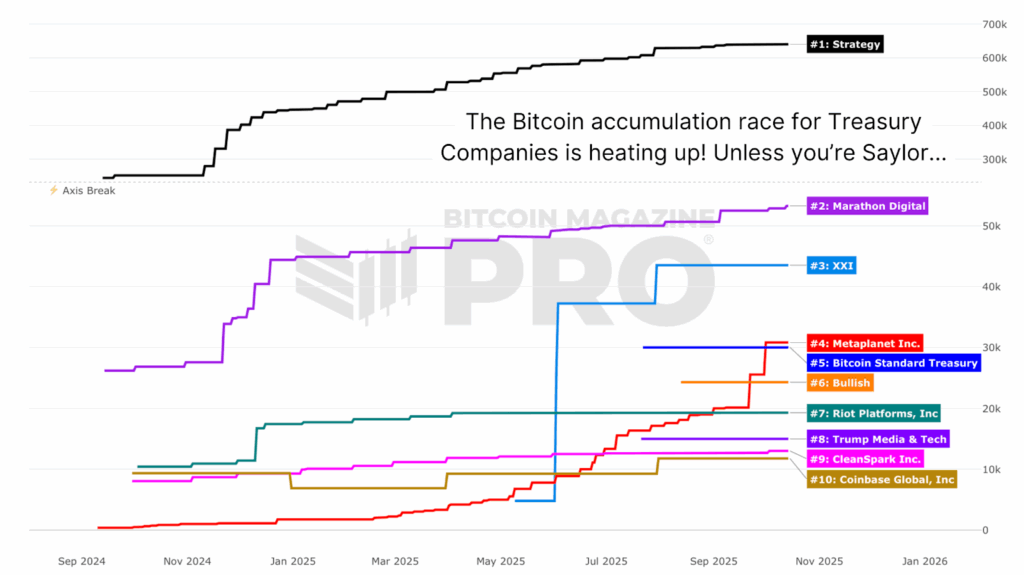

When it comes to the current market rally, Bitcoin mining stocks are stealing the spotlight, outshining both Bitcoin itself and corporate treasuries. The dynamics between Bitcoin’s corporate treasuries and the booming bitcoin mining sector have been at the forefront of this market cycle. From big players like (Micro)Strategy making billion-dollar Bitcoin moves to the emergence of MetaPlanet and the rapid growth of bitcoin mining companies, institutional and industrial adoptions are reshaping the network's landscape.

The Rise of Bitcoin Treasury Accumulation

Tracking Bitcoin Treasury Holdings

If you want a real-time peek into the Bitcoin holdings of major public and private treasury companies, our new Bitcoin Treasury Tracker is your go-to source. These treasuries collectively possess over 1 million BTC, amounting to more than 5% of the total circulating supply. This accumulation has been a linchpin of Bitcoin's current cycle strength, painting a compelling picture of the network's resilience and growth.

Assessing Valuation Trends Across Bitcoin Treasuries

Challenges in Equity Valuation

Companies like (Micro)Strategy have been pioneering corporate Bitcoin adoption. However, recent developments have shown their equity valuations struggling to keep up with Bitcoin's price performance. As Bitcoin consolidates, these companies face the pressure of aligning their market valuations with the underlying Bitcoin they hold, indicating a shift in market sentiment and investor behavior.

A Pivotal Moment for Bitcoin and Bitcoin Mining Stocks

The BTCUSD to MSTR Ratio

A critical metric to watch is the BTCUSD to MSTR ratio, spotlighting the relationship between Bitcoin and (Micro)Strategy shares. This ratio's positioning at a historical support-turned-resistance level signifies a crucial juncture that could shape future market movements. Understanding this ratio can provide valuable insights into potential market shifts and trends.

Bitcoin Mining Stocks: Shaping Market Dynamics

The Surge of Bitcoin Miners

Unlike the struggles of treasuries, Bitcoin miners are on an upward trajectory. In the last six months, Bitcoin miners have been on a winning streak, with Listed Miner equities like Marathon Digital, Riot Platforms, and Hive Digital witnessing remarkable growth. The sector's momentum is evident, with the WGMI Bitcoin Mining ETF surpassing Bitcoin's performance by a significant margin since September.

The Diverging Paths of Bitcoin Mining Stocks and Corporate Treasuries

With corporate treasuries holding over 1 million BTC, their impact on Bitcoin's market dynamics is undeniable. However, the tides seem to be turning as miners take the lead in market performance. While treasuries face challenges in outperforming spot BTC, miners are showcasing robust relative performance, hinting at broader market momentum to come.

At Bitcoin Magazine Pro, we aim to provide you with data-driven insights into all aspects of the Bitcoin ecosystem. From corporate holdings to miner activities, on-chain analytics, and macroeconomic trends, we're here to help you navigate the ever-evolving world of Bitcoin. Thank you for reading, and stay tuned for more insights!

Frequently Asked Questions

What is the benefit of a gold IRA?

A gold IRA has many benefits. It's an investment vehicle that lets you diversify your portfolio. You have control over how much money goes into each account.

You have the option of rolling over funds from other retirement account into a gold IRA. This is a great way to make a smooth transition if you want to retire earlier.

The best part about gold IRAs? You don't have to be an expert. They're readily available at almost all banks and brokerage firms. You do not need to worry about fees and penalties when you withdraw money.

But there are downsides. Gold is historically volatile. It is important to understand why you are investing in gold. Are you seeking safety or growth? Are you looking for growth or insurance? Only when you are clear about the facts will you be able take an informed decision.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. A single ounce isn't enough to cover all of your needs. Depending upon what you plan to do, you could need several ounces.

If you're planning to sell off your gold, you don't necessarily need a large amount. You can even live with just one ounce. However, you will not be able buy any other items with those funds.

What is a Precious Metal IRA and How Can You Benefit From It?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These are “precious metals” because they are hard to find, and therefore very valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals often refer to themselves as “bullion.” Bullion refers actually to the metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. This will ensure that you receive annual dividends.

Precious metal IRAs have no paperwork or annual fees. You pay only a small percentage of your gains tax. You can also access your funds whenever it suits you.

How much do gold IRA fees cost?

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes account maintenance fees and investment costs for your chosen investments.

Diversifying your portfolio may require you to pay additional fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free checking, but charge monthly fees for IRAs.

A majority of providers also charge annual administration fees. These fees range from 0% to 1%. The average rate is.25% each year. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

bbb.org

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's not exactly legal – WSJ

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads, Example and Risk Metrics

How To

How to hold physical gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. Even if the company survives, they still face the risk of losing their investment due to fluctuations in gold's price.

Alternative options include buying physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option is convenient because you can access your gold when it's low and doesn't require you to deal with stock brokers. It is also easier to check how much gold you have stored. So you can see exactly what you have paid and if you missed any taxes, you will get a receipt. You're also less susceptible to theft than investing with stocks.

However, there are disadvantages. You won't get the bank's interest rates or investment money. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. Finally, the tax man might ask questions about where you've put your gold!

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Bitcoin Mining Stocks: Leading the Market Charge Beyond Bitcoin and Corporate Treasuries

Sourced From: bitcoinmagazine.com/markets/bitcoin-mining-stocks-corporate-treasuries

Published Date: Fri, 17 Oct 2025 19:04:41 +0000