As Bitcoin enters another phase of price discovery, enthusiasts and market watchers wonder if retail FOMO has kicked in or if the surge in retail activity seen in previous bull cycles is yet to come. By analyzing data from active addresses, historical cycles, and various market indicators, we can gain insight into the current state of the Bitcoin market and what it might indicate about the near future.

Rising Interest in Retail Participation

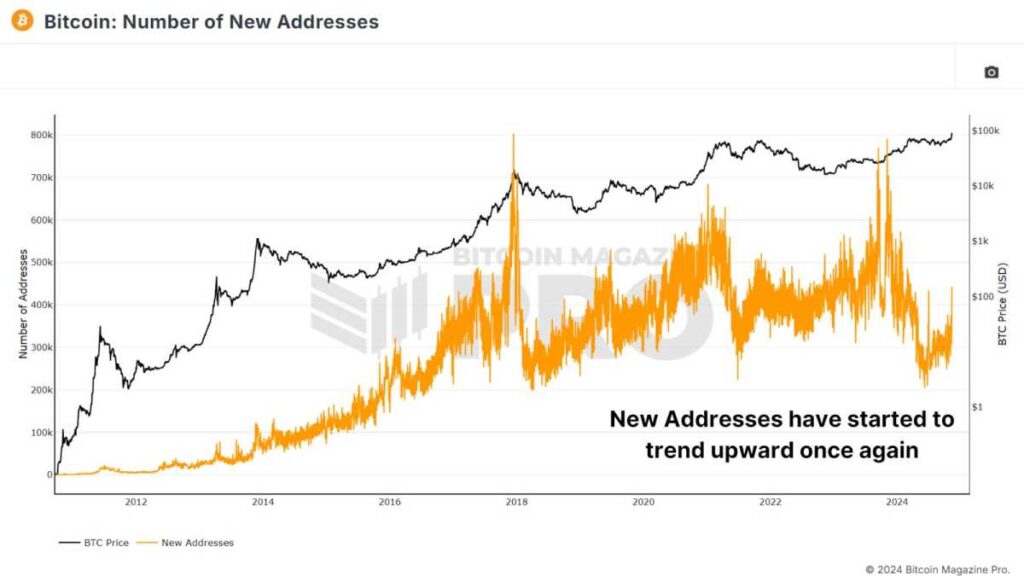

One of the clearest indicators of retail interest is the number of new Bitcoin addresses being created. In the past, significant spikes in new addresses have often signaled the start of a bull run as retail investors enter the market. While there has been a noticeable growth in new addresses in recent months, it hasn't been as sharp as expected. Last year, there were approximately 791,000 new addresses created in a single day, reflecting considerable retail interest. However, the current numbers are lower, though there has been a slight uptick in new addresses.

Figure 1: The increase in new addresses on the Bitcoin network is starting to show an upward trend. View Live Chart

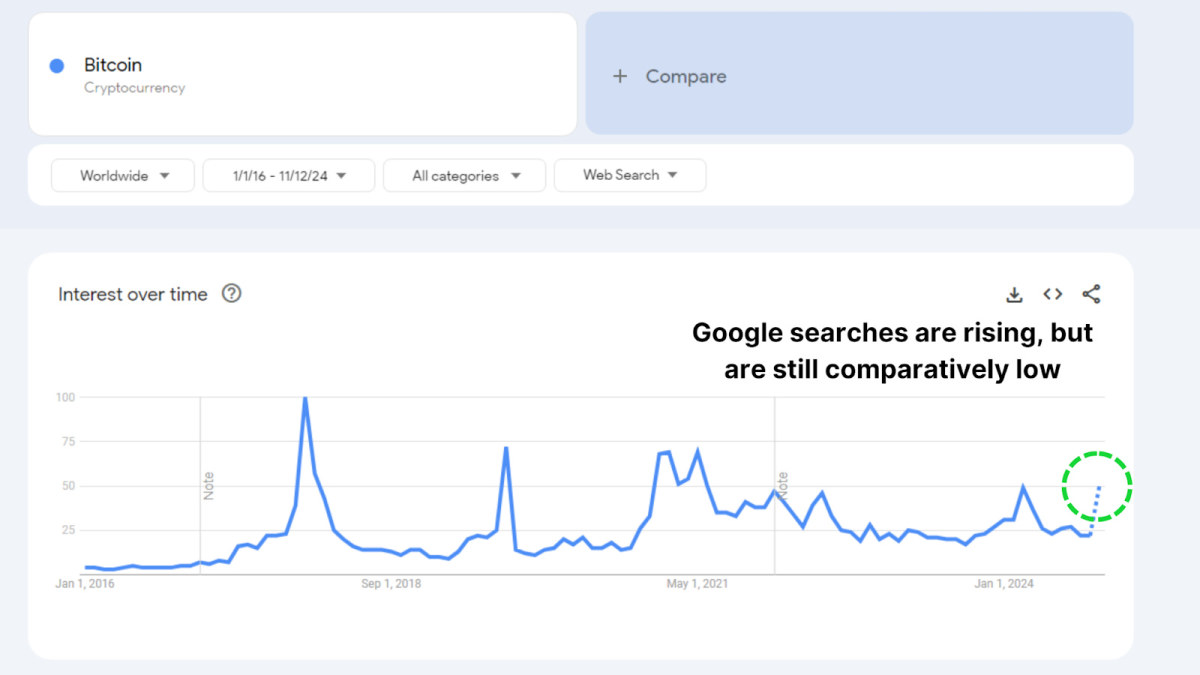

Google Trends data also mirrors this tempered interest. While searches for "Bitcoin" have been rising over the past month, they are still below the peaks seen in 2021 and 2017. This suggests that retail investors are becoming more curious but haven't reached the levels of excitement typically associated with FOMO-driven markets.

Figure 2: Google searches for 'Bitcoin' are on the rise but are relatively low compared to previous peaks.

Shift in Bitcoin Supply Dynamics

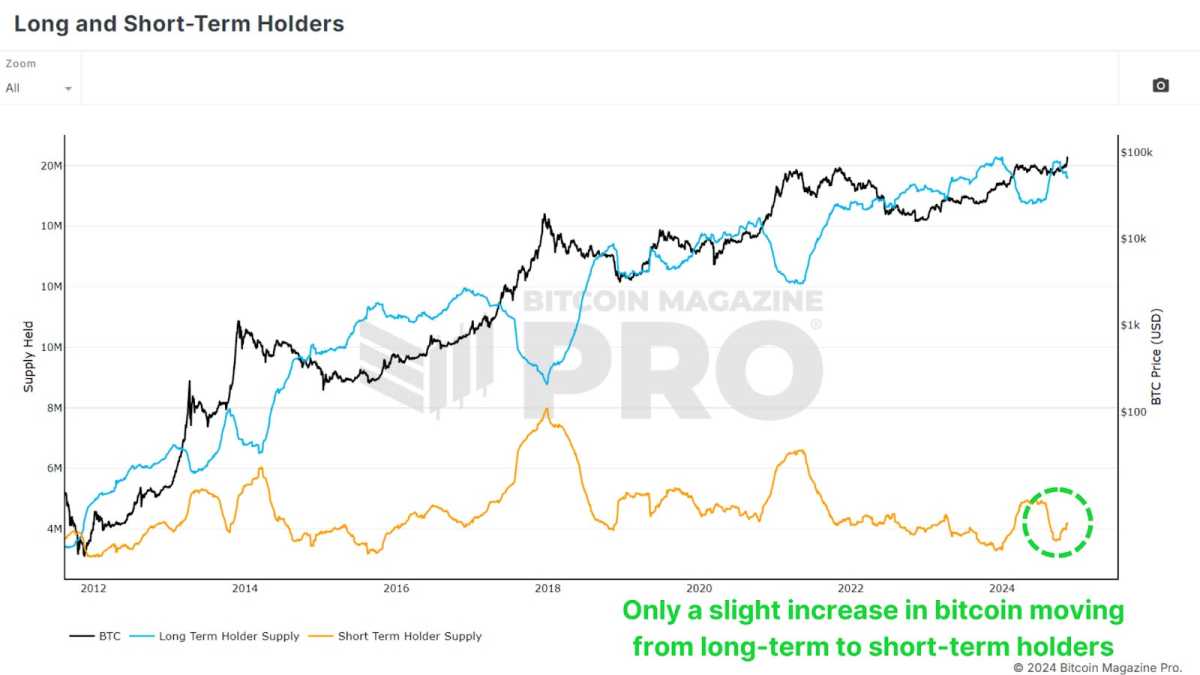

We are observing a slight shift in Bitcoin ownership from long-term holders to newer, short-term holders. This change in supply dynamics could indicate the beginning of a new market phase, where long-time holders start taking profits and selling to newer market participants. However, the overall volume of coins being transferred remains modest, suggesting that long-term holders are not yet offloading their Bitcoin in significant quantities.

Figure 3: There is a slight uptick in the transfer of Bitcoin to new holders. View Live Chart

During the previous bull run in 2020-2021, there were substantial outflows from long-term holders to new investors, fueling a subsequent price rally. Currently, the shift is minor, with long-term holders seemingly unperturbed by current price levels, choosing to hold onto their Bitcoin despite market gains. This reluctance to sell indicates their confidence in the potential for further price appreciation.

Spot-Driven Market Rally

A notable feature of Bitcoin's recent rally is its spot-driven nature, as opposed to previous bull runs that were heavily driven by leveraged positions. Open interest in Bitcoin derivatives has seen only marginal growth, contrasting with previous peaks. For example, open interest was significant before the FTX crash in 2022. A spot-driven market, with less leverage, tends to be more stable and resilient, as fewer investors are exposed to forced liquidation risks.

Figure 4: There has been a decline in open interest on a macro scale, with a slight recent uptick. View Live Chart

Accumulation by Large Holders

Interestingly, while retail addresses have not shown significant growth, addresses holding at least 100 BTC (known as "whales") have been increasing. In recent weeks, wallets with substantial BTC holdings have added tens of thousands of coins, representing billions of dollars in value. This uptrend indicates that Bitcoin's major investors are confident in the potential for further price appreciation, even as Bitcoin reaches new all-time highs.

Figure 5: The number of addresses holding 100+ BTC is at its highest level since 2019. View Live Chart

In previous bull cycles, whales have reduced their positions near market peaks, a trend that is not apparent this time. The ongoing accumulation by experienced holders serves as a strong bullish signal, indicating their belief in the long-term prospects of the market.

Future Outlook

Despite Bitcoin's surge to all-time highs attracting renewed attention, widespread retail FOMO is not yet evident. The subdued retail interest suggests that we may be in the early stages of this rally. Long-term holders remain confident, whales are accumulating, and leverage levels are moderate, all pointing towards a healthy and sustainable upward trend.

As we progress through this bull cycle, the market's dynamics hint at the potential for a significant retail-driven surge in the future. If retail interest intensifies, it could propel Bitcoin to new price levels.

For a detailed analysis of this topic, you can watch a recent YouTube video titled: "Has Retail Bitcoin FOMO Begun?"

Frequently Asked Questions

What is the tax on gold in an IRA

The tax on the sale of gold is based on its fair market value when sold. When you purchase gold, you don't have to pay any taxes. It is not income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

You can use gold as collateral to secure loans. Lenders will seek the highest return on your assets when you borrow against them. For gold, this means selling it. There's no guarantee that the lender will do this. They may hold on to it. They may decide to resell it. Either way you will lose potential profit.

To avoid losing money, only lend against gold if you intend to use it for collateral. It's better to keep it alone.

What Should Your IRA Include in Precious Metals?

It's important to understand that precious metals aren't only for wealthy people. You don’t need to have a lot of money to invest. There are many ways to make money on silver and gold investments without spending too much.

You may consider buying physical coins such as bullion bars or rounds. Shares in precious metals-producing companies could be an option. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

Their prices are more volatile than traditional investments. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

Should You Get Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Some experts believe that this could change very soon. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

Here are some things to consider if you're considering investing in gold.

- Consider first whether you will need the money to save for retirement. It's possible to save for retirement without putting your savings into gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each type offers varying levels and levels of security.

- Keep in mind that gold may not be as secure as a bank deposit. Your gold coins may be lost and you might never get them back.

Do your research before you buy gold. If you already have gold, make sure you protect it.

What are the advantages of a gold IRA

The best way to save money for retirement is to place it in an Individual Retirement Account. It's tax-deferred until you withdraw it. You have complete control over how much you take out each year. There are many types to choose from when it comes to IRAs. Some are more suitable for students who wish to save money for college. Some are for investors who seek higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. These earnings don't get taxed if they withdraw funds. So if you're planning to retire early, this type of account may make sense.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. That means you won't have to think about making deposits every month. Direct debits could be set up to ensure you don't miss a single payment.

Finally, gold is one the most secure investment options available. Because it isn't tied to any particular country its value tends be steady. Even in times of economic turmoil, gold prices tend not to fluctuate. It is therefore a great choice for protecting your savings against inflation.

How much gold do you need in your portfolio?

The amount that you want to invest will dictate how much money it takes. If you want to start small, then $5k-$10k would be great. Then as you grow, you could move into an office space and rent out desks, etc. This will allow you to pay rent monthly, and not worry about it all at once. Rent is only paid per month.

You also need to consider what type of business you will run. My website design company charges clients $1000-2000 per month depending on the order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. So you might only get paid once every 6 months or so.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k to $2k of gold, and then growing from there.

What is the benefit of a gold IRA?

There are many advantages to a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You have control over how much money goes into each account.

Another option is to rollover funds from another retirement account into a IRA with gold. If you are planning to retire early, this makes it easy to transition.

The best part about gold IRAs? You don't have to be an expert. They're readily available at almost all banks and brokerage firms. Withdrawals are made automatically without having to worry about fees or penalties.

However, there are still some drawbacks. Gold is historically volatile. Understanding why you want to invest in gold is essential. Are you looking for safety or growth? Is it for insurance purposes or a long-term strategy? Only after you have this information will you make an informed decision.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. A single ounce will not be sufficient to meet all your requirements. Depending on the purpose of your gold, you might need more than one ounce.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even live with just one ounce. But you won't be able to buy anything else with those funds.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

irs.gov

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Lawful – WSJ

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads and Example. Risk Metrics

bbb.org

How To

3 Ways to Invest in Gold for Retirement

It is important to understand the role of gold in your retirement plan. You have many options for investing in gold if there is a 401K account at your workplace. You may also be interested in investing in gold beyond your workplace. You could, for example, open a custodial bank account at Fidelity Investments if your IRA (Individual Retirement Account) is open. If you don't have any precious metals yet, you might want to buy them from a reputable dealer.

These are the three rules to follow if you decide to invest in gold.

- Buy Gold with Your Cash – Don't use credit cards or borrow money to fund your investments. Instead, invest in cash. This will help you to protect yourself against inflation while also preserving your purchasing power.

- Physical Gold Coins – Physical gold coins are better than a paper certificate. The reason for this is that physical gold coins are much more easily sold than certificates. There are no storage fees for physical gold coins.

- Diversify your Portfolio – Don't put all your eggs in one basket. This means that you should diversify your wealth by investing in different assets. This can reduce market volatility and help you be more flexible.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Are Retail Investors Driving The Surge in Bitcoin Prices?

Sourced From: bitcoinmagazine.com/markets/are-retail-investors-behind-the-bitcoin-price-surge-this-bull-run

Published Date: Sat, 16 Nov 2024 15:02:26 GMT