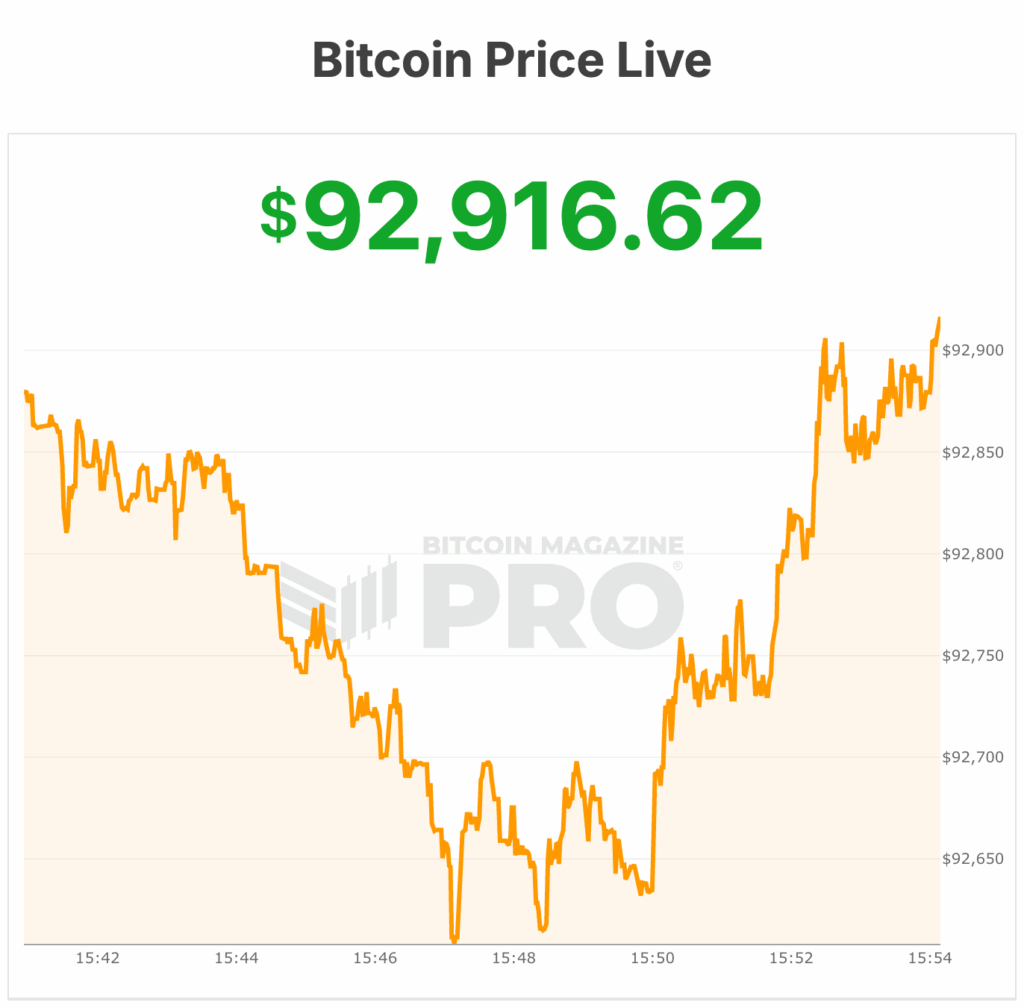

Hey there, crypto enthusiasts! Today we're diving into the latest on Bitcoin's price movements. As the bears tighten their grip, the value of Bitcoin hovers around $93,000, creating a buzz in the market. Let's unpack what's happening and what it means for investors.

Market Volatility and Liquidity Concerns

With Bitcoin trading near $94,000, showcasing a 1% increase over the last 24 hours and a significant trading volume of $111 billion, the market dynamics are intriguing. However, the current scenario reflects a delicate balance, with the asset teetering between a weekly high and low.

Supply and Market Cap Insights

As Bitcoin's circulating supply inches closer to its 21 million hard cap, currently standing at 19,950,440 BTC, the global market cap sees a 1% uptick to $1.85 trillion. These numbers shed light on the evolving landscape of the cryptocurrency market.

Navigating Through Market Turbulence

The recent wave of liquidations triggered by trade uncertainties has rattled the market, resulting in a massive sell-off of leveraged positions. This event led to a significant drop in Bitcoin's price, marking a historic liquidation episode.

Insights and Predictions

Industry experts suggest a potential dip in Bitcoin's value to the mid-$80,000 range. However, the likelihood of a rebound or stabilization at current levels appears more plausible, offering a glimmer of hope amidst the chaos.

Analyzing the Bearish Market Structure

Following Bitcoin's decline below $96,000, analysts have highlighted a bearish trend dominating the market sentiment. Key support and resistance levels are closely watched, with potential price zones signaling critical turning points.

Potential Scenarios and Roadblocks

While the market faces resistance at various price levels, the possibility of a sharp downturn cannot be ruled out. Scenarios for an upside remain challenging, with significant barriers hindering substantial price increases, making a bear trend continuation more likely.

As Bitcoin experiences a more than 25% decline from its recent peak, discussions arise on whether the cycle's peak has passed. Despite historical patterns, this year brings a unique twist, hinting at a potential shift in cycle dynamics.

With uncertainties looming and market conditions evolving, the future trajectory of Bitcoin's price remains uncertain, leaving investors on edge.

Currently, Bitcoin is valued at $92,916, with its 24-hour low hitting $89,183, as per BM Pro data. Stay tuned for more updates on the dynamic cryptocurrency landscape!

Frequently Asked Questions

What Is a Precious Metal IRA?

You can diversify your retirement savings by investing in precious metal IRAs. This allows you to invest in gold, silver and platinum as well as iridium, osmium and other rare metals. These are “precious metals” because they are hard to find, and therefore very valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers simply to the physical metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

You can invest directly in bullion with a precious metal IRA instead of buying shares of stock. This means you'll receive dividends every year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. Instead, you only pay a small percentage on your gains. Plus, you can access your funds whenever you like.

Who is entitled to the gold in a IRA that holds gold?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

What are the advantages of a IRA with a gold component?

Many benefits come with a gold IRA. It can be used to diversify portfolios and is an investment vehicle. You have control over how much money goes into each account.

You also have the option to roll over funds from other retirement accounts into a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best thing about investing in gold IRAs is that you don’t need any special skills. These IRAs are available at all banks and brokerage houses. Withdrawals can happen automatically, without any fees or penalties.

That said, there are drawbacks too. Gold has historically been volatile. It is important to understand why you are investing in gold. Are you looking for growth or safety? Are you looking for growth or insurance? Only by knowing the answer, you will be able to make an informed choice.

You might want to buy more gold if you intend to keep your gold IRA for a long time. You won't need to buy more than one ounce of gold to cover all your needs. Depending on the purpose of your gold, you might need more than one ounce.

If you're planning to sell off your gold, you don't necessarily need a large amount. You can even manage with one ounce. These funds won't allow you to purchase anything else.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- How do you keep your IRA Gold at Home? It's not exactly legal – WSJ

investopedia.com

How To

How to Buy Physical Gold in An IRA

The easiest way to invest is to buy shares in companies that make gold. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. There is always the chance of them losing their money due to fluctuations of the gold price.

Another option is to purchase physical gold. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. This option offers the advantages of being able to purchase gold at low prices and easy access (you don’t need to deal directly with stock exchanges). It's easier to track how much gold is in your possession. A receipt will be sent to you indicating exactly how much you paid. This will allow you to see if there were any tax omissions. You have less risk of theft when investing in stocks.

However, there are some disadvantages too. You won't get the bank's interest rates or investment money. Also, you won't be able to diversify your holdings – you're stuck with whatever you bought. Finally, the tax man might ask questions about where you've put your gold!

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————-

By: Micah Zimmerman

Title: Bitcoin Price Update: Bears Hold Sway at $93,000 While Market Sentiment Wavers

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-teeters-at-93000

Published Date: Tue, 18 Nov 2025 21:01:41 +0000