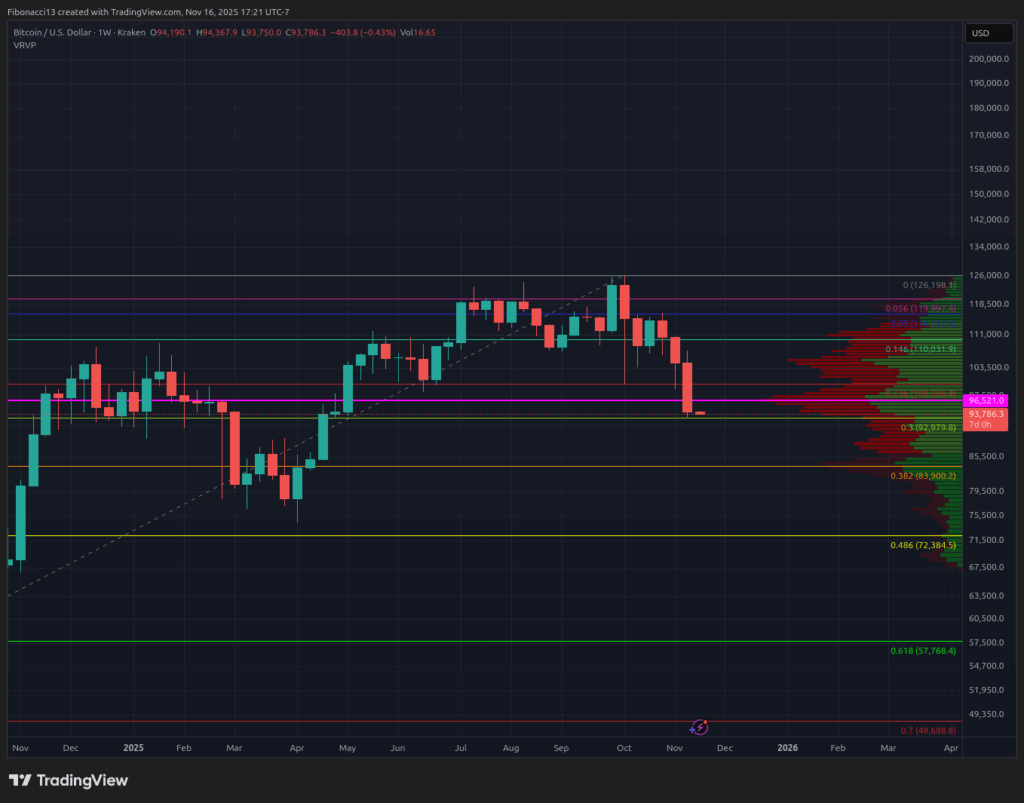

Hey there, crypto enthusiasts! This week dealt a heavy blow to the optimistic bulls as Bitcoin plummeted to $94,290, slipping under the crucial $96,000 weekly support threshold. Brace yourselves for more downward pressure ahead as critical support levels crumble. While there might be brief upward movements, don't expect any significant price recovery anytime soon.

Key Levels to Watch Out For

The Downside

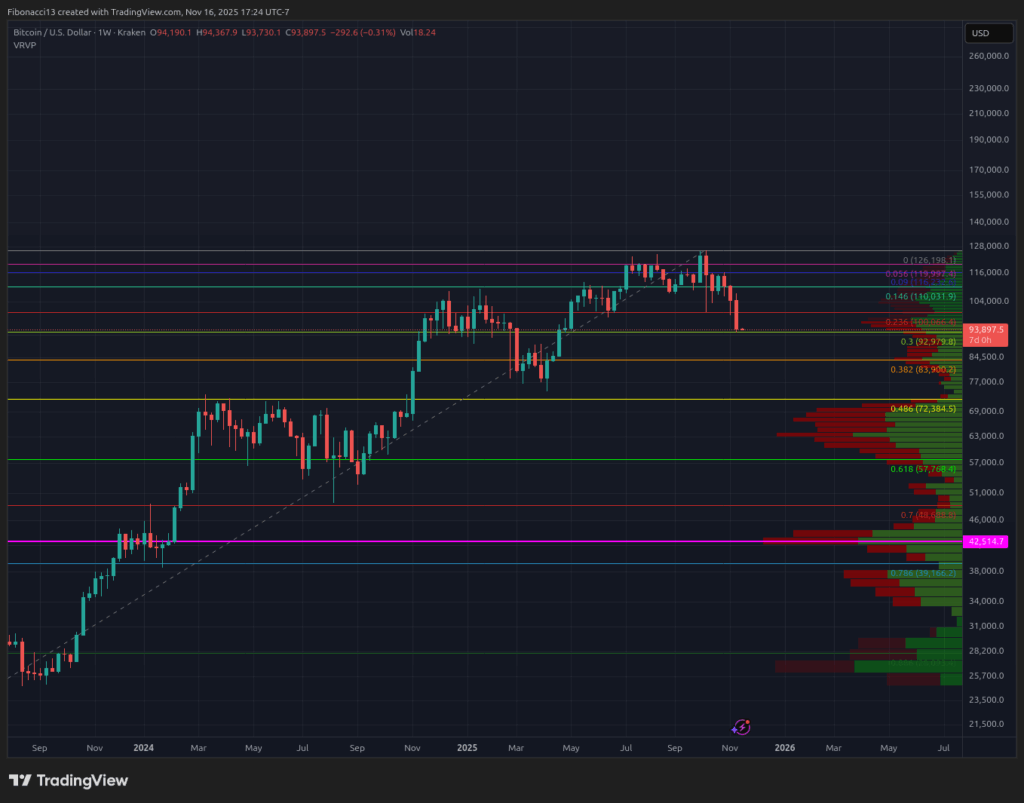

Bitcoin's failure to hold above $96,000 signals trouble. The next significant support lies at the 0.382 Fibonacci Retracement level from the 2022 low to the October 2025 high, with another substantial volume node sitting between $83,000 and $84,000. Further down, we look at the upper limits of the 2024 consolidation range spanning $69,000 to $72,000.

The Upside

On the flip side, the path above $94,000 is riddled with obstacles. Any rebound from this point is likely to face stiff resistance. A move towards $98,000 could encounter a standstill. However, if there's an upward push, eyes will be on the $101,000 level. Surpassing this might pave the way to the $106,000-$109,000 zone, followed by $114,000 and $116,000 as formidable barriers.

Forecast for the Week

The Battle Ahead

Do miracles happen in the crypto world? Well, Bitcoin's current position within a broadening wedge pattern offers a glimmer of hope for the bulls. While the pattern hasn't definitively broken bearish yet, the road to recovery is steep. A bounce to $106,000 could be the best-case scenario, but a retreat to lower lows seems more probable given the prevailing resistance levels. Brace for the wedge to potentially collapse on the bearish side soon.

Market sentiment: Brace for Impact – The bears have taken the wheel, with Bitcoin down over 25% from its October peaks. Optimism is fading fast, and the odds of a substantial rally or new highs seem bleak following the loss of critical support.

Insights into the Near Future

Decoding the Cycle

Delving into the nuances of the 4-year Bitcoin cycle theory, it seems like the peak has already come and gone. With the current price levels and significant resistance overhead, a sustainable rally to new highs by year-end appears unlikely. While the recent price trajectory hints at a potential late-cycle surge in Q1 2026, the lack of strength in Bitcoin amidst a robust stock market performance casts doubts on such a scenario. As traditional markets brace for a downturn, Bitcoin's prospects for a significant upswing remain dim.

Understanding the Jargon

Bulls/Bullish: Those betting on the price to rise.

Bears/Bearish: Traders expecting a price drop.

Support: A price level where an asset is expected to hold. The more it's tested, the weaker it becomes.

Resistance: A level expected to push the price down. Like support, repeated tests weaken it.

Fibonacci Levels: Ratios based on the golden ratio, aiding in price analysis.

Volume Profile: Shows total buy and sell volumes at specific prices.

Broadening Wedge: A pattern signaling increased price volatility.

So, buckle up, folks! The crypto rollercoaster ride continues. Stay informed, stay cautious, and let's navigate these turbulent times together. Remember, in the crypto world, fortune favors the informed. Happy trading!

Frequently Asked Questions

What are the pros & cons of a Gold IRA?

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. However, there are also disadvantages to this type of investment.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. You may also be prohibited by the IRS from making withdrawals from an IRA after you turn 59 1/2. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

Insurance is necessary if you wish to keep your money safe from the banks. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. Some insurers may require you to have insurance that covers losses up $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. Some providers limit the amount of gold that you are allowed to own. Others let you pick your weight.

It's also important to decide whether or not to buy gold futures contracts. The price of physical gold is higher than that of gold futures. Futures contracts offer flexibility for buying gold. They enable you to establish a contract with an expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. The policy does not cover natural disasters. You might consider purchasing additional coverage if your area is at high risk.

You should also consider the cost of storage for your gold. Storage costs will not be covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians are not allowed to sell your assets. Instead, they must maintain them for as long a time as you request.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. Also, you should specify how much each month you plan to invest.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will then review your application and mail you a letter of confirmation.

When opening a gold IRA, you should consider using a financial planner. Financial planners are experts at investing and can help you determine which type of IRA is best for you. They can help you find cheaper insurance options to lower your costs.

What are the benefits of a gold IRA

There are many advantages to a gold IRA. You can diversify your portfolio with this investment vehicle. You can control how much money is deposited into each account as well as when it's withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This allows you to easily transition if your retirement is early.

The best part about gold IRAs? You don't have to be an expert. These IRAs are available at all banks and brokerage houses. You don't have to worry about penalties or fees when withdrawing money.

However, there are still some drawbacks. Gold has always been volatile. So it's essential to understand why you're investing in gold. Do you want safety or growth? Do you want to use it as an insurance strategy or for long-term growth? Only when you are clear about the facts will you be able take an informed decision.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. You won't need to buy more than one ounce of gold to cover all your needs. Depending on the purpose of your gold, you might need more than one ounce.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even manage with one ounce. But you won't be able to buy anything else with those funds.

Is physical gold allowed in an IRA.

Gold is money, not just paper currency or coinage. It is an asset that people have used over thousands of years as money, and a way to protect wealth from inflation and economic uncertainties. Investors use gold today as part of their diversified portfolio, because it tends to perform better in times of financial turmoil.

Many Americans now invest in precious metals. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

One reason is that gold has historically performed better than other assets during periods of financial panic. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Your stock portfolio can fall, but you will still own your shares. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold offers liquidity. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. The liquidity of gold makes it a good investment. This allows you to take advantage of short-term fluctuations in the gold market.

What is the best precious-metal to invest?

This question depends on how risky you are willing to take, and what return you want. While gold is considered a safe investment option, it can also be a risky choice. Gold may not be right for you if you want quick profits. If you have time and patience, you should consider investing in silver instead.

Gold is the best investment if you aren't looking to get rich quick. Silver might be a better investment option if steady returns are desired over a long period of time.

Are You Ready to Invest in Gold?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. You can invest in both options if you aren't sure which option is best for you.

Not only is it a safe investment but gold can also provide potential returns. This makes it a worthwhile choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. Its value fluctuates over time.

But this doesn't mean you shouldn't invest in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit to gold? It's a tangible asset. Unlike stocks and bonds, gold is easier to store. It can be easily transported.

You can always access your gold if it is stored in a secure place. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold rises in the face of a falling stock market.

Gold investment has another advantage: You can sell it anytime. You can also liquidate your gold position at any time you need cash, just like stocks. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

You shouldn't buy too little at once. Begin by buying a few grams. Then add more as needed.

Remember, the goal here isn't to get rich quickly. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

How do I Withdraw from an IRA with Precious Metals?

First, decide if it is possible to withdraw funds from an IRA. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, determine how much money you plan to withdraw from your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will accept bullion bars, others require you to buy individual coins. Either way, you'll need to weigh the pros and cons of each before choosing one.

Bullion bars, for example, require less space as you're not dealing with individual coins. However, each coin will need to be counted individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some people prefer to keep coins safe in a vault. Others prefer to store them in a safe deposit box. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

investopedia.com

forbes.com

How To

How to keep physical gold in an IRA

An easy way to invest gold is to buy shares from gold-producing companies. This method is not without risks. There's no guarantee these companies will survive. There is always the chance of them losing their money due to fluctuations of the gold price.

You can also buy gold directly. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. These options offer the convenience of easy access, as you don't need stock exchanges to do so. You can also make purchases at lower prices. It's easier to track how much gold is in your possession. So you can see exactly what you have paid and if you missed any taxes, you will get a receipt. You are also less likely to be robbed than investing in stocks.

However, there are some disadvantages too. You won't be able to benefit from investment funds or interest rates offered by banks. Also, you won't be able to diversify your holdings – you're stuck with whatever you bought. The taxman might also ask you questions about where your gold is located.

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————-

By: Ethan Greene – Feral Analysis and Juan Galt

Title: Bitcoin in Freefall: Breaking Below $96K Support and Wiping Out 2025 Gains Amidst Strong Bearish Sentiment

Sourced From: bitcoinmagazine.com/markets/bitcoin-plunges-below-96k-support-erasing-2025-gains-amid-extreme-bearish-sentiment

Published Date: Tue, 18 Nov 2025 00:52:39 +0000