Bitcoin is showing promising signs of a bullish trend as we kick off 2025. Despite this positive start, uncertainties linger regarding the overall market health and the sustainability of the current upward momentum. Let's delve into a comprehensive and data-centric analysis to uncover the underlying factors driving this trend.

Miner Recovery and Network Strength

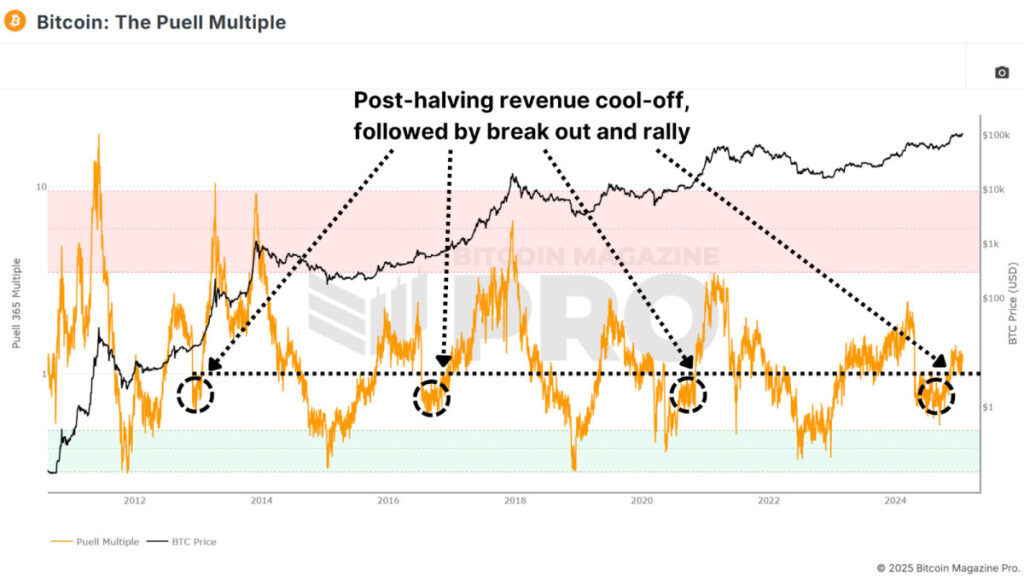

The Puell Multiple, a metric that compares miners' daily USD revenue to the yearly average, indicates a robust fundamental network strength for Bitcoin. Typically, after a halving event, miner revenue takes a hit due to the reduction in block rewards. However, the Puell Multiple has recently surpassed the critical value of 1, signaling a recovery phase and a potential bullish trend.

Historical data shows that breaching and retesting the value of 1 often precedes significant price surges. This pattern is emerging once again, underscoring strong market support from mining activities.

Potential Upside and Market Value

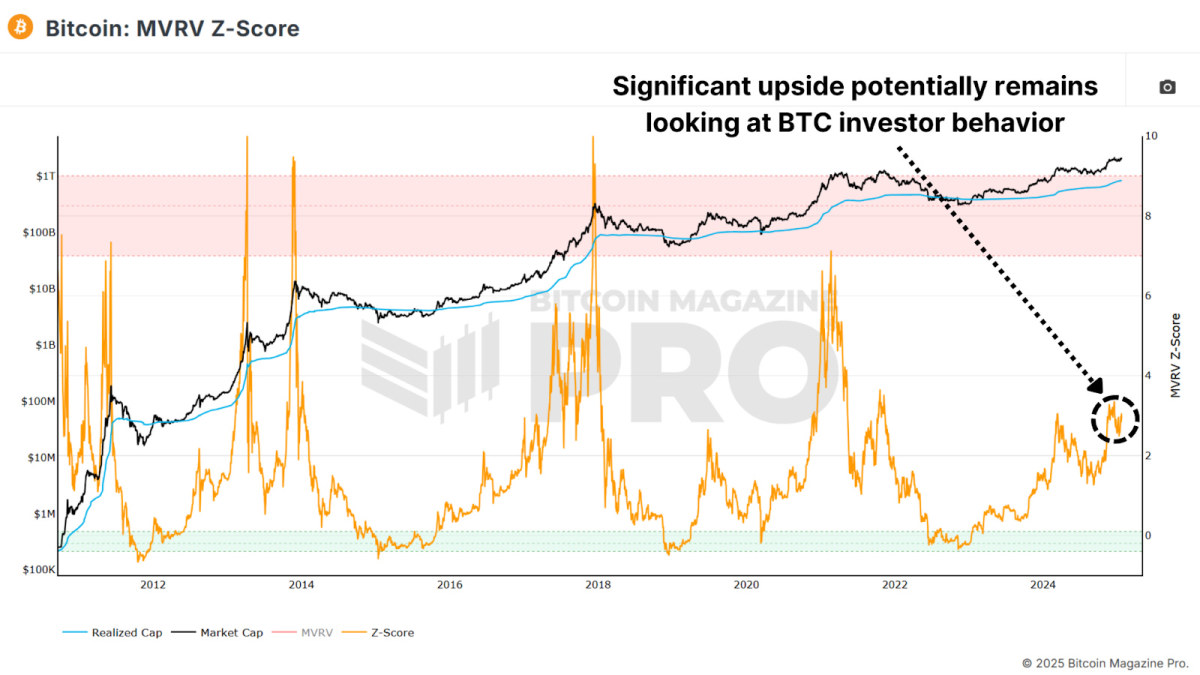

The MVRV Z-Score, a metric that evaluates Bitcoin's market value relative to its realized value, suggests that current values are well below historical peak levels. This indicates a substantial room for growth in the market.

Even when considering a two-year rolling version of the MVRV Z-Score that accounts for market dynamics, Bitcoin remains far from its previous cycle peaks. This leaves ample space for further price appreciation.

Sentiment Analysis and Market Dynamics

The Bitcoin Fear and Greed Index currently reflects a healthy level of Greedy sentiment, implying a sustainable level of greed in the market. Historical data from the 2020-2021 bull cycle indicates that greed levels in the range of 80-90 can persist for extended periods, supporting a prolonged bullish trend. Extreme levels of greed (95+) typically precede significant market corrections.

The Active Address Sentiment Indicator suggests a slight decline in network activity, indicating that retail investors have not fully re-entered the market. However, this could signal untapped retail demand that might drive the next phase of the rally.

Risk Trends and Market Signals

Traditional market sentiment is displaying positive signals, with an increasing appetite for High Yield Credit as the macro-economic landscape shifts towards a more risk-on outlook. The correlation between Bitcoin's performance and periods of heightened global risk appetite has historically aligned with bullish phases in Bitcoin's price.

Future Outlook

Considering Bitcoin's on-chain metrics, market sentiment, and macroeconomic factors, the current analysis points towards a continuation of the ongoing bull market. While short-term volatility is a possibility, the convergence of these indicators suggests that Bitcoin is well-positioned to potentially reach and surpass its current all-time high in the near future.

For a more detailed analysis of Bitcoin and access to advanced features like live charts, personalized indicator alerts, and industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This article serves for informational purposes only and does not constitute financial advice. Always conduct your research before making any investment decisions.

Frequently Asked Questions

Can I buy or sell gold from my self-directed IRA

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. These contracts allow you to speculate on future gold prices without actually owning it. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

Can the government take your gold?

Because you have it, the government can't take it. You have earned it by working hard for it. It belongs to your. There may be exceptions to this rule. You could lose your gold if convicted of fraud against a federal government agency. If you owe taxes, your precious metals could be taken away. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

What are some of the benefits of a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It is tax-deferred until it's withdrawn. You control how much you take each year. There are many types available. Some are better suited for college students. Some are for investors who seek higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. These earnings don't get taxed if they withdraw funds. This account is a good option if you plan to retire early.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. You won't have the hassle of making deposits each month. To avoid missing a payment, direct debits can be set up.

Finally, gold remains one of the best investment options today. Because it isn't tied to any particular country its value tends be steady. Even during economic turmoil the gold price tends to remain fairly stable. This makes it a great investment option to protect your savings from inflation.

What precious metals can you invest in for retirement?

Gold and silver are the best precious metal investments. They are both simple to purchase and sell, and they have been around for a long time. They are a great way to diversify your portfolio.

Gold: One of the oldest forms of currency, gold, is one of mankind's most valuable. It's stable and safe. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver is a popular investment choice. It's a great option for those who want stability. Silver tends to move up, not down, unlike gold.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It's durable and resists corrosion, just like gold and silver. It is however more expensive than its counterparts.

Rhodium: Rhodium is used in catalytic converters. It is also used to make jewelry. And, it's relatively cheap compared to other types of precious metals.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also much more affordable. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

How Do You Make a Withdrawal from a Precious Metal IRA?

You first need to decide if you want to withdraw money from an IRA account. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, determine how much money you plan to withdraw from your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage facilities will accept bullion bars, others require you to buy individual coins. Before you choose one, weigh the pros and cons.

Because you don't have to store individual coins, bullion bars take up less space than other items. However, each coin will need to be counted individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some people like to keep their coins in vaults. Others prefer to store them in a safe deposit box. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

finance.yahoo.com

How To

Guidelines for Gold Roth IRA

You should start investing early to ensure you have enough money for retirement. Start saving as soon as possible, usually at age 50. You can continue to save throughout your career. It's vital to contribute enough money each year to ensure adequate growth on an ongoing basis.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. These savings vehicles can be a great option for individuals who don't qualify for employer matching funds.

It is important to save consistently over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Bitcoin Analysis: Unveiling the Data Insights and On-Chain Trends

Sourced From: bitcoinmagazine.com/markets/bitcoin-deep-dive-data-analysis-on-chain-roundup

Published Date: Thu, 23 Jan 2025 15:33:00 GMT