Hey there, crypto enthusiasts! Exciting times are ahead as Bitcoin gears up for a potential $94,000 breakout amidst the looming FOMC rate cut decision. Last week was a roller coaster ride, with bears and bulls battling it out. But what's in store for us this week? Let's dive in and uncover the latest insights.

Bitcoin Rollercoaster: Bulls vs. Bears

The Battle for $94K

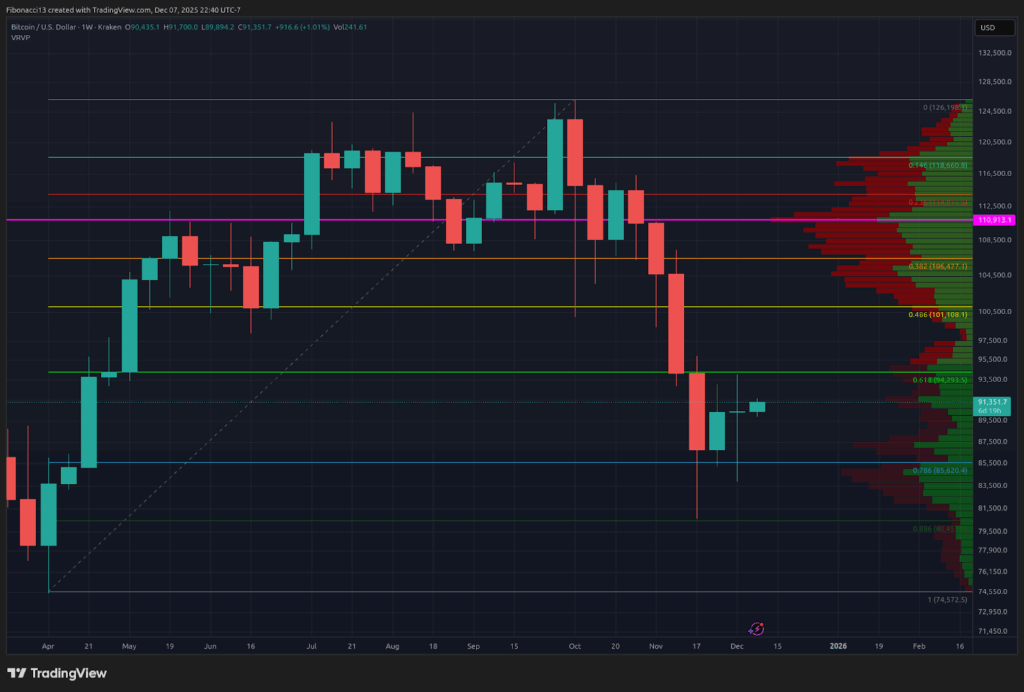

Last week saw Bitcoin's price swing from $84,000 support to $94,000 resistance, only to drop below $88,000 before closing at $90,429. The bulls are eyeing that $94,000 mark for a breakthrough, aiming to shift the market sentiment in their favor. Can they make it happen this week?

Resistance Ahead

If the bulls conquer $94,000, the next hurdles are at $96,000, $101,000, and beyond. Sellers might slow the momentum above $96,000, with a tough resistance zone from $107,000 to $110,000. Breaking above $100,000 won't be a walk in the park!

Support Levels: Holding the Line

Staying Above $87,200

To avoid revisiting the $84,000 support, bulls need to keep daily closes above $87,200. A slip below $84,000 weakens the support level, risking further downward pressure. There's a safety net at $72,000 to $68,000, acting as a buffer zone.

Momentum and Market Sentiment

Short-term momentum favors the bulls, with the RSI showing positive signs. Keeping above support levels is crucial, especially with the FOMC meeting looming. A surprise no-rate-cut decision could test the $84,000 support once more.

What Lies Ahead

Market Analysis and Outlook

The monthly MACD oscillator signals a bearish trend, likely influencing December and January's price movements. Climbing above the 100-week SMA at $84,700 is key for the bulls. However, strong resistance awaits beyond $110,000, posing a significant challenge.

Key Terms to Know

Let's break down some essential terms to better understand the market dynamics:

- Bulls/Bullish: Optimistic investors expecting price uptrends.

- Bears/Bearish: Pessimistic investors anticipating price downtrends.

- Support Level: The price level expected to hold initially, weakening with more tests.

- Resistance Level: The price level likely to reject advances, also weakening with repeated tests.

- SMA: Simple Moving Average, providing insight into price trends over a specific period.

- Fibonacci Retracements and Extensions: Ratios based on natural growth and decay cycles, aiding in price analysis.

- Oscillators: Technical indicators fluctuating within set levels, like RSI and MACD.

Stay tuned as Bitcoin's journey unfolds, and remember, the crypto market is full of surprises. Keep a close eye on the ever-changing trends, and happy trading!

Frequently Asked Questions

Can I hold a gold ETF in a Roth IRA?

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow contributions from both the employer and employee. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP gives employees tax advantages as they share the stock of the company and the profits it makes. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

A Individual Retirement Annuity is also possible. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions to IRAs can be made without tax.

Is buying gold a good way to save money for retirement?

Although gold investment may not seem appealing at first glance due to the high average global gold consumption, it's worth considering.

Physical bullion bar is the best way to invest in precious metals. However, there are many other ways to invest in gold. It's best to thoroughly research all options before you make a decision.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

Should You Buy Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Experts believe this could change soon. They say that gold prices could rise dramatically with another global financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

These are some important things to remember if your goal is to invest in gold.

- Consider first whether you will need the money to save for retirement. You can save for retirement and not invest your savings in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, ensure you fully understand the risks involved in buying gold. Each offer varying degrees of security and flexibility.

- Remember that gold is not as safe as a bank account. Your gold coins may be lost and you might never get them back.

Don't buy gold unless you have done your research. Make sure to protect any gold you already own.

What is the Performance of Gold as an Investment?

Gold's price fluctuates depending on the supply and demand. Interest rates can also affect the gold price.

Due to limited supplies, gold prices are subject to volatility. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

Can I buy Gold with my Self-Directed IRA?

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts are financial instruments that are based on gold's price. These financial instruments allow you to speculate about future prices without actually owning the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

How is gold taxed in Roth IRA?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

The rules governing these accounts vary by state. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. Massachusetts allows you to wait until April 1. New York allows you to wait until age 70 1/2. To avoid penalties, you should plan ahead and take distributions as soon as possible.

What is the value of a gold IRA

A gold IRA has many benefits. It's an investment vehicle that lets you diversify your portfolio. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best thing is that investing in gold IRAs doesn't require any special skills. They are readily available at most banks and brokerages. Withdrawals are made automatically without having to worry about fees or penalties.

That said, there are drawbacks too. Gold has always been volatile. It's important to understand the reasons you're considering investing in gold. Are you looking for safety or growth? Is it for security or long-term planning? Only once you know, that will you be able to make an informed decision.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. A single ounce will not be sufficient to meet all your requirements. Depending upon what you plan to do, you could need several ounces.

A small amount is sufficient if you plan to sell your gold. You can even get by with less than one ounce. You won't be capable of buying anything else with these funds.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

investopedia.com

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's not exactly legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement funds

How To

Three Ways to Invest In Gold For Retirement

It's crucial to understand where gold fits in your retirement strategy. If you have a 401(k) account at work, there are several ways you can invest in gold. You may also want to consider investing in gold outside of your workplace. For example, if you own an IRA (Individual Retirement Account), you could open a custodial account at a brokerage firm such as Fidelity Investments. If precious metals aren't your thing, you may be interested in buying them from a dealer.

These are the rules for gold investing:

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, cash in your accounts. This will protect your against inflation and increase your purchasing power.

- Physical Gold Coins – Physical gold coins are better than a paper certificate. It's easier to sell physical gold coins rather than certificates. Also, there are no storage fees associated with physical gold coins.

- Diversify Your Portfolio – Never put all of your eggs in one basket. By investing in multiple assets, you can spread your wealth. This will reduce your risk and give you more flexibility in times of market volatility.

—————————————————————————————————————————————————————————————-

By: Ethan Greene – Feral Analysis and Juan Galt

Title: Bitcoin Bulls: Get Ready for a $94K Breakout Before the Crucial FOMC Rate Cut Decision

Sourced From: bitcoinmagazine.com/markets/bitcoin-bulls-eye-94k-breakout-ahead-of-crucial-fomc-rate-cut-decision

Published Date: Mon, 08 Dec 2025 17:38:07 +0000