Over the past year, bitcoin has surged by 153%, with numerous other digital currencies also seeing substantial increases. However, when assessing the top cryptocurrencies in relation to bitcoin's performance, the annual shifts present a distinctly varied perspective.

2023 Sees Altcoins Lag Behind Bitcoin's Rally Despite Overall Market Boom

The landscape of top cryptocurrencies has significantly evolved since December 2022, with the overall market value of the crypto economy soaring from $811 billion to $1.68 trillion, marking an impressive increase of over $909 billion. During this period, while ethereum has witnessed a 95% surge this year, its value compared to BTC has diminished. Specifically, ETH decreased from 0.07237 BTC to 0.05432 BTC, translating to a loss exceeding 24% against bitcoin, the premier cryptocurrency by market capitalization.

Ethereum wasn't the only digital currency to experience a decline relative to BTC. Binance coin (BNB) also saw a substantial reduction, falling from 0.0146 BTC to the present 0.007219 BTC. This signifies that BNB has lost 50.55% of its value when measured against bitcoin. Solana's journey paints a contrasting picture, boasting an 877% surge against the dollar and an impressive ascent of over 257% against BTC. Within a year, SOL escalated from 0.0006985 BTC to the current 0.002496 BTC.

Conversely, XRP experienced a decline of about 30% against BTC, descending from 0.00002096 to 0.00001462. Cardano's ADA saw a more modest decrease of approximately 6.54%, dropping from 0.00001544 to 0.00001443 per unit against bitcoin. Meanwhile, Avalanche (AVAX) emerged as another notable contender, elevating from 0.0007008 BTC to 0.001006 BTC, marking a 43.55% increase against bitcoin over the year.

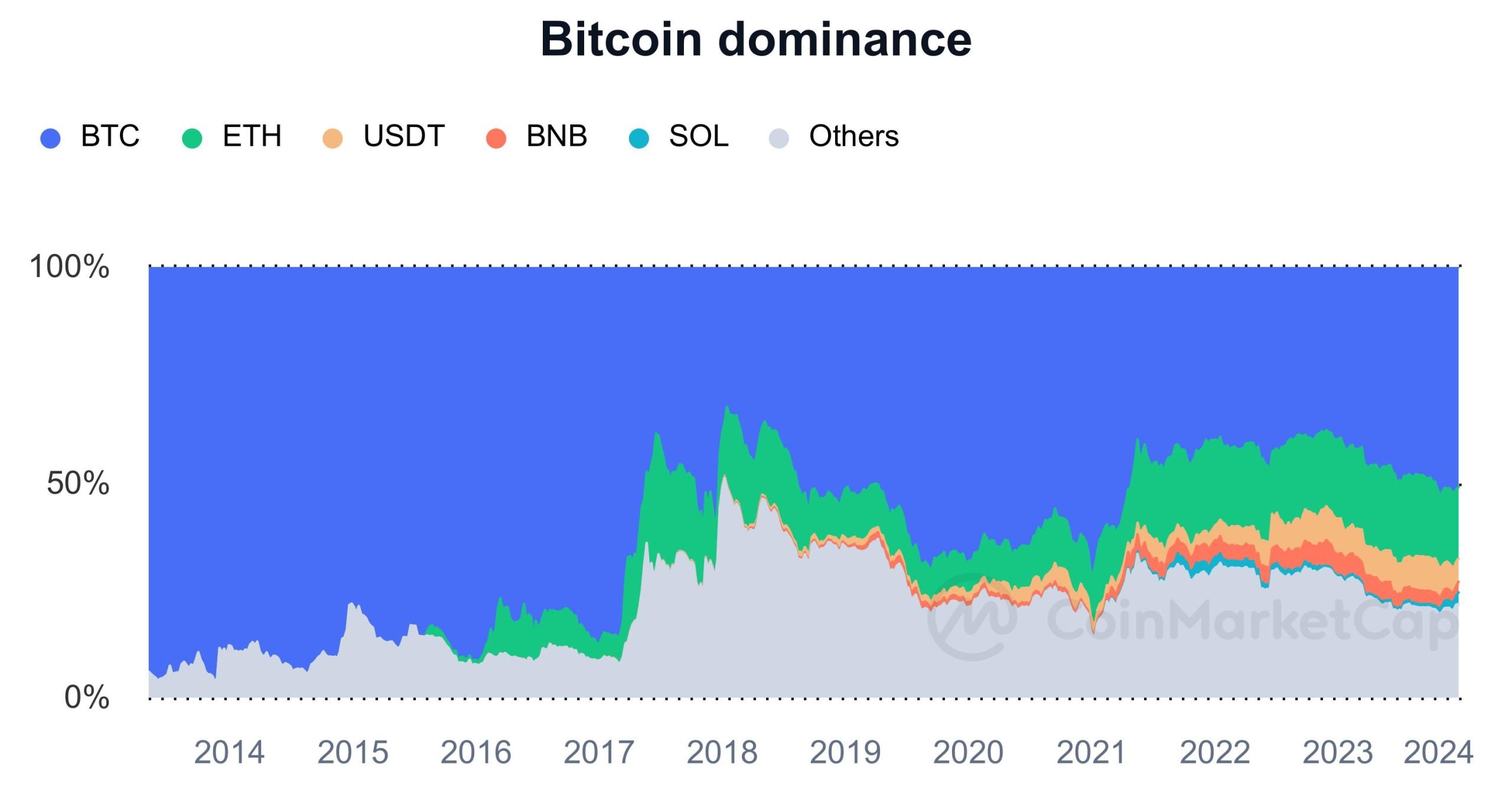

DOGE faced a notable setback, losing 52.79% against BTC, falling from 0.000004591 BTC to the current 0.000002167 BTC per unit over the past year. Polkadot (DOT) also saw a reduction, moving from 0.0002659 BTC to 0.0002074 BTC, a 22% decline over the same timeframe. As of December 2023, BTC's dominance has risen to around 50% from December 2022's 39.9%, while ETH's influence has slightly decreased to 16.7% from its previous 18.4%.

What's also interesting is the fact that the infamous 'Altcoin Season' appears to be getting closer as figures from blockchaincenter.net's Altcoin Season Index shows a score of 67 when 'Altcoin Season' starts above 75. Blockchaincenter.net's Altcoin Season Index rule is that if 75% of the top 50 coins performed better than bitcoin (BTC) over the last season (90 days), it is officially Altcoin Season.

What do you think about the top coins and their performances against bitcoin over the last 12 months? Share your thoughts and opinions about this subject in the comments section below.

Frequently Asked Questions

How much should I contribute to my Roth IRA account?

Roth IRAs are retirement accounts where you deposit your own money tax-free. These accounts cannot be withdrawn until you turn 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, your principal (the deposit amount originally made) is not transferable. This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule says that you cannot withdraw your earnings without paying income tax. You will pay income taxes when you withdraw your earnings. Let's assume that you contribute $5,000 each year to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. The remaining $6,500 is yours. Because you can only withdraw what you have initially contributed, this is all you can take out.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. In addition, 50% of your earnings will be subject to tax again (half of 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. You can withdraw your contributions plus interest from your traditional IRA when you retire. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs are not allowed to allow you deductions for contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement account (IRA) is a better option than regular savings accounts in that interest earned is exempted from tax. This makes an IRA great for people who want to save money but don't want to pay tax on the interest they earn. However, there are also disadvantages to this type of investment.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers may charge monthly management fees, ranging between $10 and $50.

Insurance will be required if you would like to keep your cash out of banks. Most insurers require you to own a minimum amount of gold before making a claim. Insurance that covers losses upto $500,000.

If you choose to have a gold IRA you will need to establish how much gold to use. Some providers limit the amount of gold that you are allowed to own. Some providers allow you to choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more costly than gold futures. However, futures contracts give you flexibility when buying gold. They enable you to establish a contract with an expiration date.

You also need to decide the type and level of insurance coverage you want. Standard policies don't cover theft protection, loss due to fire, flood or earthquake. The policy does not cover natural disasters. You may consider adding additional coverage if you live in an area at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Insurance doesn't cover storage costs. Safekeeping costs can be as high as $25-40 per month at most banks.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians don't have the right to sell assets. Instead, they must keep your assets for as long you request.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. The plan should also include information about how much you are willing to invest each month.

After filling in the forms, please send them to the provider. Once the company has received your application, they will review it and send you a confirmation email.

When opening a gold IRA, you should consider using a financial planner. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

How much of your IRA should include precious metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don't need to be rich to make an investment in precious metals. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You may consider buying physical coins such as bullion bars or rounds. It is possible to also purchase shares in companies that make precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You will still reap the benefits of owning precious metals, regardless of which option you choose. Even though they aren't stocks, they still offer the possibility of long-term growth.

And, unlike traditional investments, their prices tend to rise over time. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

Which precious metals are best to invest in retirement?

The best precious metal investments are gold and silver. They're both easy to buy and sell and have been around forever. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: Gold is one the oldest forms currency known to man. It is stable and very secure. Because of this, it is considered a great way of preserving wealth during times when there are uncertainties.

Silver: Silver has been a favorite among investors for years. It's a good choice for those who want to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinum: A new form of precious metal, platinum is growing in popularity. It's like silver or gold in that it is durable and resistant to corrosion. It's also more expensive than the other two.

Rhodium: The catalytic converters use Rhodium. It is also used as a jewelry material. It is relatively affordable when compared to other types.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also more accessible. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

Who owns the gold in a Gold IRA?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

The purchase of gold can protect you from inflation and price volatility. But it's not smart to hold it if your only intention is to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

You should consult a financial planner or accountant to see what options are available to you.

Do You Need to Open a Precious Metal IRA

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. You cannot recover any money you have invested. This includes all investments that are lost to theft, fire, flood, or other causes.

Protect yourself against this type of loss by investing in physical gold or silver coins. These coins have been around for thousands and represent a real asset that can never be lost. You would probably get more if you sold them today than you paid when they were first created.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

Remember that you will not see any returns unless you are retired if you open an Account. Remember the future.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

cftc.gov

investopedia.com

finance.yahoo.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

From the ancient days to the early 20th Century, gold was a common currency. It was widely accepted around the world and enjoyed its purity, divisibility and uniformity. Because of its intrinsic value, it was also widely traded. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. For example in England, a pound sterling equals 24 carats. In France, a livre tournois equals 25. Carats of golden. Germany had one mark which equals 28. Carats.

In the 1860s, the United States began to issue American coins made from 90% copper, 10% Zinc, and 0.942 Fine Gold. This led to a decline in demand for foreign currencies, which caused their price to increase. At this point, the United States minted large amounts of gold coins, causing the price of gold to drop. They needed to pay off debt because they had too much money coming into circulation. They decided to return some of the gold they had left to Europe.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The price of gold rose significantly over the years. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Altcoin Fortunes Declined When Paired Against BTC in 2023 Despite Crypto Market Surge

Sourced From: news.bitcoin.com/altcoin-fortunes-declined-when-paired-against-btc-in-2023-despite-crypto-market-surge/

Published Date: Wed, 27 Dec 2023 20:30:22 +0000