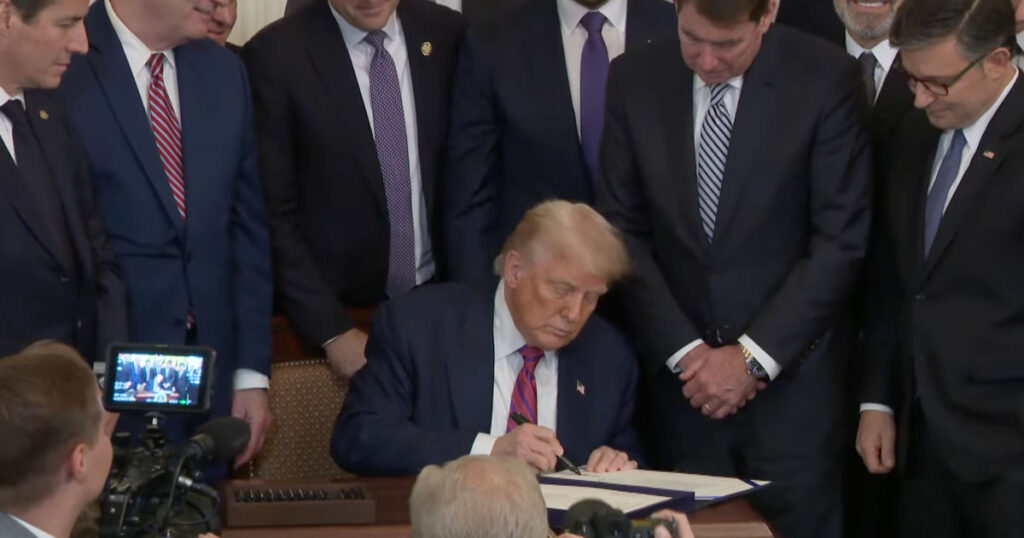

Have you heard the news? Bitcoin's price has surged to an impressive $116,850 following reports that President Donald Trump is gearing up to sign an executive order permitting cryptocurrencies and other alternative assets in 401(k) retirement accounts. This move could unlock a whole new world of institutional capital for Bitcoin enthusiasts.

The Executive Order Impact

Unlocking New Investment Avenues

The executive order, set to be signed imminently, will instruct the Labor Department to reassess the current guidelines concerning alternative investments within retirement plans governed by the Employee Retirement Income Security Act of 1974 (ERISA). This could potentially provide Americans with more opportunities to include Bitcoin and other cryptocurrencies in their retirement portfolios, which currently hold a whopping $12.5 trillion in assets.

Bitcoin Adoption Milestone

Reshaping Institutional Landscape

This groundbreaking executive order signals a pivotal moment for Bitcoin adoption. By allowing 401(k)s to invest in Bitcoin, it has the potential to reshape the institutional environment for Bitcoin and attract substantial new capital to the market.

Corporate Bitcoin Adoption

Increasing Institutional Confidence

Corporate interest in Bitcoin is on the rise, with companies like Metaplanet and Smarter Web Company making significant moves in the space. More than 200 public companies have already invested in Bitcoin, demonstrating a growing institutional trust in this asset class.

Regulatory Clarity for Retirement Plans

Removing Barriers to Crypto Exposure

The Labor Department's role in clarifying fiduciary responsibilities for retirement plan providers offering alternative assets could eliminate a major obstacle that has hindered Bitcoin and crypto investments in retirement accounts. This could pave the way for advanced Bitcoin investment products tailored to retirement savings.

Institutional Interest in Bitcoin

Evolution of the Market

The executive order comes at a time when institutional interest in Bitcoin as a treasury asset and investment option is growing. The market is already adapting to accommodate increased institutional involvement with the introduction of innovative financial products.

Market Impact and Future Prospects

Expanding Investment Horizons

Not only will Bitcoin and crypto benefit from this executive order, but other alternative assets like private equity and real estate are also expected to gain. Bitcoin's prominence in the crypto sphere makes it a top choice for institutional investors seeking exposure to this market.

Following the news, trading volumes on major cryptocurrency exchanges have surged, with over $30 billion in Bitcoin traded in the past 24 hours. Investors seem to be factoring in the long-term implications of including Bitcoin in retirement accounts.

Exciting times lie ahead for Bitcoin and the crypto market as a whole. With institutional doors opening wider, the future looks promising for those involved in the crypto space. Stay tuned for more updates and potential opportunities!

Frequently Asked Questions

What are the fees associated with an IRA for gold?

An Individual Retirement Account (IRA) fee is $6 per month. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

You may have to pay additional fees if you want to diversify your portfolio. The type of IRA you choose will determine the fees. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge an annual management fee. These fees are usually between 0% and 1%. The average rate per year is.25%. These rates can be waived if the broker is TD Ameritrade.

How to open a Precious Metal IRA

It is important to decide if you would like an Individual Retirement Account (IRA). You must complete Form 8606 to open an account. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. This form should be filled within 60 calendar days of opening the account. Once this is done, you can start investing. You can also contribute directly to your paycheck via payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, the process will be identical to an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS requires that you are at least 18 years old and have earned an income. Your annual earnings cannot exceed $110,000 ($220,000 if you are married and file jointly) for any tax year. And, you have to make contributions regularly. These rules apply to contributions made directly or through employer sponsorship.

You can use a precious-metals IRA to purchase gold, silver and palladium. You can only purchase bullion in physical form. You won't have the ability to trade stocks or bonds.

Your precious metals IRA may also be used to invest in precious-metal companies. This option is offered by some IRA providers.

There are two main drawbacks to investing through an IRA in precious metallics. First, they aren't as liquid than stocks and bonds. It's also more difficult to sell them when they are needed. Second, they don’t produce dividends like stocks or bonds. Therefore, you will lose more money than you gain over time.

Can I buy or sell gold from my self-directed IRA

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts are financial instruments that are based on gold's price. These financial instruments allow you to speculate about future prices without actually owning the metal. However, physical bullion is real gold or silver bars you can hold in your hands.

What precious metals could you invest in to retire?

Silver and gold are two of the most valuable precious metals. They are both easy to trade and have been around for years. You should add them to your portfolio if you are looking to diversify.

Gold: One of the oldest forms of currency, gold, is one of mankind's most valuable. It's also very safe and stable. It is a good way for wealth preservation during uncertain times.

Silver: Investors have always loved silver. It is an excellent choice for investors who wish to avoid volatility. Silver tends instead to go up than down, which is unlike gold.

Platinium is another precious metal that is becoming increasingly popular. It is very durable and resistant against corrosion, much like silver and gold. However, it's much more expensive than either of its counterparts.

Rhodium. Rhodium is used as a catalyst. It is also used to make jewelry. It is also quite affordable compared with other types of precious metals.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also more affordable. It's a popular choice for investors who want to add precious metals into their portfolios.

What proportion of your portfolio should you have in precious metals

To answer this question, we must first understand what precious metals are. Precious Metals are elements that have a very high relative value to other commodities. This makes them very valuable in terms of trading and investment. Gold is currently the most widely traded precious metal.

There are also many other precious metals such as platinum and silver. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is not affected by inflation or deflation.

In general, prices for precious metals tend increase with the overall marketplace. They do not always move in the same direction. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. They are more rare, so they become more expensive and less valuable.

To maximize your profits when investing in precious metals, diversify across different precious metals. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

Is gold a good investment IRA option?

Anyone who is looking to save money can make gold an excellent investment. You can diversify your portfolio with gold. But gold is not all that it seems.

It has been used throughout the history of currency and remains a popular payment method. It's often referred to as “the world's oldest currency.”

But unlike paper currencies, which governments create, gold is mined out of the earth. Because it is rare and difficult to make, it is extremely valuable.

The price of gold fluctuates based on supply and demand. The strength of the economy means people spend more, and so, there is less demand for gold. Gold's value rises as a result.

The flip side is that people tend to save money when the economy slows. This causes more gold to be produced, which lowers its value.

This is why gold investment makes sense for both individuals and businesses. You will benefit from economic growth if you invest in gold.

Additionally, you'll earn interest on your investments which will help you grow your wealth. Plus, you won't lose money if the value of gold drops.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

irs.gov

finance.yahoo.com

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Tips to Invest in Gold

Investing in Gold is a popular investment strategy. This is due to the many benefits of investing in gold. There are several ways to invest in gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

Before buying any kind of gold, you need to consider these things.

- First, find out if your country allows gold ownership. If it is, you can move on. If not, you may want to consider purchasing gold from overseas.

- You should also know the type of gold coin that you desire. You have options: you can choose from yellow gold, white or rose gold.

- Thirdly, it is important to take into account the gold price. It is best to begin small and work your ways up. One thing that you should never forget when purchasing gold is to diversify your portfolio. Diversify your investments in stocks, bonds or real estate.

- Last but not least, remember that gold prices fluctuate frequently. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————-

By: Vivek Sen

Title: Bitcoin Price Skyrockets to $116,000 Amid Trump's Plan to Allow Bitcoin and Crypto in 401(k)s

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-rallies-to-116000-as-trump-set-to-sign-an-eo-to-allow-bitcoin-and-crypto-to-401ks

Published Date: Thu, 07 Aug 2025 12:05:53 +0000