As the crypto market experienced a significant downturn, the Abu Dhabi Investment Council (ADIC) made a bold move by tripling its stake in BlackRock's iShares Bitcoin Trust (IBIT) during Q3. This strategic decision showcases the council's confidence in the digital asset despite market uncertainties.

The Rising Bitcoin Bet by Abu Dhabi

ADIC's Calculated Expansion

ADIC, operating under Mubadala Investment Co., significantly boosted its IBIT holdings to nearly 8 million shares by the end of September, reflecting a value of approximately $518 million. This move marked a substantial increase from its previous stake, signaling a strong commitment to Bitcoin.

Long-Term Diversification Strategy

According to reports, Abu Dhabi's move was part of a broader diversification strategy, likening Bitcoin to a modern-day equivalent of gold. The council views Bitcoin as a digital store of value, aligning with its traditional asset portfolio.

Abu Dhabi's Strategic Crypto Vision

Global Expansion Ambitions

Abu Dhabi's financial influence, with oversees assets exceeding $1.7 trillion, positions it as a key player in the digital asset realm. The council's foray into Bitcoin underscores its ambition to become a significant global crypto hub, setting the stage for further growth and innovation.

Shift Towards Digital Assets

ADIC's strategic shift towards Bitcoin mirrors a broader trend among large sovereign funds embracing cryptocurrencies as long-term strategic assets. Despite market volatility, Abu Dhabi's bold stance highlights a growing trend of major institutions viewing Bitcoin as a valuable addition to their investment portfolios.

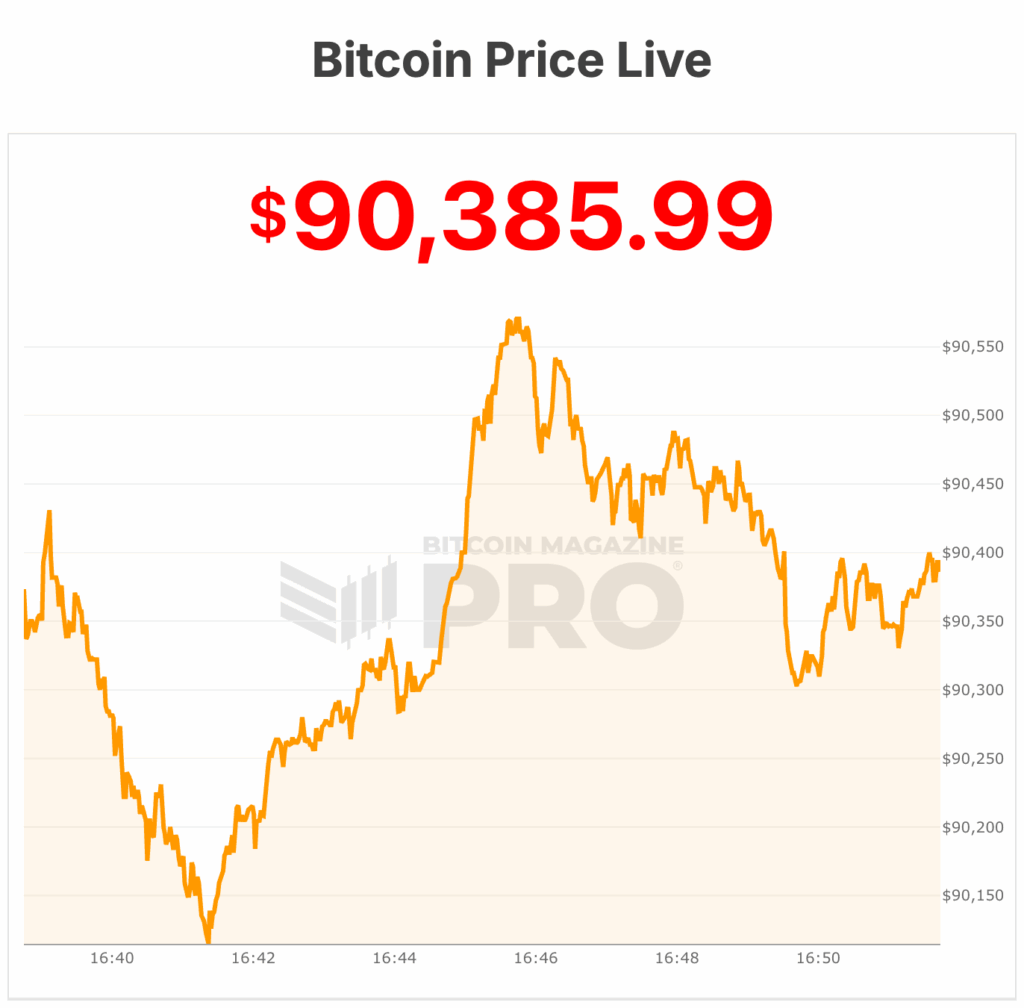

Bitcoin's current price hovers around $90,300, reflecting the ongoing fluctuations in the cryptocurrency market. Amidst uncertainties, strategic investments like Abu Dhabi's emphasize the evolving landscape of digital assets and the growing confidence in Bitcoin's long-term potential.

Frequently Asked Questions

How is gold taxed within an IRA?

The fair market value of gold sold is the basis for tax. If you buy gold, there are no taxes. It is not considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

As collateral for loans, gold is possible. Lenders seek to get the best return when you borrow against your assets. Selling gold is usually the best option. However, there is no guarantee that the lender would do this. They may keep it. They may decide to resell it. Either way, you lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. It's better to keep it alone.

How much is gold taxed under a Roth IRA

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

These rules vary from one state to another. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York is open until 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

What Should Your IRA Include in Precious Metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don't have to be rich to invest in them. There are many ways to make money on silver and gold investments without spending too much.

You might also be interested in buying physical coins, such bullion rounds or bars. You could also buy shares in companies that produce precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You will still reap the benefits of owning precious metals, regardless of which option you choose. These metals are not stocks, but they can still provide long-term growth.

Their prices rise with time, which is a different to traditional investments. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

Should You Purchase Gold?

Gold was a safe investment option for those who were in financial turmoil. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

This could be changing, according to some experts. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also point out that gold is becoming popular because of its perceived value and potential return.

Here are some things to consider if you're considering investing in gold.

- Before you start saving money for retirement, think about whether you really need it. It is possible to save for retirement while still investing your gold savings. The added protection that gold provides when you retire is a good option.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each offers varying levels of flexibility and security.

- Last but not least, gold doesn't provide the same level security as a savings account. Losing your gold coins could result in you never being able to retrieve them.

So, if you're thinking about buying gold, make sure you do your research first. If you already have gold, make sure you protect it.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

investopedia.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

irs.gov

How To

Guidelines for Gold Roth IRA

Starting early is the best way to save for retirement. As soon as you become eligible, which is usually around age 50, start saving and keep it up throughout your career. It's vital to contribute enough money each year to ensure adequate growth on an ongoing basis.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles let you make contributions and not pay taxes until the earnings are withdrawn. This makes them a great choice for people who don’t have access employer matching funds.

It is important to save consistently over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————-

By: Micah Zimmerman

Title: Abu Dhabi's Strategic Bitcoin Investment Surge: Insights Before the Crypto Market Plunge

Sourced From: bitcoinmagazine.com/news/abu-dhabi-tripled-its-bitcoin

Published Date: Wed, 19 Nov 2025 21:52:16 +0000