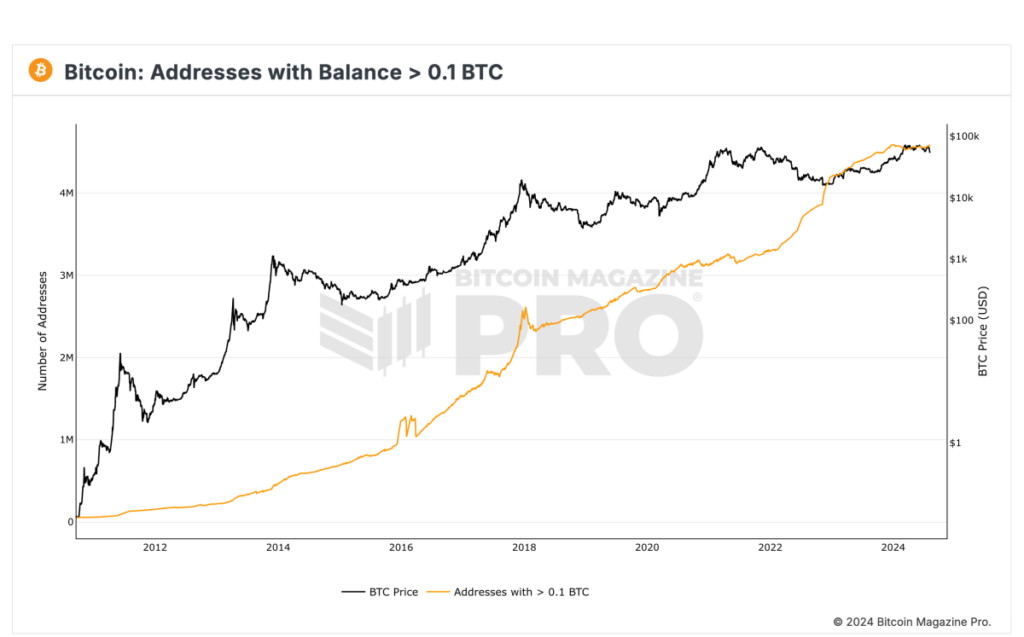

Recent data from Bitcoin Magazine Pro reveals that the number of Bitcoin addresses with a balance exceeding 0.1 BTC is approaching a historical peak. As of now, there are 4,580,424 such addresses, just slightly below the record of 4,586,540. This marks a significant monthly increase of 27,939 addresses.

Opportunity Amid Price Volatility

The recent price dip in Bitcoin, dropping from approximately $67,500 to $49,000, presented investors with a favorable buying opportunity. This allowed them to acquire Bitcoin at prices below the $50,000 mark. Despite the current trading range of $50,000-$60,000, which is 24% lower than its peak, buyers are actively accumulating, potentially driving the number of addresses holding over 0.1 BTC to a new high in the coming days.

Significance of Unique Addresses

The graph depicting the count of unique addresses holding a minimum of 0.1 BTC serves as a valuable indicator of Bitcoin adoption and usage trends. An uptick in addresses with small Bitcoin holdings suggests a growing adoption rate among new users entering the ecosystem.

Understanding Bitcoin Addresses

A Bitcoin address, typically composed of 26-35 alphanumeric characters, enables individuals to send and receive Bitcoin. Each wallet can encompass multiple addresses, serving as the public-facing component necessary for conducting transactions securely.

Future Outlook and Adoption Trends

With Bitcoin's total supply limited to 21 million coins, nearly 19 million have already been mined. Estimates propose that around 3 million of these coins may be irretrievably lost. As Bitcoin garners more mainstream acceptance, the count of addresses holding at least 0.1 BTC is projected to escalate, indicating broader adoption and heightened usage among diverse user groups.

For in-depth insights, detailed information, and access to Bitcoin Magazine Pro's data and analytics, interested individuals can visit the official website for a complimentary trial.

Frequently Asked Questions

What precious metals do you have that you can invest in for your retirement?

The best precious metal investments are gold and silver. They are both simple to purchase and sell, and they have been around for a long time. They are a great way to diversify your portfolio.

Gold: One of the oldest forms of currency, gold, is one of mankind's most valuable. It is very stable and secure. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver has been a favorite among investors for years. It's a great option for those who want stability. Silver, unlike gold, tends not to go down but up.

Platinum: A new form of precious metal, platinum is growing in popularity. It's resistant to corrosion and durable, similar to gold and silver. It is however more expensive than its counterparts.

Rhodium – Rhodium is used to make catalytic conversions. It is also used in jewelry-making. And, it's relatively cheap compared to other types of precious metals.

Palladium: Palladium, which is a form of platinum, is less common than platinum. It's also much more affordable. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

Can I keep a Gold ETF in a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow for contributions from both employees and employers. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

You can also get an Individual Retirement Annuity, or IRA. With an IRA, you make regular payments to yourself throughout your lifetime and receive income during retirement. Contributions to IRAs will not be taxed

How does gold perform as an investment?

Supply and demand determine the gold price. It is also affected negatively by interest rates.

Gold prices are volatile due to their limited supply. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

Is it a good idea to open a Precious Metal IRA

You should be aware that precious metals cannot be covered by insurance. You cannot recover any money you have invested. This includes all investments that are lost to theft, fire, flood, or other causes.

Protect yourself against this type of loss by investing in physical gold or silver coins. These items can be lost because they have real value and have been around for thousands years. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

Do not open an account unless you're ready to retire. Don't forget the future!

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads and Example. Risk Metrics

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

cftc.gov

How To

Investing in gold vs. investing in stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. Many people believe that investing in gold is not profitable. This belief arises because most people believe that the global economy is driving down gold prices. They fear that investing in gold will result in a loss of money. There are many benefits to investing in gold. Below are some of them.

Gold is the oldest known form of currency. Its use can be traced back to thousands of years ago. It is a valuable store of value that has been used by many people throughout the world. It's still used by countries like South Africa as a method of payment.

It is important to determine the price per Gram that you will pay for gold when making a decision about whether or not to invest. If you're interested in buying gold bullion, it is crucial that you decide how much per gram. You can always ask a local jeweler what the current market rate is if you don't have it.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. Although gold's price has fallen, its production costs have not.

You should also consider the amount of your intended purchase when considering whether you should buy or not. It makes sense to save any gold you don't need to purchase if your goal is to use it for wedding rings. If you plan to do so as long-term investments, it is worth looking into. Profitable gold can be sold at a lower price than it was when you bought it.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. We recommend that you investigate all options before making any major decisions. Only then can informed decisions be made.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: Bitcoin Addresses Holding Over 0.1 BTC Nearing All-Time High

Sourced From: bitcoinmagazine.com/markets/bitcoin-addresses-holding-over-0-1-btc-near-all-time-high-amid-price-dip

Published Date: Wed, 07 Aug 2024 17:10:00 GMT