Hey there, fellow investors! Today, we're diving into the tumultuous world of Bitcoin mining stocks. If you've been keeping an eye on the market, you probably noticed the significant nosedive that Bitfarms ($BITF), Riot Platforms ($RIOT), and Marathon Digital Holdings ($MARA) took. But what exactly caused this deep red sea? Let's uncover the mysteries together!

The Bitcoin Mining Rollercoaster

The Market Shake-Up

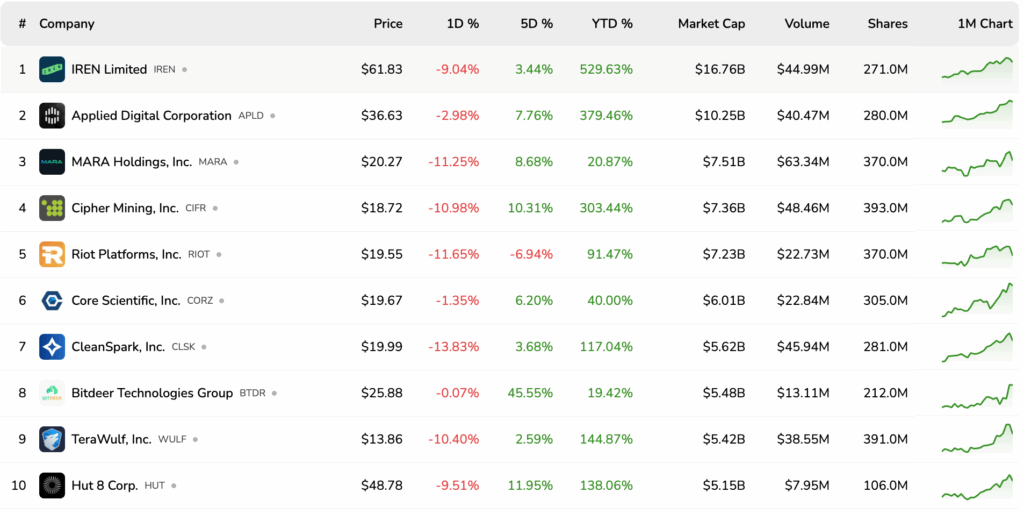

Picture this: the broader market is like a rollercoaster ride, with Bitcoin as the main attraction. As Bitcoin experienced its third consecutive day of declines, the mining stocks felt the ripple effect. Bitfarms led the pack with an over 18% drop, closely followed by Riot Platforms and Marathon Digital Holdings with 10%–11% dips. It's like a chain reaction where one car on the rollercoaster suddenly hits the brakes, causing the rest to slow down.

Ups and Downs in the Mining Sector

Just when miners were enjoying the thrill of soaring prices and expanding hash rates, the market threw a curveball. The recent pullback has left many miners reeling from the sudden drop. It's like riding a wave of success only to be hit by an unexpected undertow.

The Aftermath and Future Outlook

Week-Long Recap

Despite today's rough patch, the Bitcoin mining sector has seen better days this week. Companies like Applied Digital and Cipher Mining have been basking in the green, with impressive growth over the past year. It's like a marathon runner hitting a wall but finding a burst of energy to push through and finish strong.

The Ripple Effect

When Bitcoin sneezes, mining stocks catch a cold. Today, as Bitcoin's price dipped, the mining stocks followed suit. It's a domino effect where one small push can set off a chain reaction of falling prices. Investors are on the edge of their seats, waiting to see if the miners can weather the storm or if more turbulence is ahead.

The Broader Crypto Market Reaction

Market Woes Across the Board

It's not just Bitcoin miners feeling the heat. Crypto-related equities, like Coinbase, Robinhood, and Strategy, also took hits. The market is like a giant puzzle, and when one piece falters, the others feel the impact too.

The Mining Game

Bitcoin miners play a high-stakes game, relying on factors like Bitcoin's price, mining efficiency, and energy costs to stay afloat. It's a delicate balance of risks and rewards, where every move can make or break their profitability. Imagine juggling multiple balls in the air, hoping none drop.

A Glimpse Into the Future

Diversification on the Horizon

With the market landscape evolving, miners are exploring new horizons. From renewable energy initiatives to branching out into AI and data center services, they're adapting to stay ahead of the game. It's like a chess match where strategic moves can lead to long-term success.

As we navigate these turbulent waters together, remember that every dip is an opportunity for growth. Stay informed, stay vigilant, and brace yourself for the next twist and turn in the exciting world of Bitcoin mining stocks!

Frequently Asked Questions

How is gold taxed in an IRA?

The fair market price of gold when it is sold determines the tax due on its sale. You don't pay taxes when you buy gold. It isn't considered income. If you sell it later you will have a taxable profit if the price goes down.

Gold can be used as collateral for loans. Lenders will seek the highest return on your assets when you borrow against them. In the case of gold, this usually means selling it. However, there is no guarantee that the lender would do this. They may hold on to it. Or, they may decide to resell the item themselves. Either way, you lose potential profit.

You should not lend against your gold if it is intended to be used as collateral. Otherwise, it's better to leave it alone.

Is gold a good investment IRA?

If you are looking for a way to save money, gold is a great investment. It is also an excellent way to diversify you portfolio. There is much more to gold than meets your eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the most ancient currency in the universe.”

But gold is mined from the earth, unlike paper currencies that governments create. Because it is rare and difficult to make, it is extremely valuable.

The supply and demand factors determine how much gold is worth. When the economy is strong, people tend to spend more money, which means fewer people mine gold. Gold's value rises as a result.

On the other hand, people will save cash when the economy slows and not spend it. This increases the production of gold, which in turn drives down its value.

This is why gold investment makes sense for both individuals and businesses. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

You'll also earn interest on your investments, which helps you grow your wealth. Additionally, you won't lose cash if the gold price falls.

What's the advantage of a Gold IRA?

There are many advantages to a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best thing is that investing in gold IRAs doesn't require any special skills. They're available at most banks and brokerage firms. Withdrawals can be made instantly without the need to pay fees or penalties.

But there are downsides. Gold is known for being volatile in the past. Understanding why you invest in gold is crucial. Are you looking for growth or safety? Are you trying to find safety or growth? Only when you are clear about the facts will you be able take an informed decision.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. A single ounce will not be sufficient to meet all your requirements. Depending on your plans for using your gold, you may need multiple ounces.

You don't need to have a lot of gold if you are selling it. You can even get by with less than one ounce. You won't be capable of buying anything else with these funds.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

finance.yahoo.com

investopedia.com

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

How To

Tips for Investing with Gold

Investing in Gold remains one of the most preferred investment strategies. This is because there are many benefits if you choose to invest in gold. There are several options to invest in the gold. Some people buy physical gold coins, while others prefer investing in gold ETFs (Exchange Traded Funds).

Before you purchase any type or gold, here are some things to think about.

- First, find out if your country allows gold ownership. If so, then you can proceed. You can also look at buying gold abroad.

- Second, it is important to know which type of gold coin you are looking for. You have options: you can choose from yellow gold, white or rose gold.

- Third, consider the cost of gold. Start small and build up. You should diversify your portfolio when buying gold. You should invest in different assets such as stocks, bonds, real estate, mutual funds, and commodities.

- You should also remember that gold prices can change often. You need to keep up with current trends.

—————————————————————————————————————————————————————————————-

By: Micah Zimmerman

Title: Bitcoin Mining Stocks Plunge: What's Behind $BITF, $MARA, and $RIOT's Deep Red?

Sourced From: bitcoinmagazine.com/markets/bitcoin-mining-stocks-tumble

Published Date: Thu, 16 Oct 2025 20:42:19 +0000