Recent findings reveal a trend in the cryptocurrency market where bitcoin investors are shifting from being long-term holders to short-term speculators. This trend signifies a potential recovery from the extended bear market that the cryptocurrency landscape has been experiencing.

An Overview of The Transition from Long-term Holders to Short-term Speculators

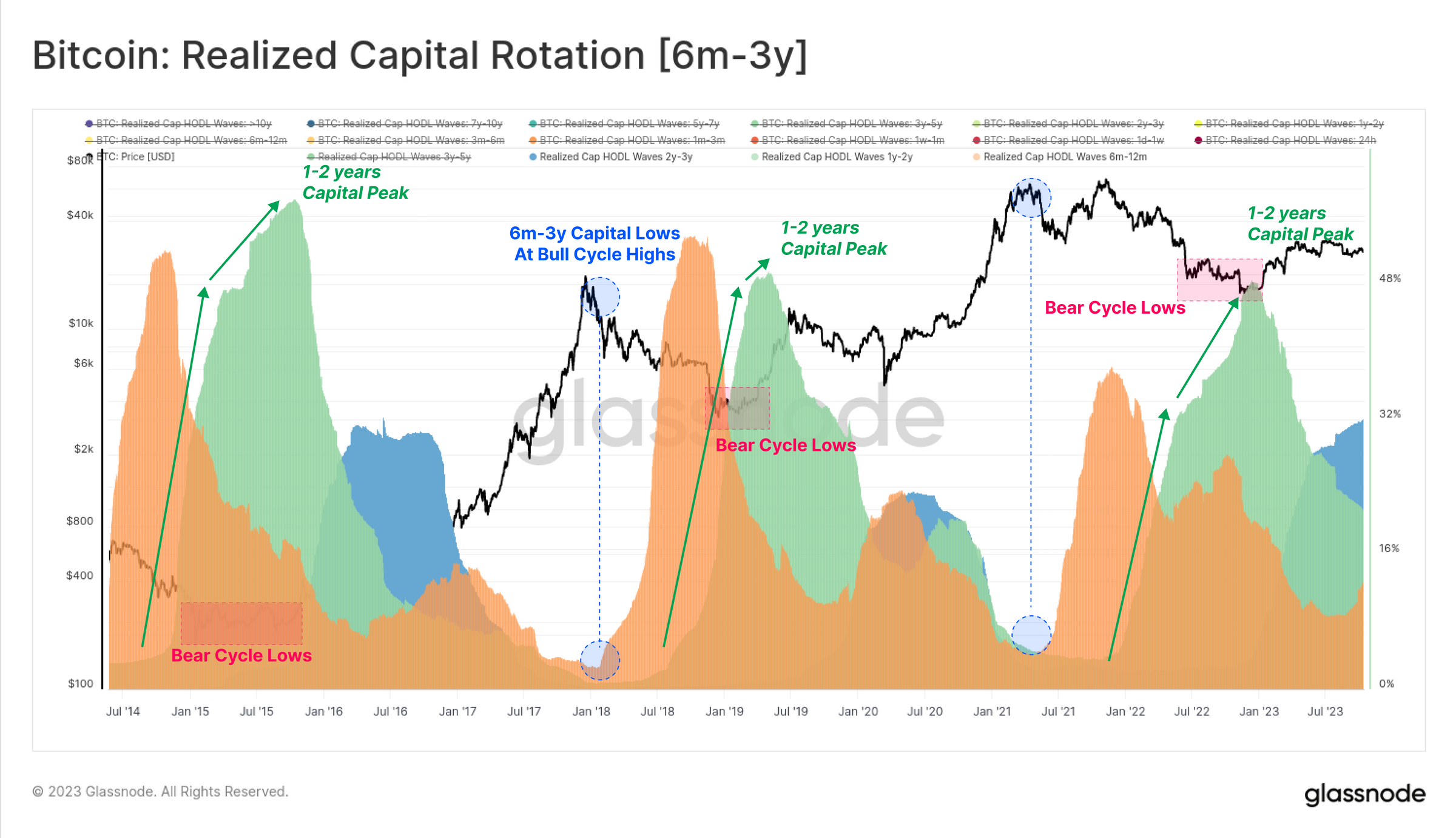

A report from the onchain analytics firm Glassnode, provides an insightful analysis into the bitcoin (BTC) ownership transition over time. The study meticulously examines the cycle of bitcoin ownership, tracking the trajectory of coins from long-term holders, who accumulated bitcoins during the bear market, to short-term speculators looking to capitalize on price fluctuations.

The Use of Realized Capital Metric by Glassnode

Glassnode employs a unique metric termed "realized capital" to evaluate the aggregate amount historically disbursed to acquire all existing bitcoins. This allows for a comprehensive insight into the timing of coin movement between investors. Following this, Glassnode categorizes the bitcoin supply into "age bands" which illustrate the dispersion of dormant coins held over various durations.

The Shift in Coin Ownership

The analysis indicates, "During market uptrends, older coins are spent and transferred from long-term holders to newer investors. On the flip side, during market downtrends, speculators lose interest and progressively transfer coins to longer-term holders."

Identifying Key Long-term Holder Cohorts

The report marks the coins held for 1-2 years as a significant long-term holder cohort. The holdings of this group reach their zenith during bear market lows as resolute buyers accumulate. Conversely, bitcoins held for less than a month typify short-term speculators. Their share of the bitcoin supply spikes during bull markets as fresh money is introduced.

Market Cycle Interpretation Through Glassnode’s Models

By contrasting the holdings of each group, Glassnode’s models determine the current position of the market in its cycle. The present structure is akin to the recovery stage succeeding a major bear market low, mirroring the trends observed in 2016 and 2019. Bitcoin’s price has bounced back from its lows, yet long-term holders still possess more than 80% of the supply.

Bitcoin Supply Dominated by the HODLer Cohort

"The bitcoin supply remains robustly dominated by the HODLer cohort, with a significant majority of coins now being older than 6-months," concludes the report.

The Profitability of Short and Long-term Holders

Along with tracking coin age, Glassnode also models the profitability of short and long-term holders premised on their average cost basis. This helps assess the financial incentive to sell versus hold at varying price levels. Yet again, the firm’s models suggest that the market may have entered an early bullish phase where long-term holders are reaping profits, while short-term traders are hovering around the break-even point.

Reflecting on Glassnode's Recent Report

We encourage you to share your perspectives on this recent Glassnode report about the transition of bitcoin ownership. Your thoughts and opinions about this subject are highly valued.

Frequently Asked Questions

What Does Gold Do as an Investment Option?

The supply and demand for gold affect the price of gold. It is also affected negatively by interest rates.

Due to their limited supply, gold prices fluctuate. There is also a risk in owning gold, as you must store it somewhere.

What precious metals can you invest in for retirement?

The best precious metal investments are gold and silver. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: One of the oldest forms of currency, gold, is one of mankind's most valuable. It's also very safe and stable. Because of this, it is considered a great way of preserving wealth during times when there are uncertainties.

Silver: Silver has always been popular among investors. It's an ideal choice for those who prefer to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It is very durable and resistant against corrosion, much like silver and gold. It's however much more costly than any of its counterparts.

Rhodium: Rhodium can be used in catalytic convertors. It is also used to make jewelry. It is relatively affordable when compared to other types.

Palladium: Palladium, which is a form of platinum, is less common than platinum. It's also much more affordable. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

What's the advantage of a Gold IRA?

There are many benefits to a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best part is that you don't need special skills to invest in gold IRAs. They're available at most banks and brokerage firms. You don't have to worry about penalties or fees when withdrawing money.

But there are downsides. Gold is known for being volatile in the past. It is important to understand why you are investing in gold. Do you want safety or growth? Is it for security or long-term planning? Only then will you be able make informed decisions.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. One ounce doesn't suffice to cover all your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don't need to have a lot of gold if you are selling it. Even a single ounce can suffice. But you won't be able to buy anything else with those funds.

What should I pay into my Roth IRA

Roth IRAs can be used to save taxes on your retirement funds. The account cannot be withdrawn from until you are 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, you can't touch your principal (the initial amount that was deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you are able to take out more that what you have initially contributed, you must pay taxes.

You cannot withhold your earnings from income taxes. Also, taxes will be due on any earnings you take. For example, let's say that you contribute $5,000 to your Roth IRA every year. Let's say you earn $10,000 each year after contributing. This would mean that you would have to pay $3,500 in federal income tax. The remaining $6,500 is yours. Because you can only withdraw what you have initially contributed, this is all you can take out.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

There are two types if Roth IRAs, Roth and Traditional. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. You can withdraw your contributions plus interest from your traditional IRA when you retire. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs won't let you deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's not exactly legal – WSJ

cftc.gov

forbes.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Investing in gold vs. investing in stocks

It might seem risky to invest in gold as an investment vehicle these days. The reason behind this is that many people believe that gold is no longer profitable to invest in. This belief comes from the fact most people see gold prices falling due to the global economy. They think that they would lose money if they invested in gold. However, investing in gold can still provide significant benefits. Let's take a look at some of the benefits.

Gold is the oldest known form of currency. It has been in use for thousands of year. People around the world have used it as a store of value. It's still used by countries like South Africa as a method of payment.

When deciding whether to invest in gold, the first thing you need to do is to decide what price per gram you are willing to pay. It is important to determine the price per gram you are willing and able to pay for gold bullion. You can always ask a local jeweler what the current market rate is if you don't have it.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although gold's price has fallen, its production costs have not.

Another thing to remember when thinking about whether or not you should buy gold is the amount of gold you plan on purchasing. For example, if you only intend to purchase enough to cover your wedding rings, it probably makes sense to hold off on buying any gold. This is not a wise decision if you're looking to invest in long-term assets. You can profit if you sell your gold at a higher price than you bought it.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We strongly recommend that you research all available options before making any decisions. Only then can informed decisions be made.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Bitcoin Investors Transitioning: An In-depth Analysis into Cryptocurrency Trends

Sourced From: news.bitcoin.com/bitcoin-changing-hands-cycle-signals-bear-market-recovery-glassnode-study-shows/

Published Date: Tue, 17 Oct 2023 19:30:26 +0000