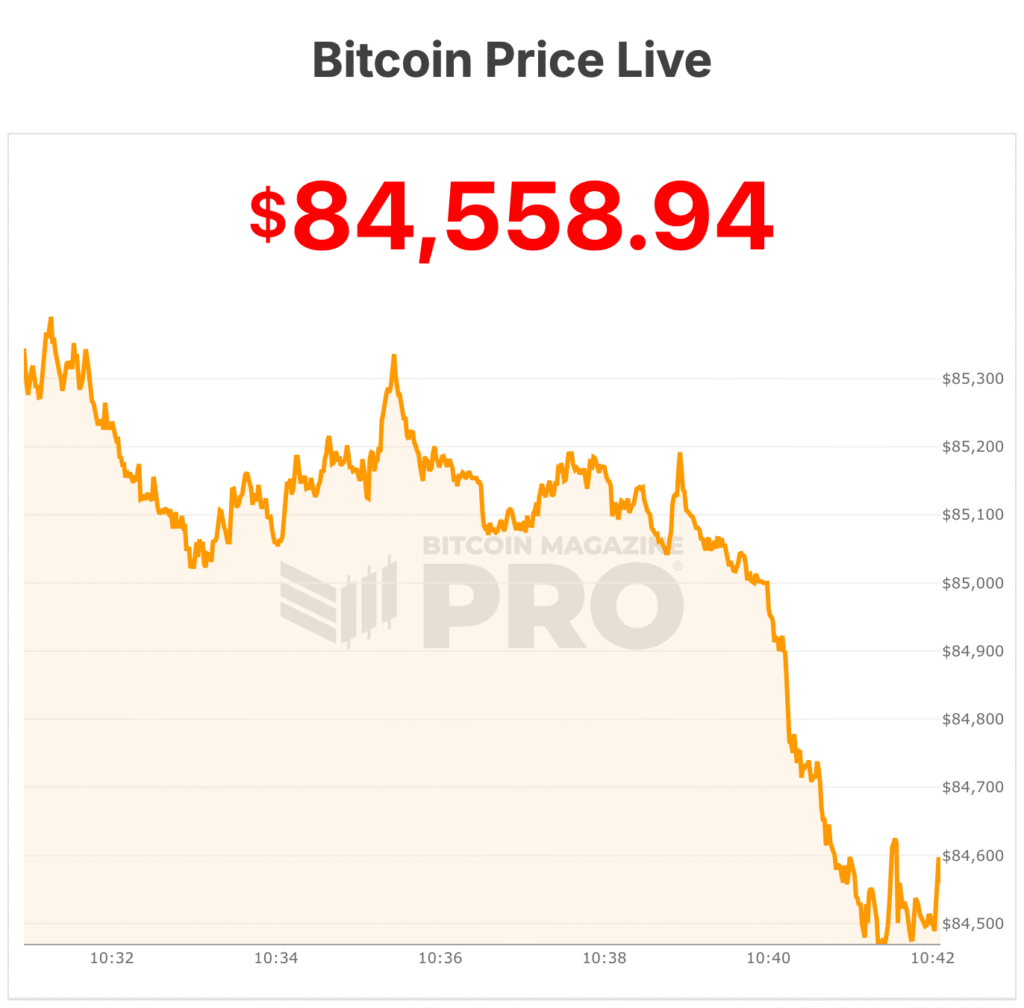

Hey there, crypto enthusiasts! Today, let's dive into the recent drop in Bitcoin's price and what it means for the market moving forward. If you've been keeping an eye on the crypto world, you probably noticed the plunge to $84,000 and the anticipation for the next big move. Exciting, right?

Bitcoin's Rollercoaster Ride

So, what exactly happened? Bitcoin took a nosedive to $84,000, marking a 6% decrease in just 24 hours. This sudden drop followed a quick climb to over $90,000, showcasing the wild volatility surrounding the recent Federal Reserve meeting. With trading volume hitting $48 billion, it's clear that things got pretty intense out there.

Market Response to Fed Meeting

The Fed meeting stirred the pot even more. As the market reacted to the Fed's decisions, Bitcoin faced a "sell the news" scenario. While unemployment rates remained stable, the market wasn't too thrilled with the lack of urgency in easing policies. This led to a significant pullback in speculative assets.

Key Levels to Watch

Now, the big question is: where does Bitcoin go from here? Analysts are keeping a close eye on the $84,000 support level. If Bitcoin fails to hold above this key point, we might see a further decline towards the $72,000–$68,000 range. Bulls are gearing up to defend the $84,000 mark fiercely to prevent a major breakdown.

Upcoming White House Meeting

Looking ahead, all eyes are on the White House gathering with banking and crypto bigwigs. Scheduled for February 2, the meeting aims to revive stalled U.S. crypto legislation. This event could have a significant impact on the crypto market, so stay tuned for more updates!

As of now, Bitcoin is trading at $84,437 with a daily trading volume of $48 billion. While the recent dip might seem concerning, it's all part of the crypto rollercoaster. Keep an eye on those support levels and get ready for whatever the market throws our way!

Frequently Asked Questions

What are the benefits of a Gold IRA?

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It's tax-deferred until you withdraw it. You control how much you take each year. There are many types of IRAs. Some are better suited to college savings. Some are for investors who seek higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. However, once they begin withdrawing funds, these earnings are not taxed again. This account may be worth considering if you are looking to retire earlier.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. You won't have the hassle of making deposits each month. Direct debits could be set up to ensure you don't miss a single payment.

Gold is one of today's most safest investments. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in economic turmoil, gold prices tends to remain relatively stable. As a result, it's often considered a good choice when protecting your savings from inflation.

What is the value of a gold IRA

The benefits of a gold IRA are many. It can be used to diversify portfolios and is an investment vehicle. You control how much money goes into each account and when it's withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. This allows you to easily transition if your retirement is early.

The best part? You don’t need to have any special skills to invest into gold IRAs. They are offered by most banks and brokerage companies. Withdrawals can be made instantly without the need to pay fees or penalties.

That said, there are drawbacks too. Gold has historically been volatile. Understanding why you invest in gold is crucial. Are you seeking safety or growth? Is it for insurance purposes or a long-term strategy? Only by knowing the answer, you will be able to make an informed choice.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. One ounce won't be enough to meet all your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don't have to buy a lot of gold if your goal is to sell it. You can even manage with one ounce. But you won't be able to buy anything else with those funds.

Can the government take your gold?

Because you have it, the government can't take it. You earned it through hard work. It belongs to you. There may be exceptions to this rule. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. You can also lose precious metals if you owe taxes. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

Which precious metal is best to invest in?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. For example, if your goal is to make quick money, gold may not suit you. If patience and time are your priorities, silver is the best investment.

If you don't care about getting rich quickly, gold is probably the way to go. If you want to invest in long-term, steady returns, silver is a better choice.

How much of your portfolio should be in precious metals?

To answer this question, we must first understand what precious metals are. Precious Metals are elements that have a very high relative value to other commodities. This makes them highly valuable for both investment and trading. Today, gold is the most commonly traded precious metal.

There are many other precious metals, such as silver and platinum. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also relatively unaffected both by inflation and deflation.

In general, all precious metals have a tendency to go up with the market. They do not always move in the same direction. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. Investors expect lower interest rate, making bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. Since these are scarce, they become more expensive and decrease in value.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

investopedia.com

cftc.gov

finance.yahoo.com

bbb.org

How To

3 Ways To Invest in Gold For Retirement

It is crucial to understand how you can incorporate gold into your retirement plans. You can invest in gold through your 401(k), if you have one at work. You may also be interested in investing in gold beyond your workplace. One example is opening a custodial accounts at Fidelity Investments if an IRA (Individual Retirement Account), if you already own one. You might also consider purchasing precious metals directly from a trusted dealer if they are not already yours.

These are three simple rules to help you make an investment in gold.

- Buy Gold with Your Cash – Don't use credit cards or borrow money to fund your investments. Instead, cash in your accounts. This will help protect you against inflation and keep your purchasing power high.

- Physical Gold Coins to Own – Physical gold coin ownership is better than having a paper certificate. The reason is that it's much easier to sell physical gold coins than certificates. Physical gold coins don't require storage fees.

- Diversify your Portfolio – Don't put all your eggs in one basket. This means that you should diversify your wealth by investing in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————-

By: Micah Zimmerman

Title: Bitcoin Price Dips to $84,000 Amid Market Uncertainty: What's Next?

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-crashes-5-to-85k

Published Date: Thu, 29 Jan 2026 15:43:18 +0000