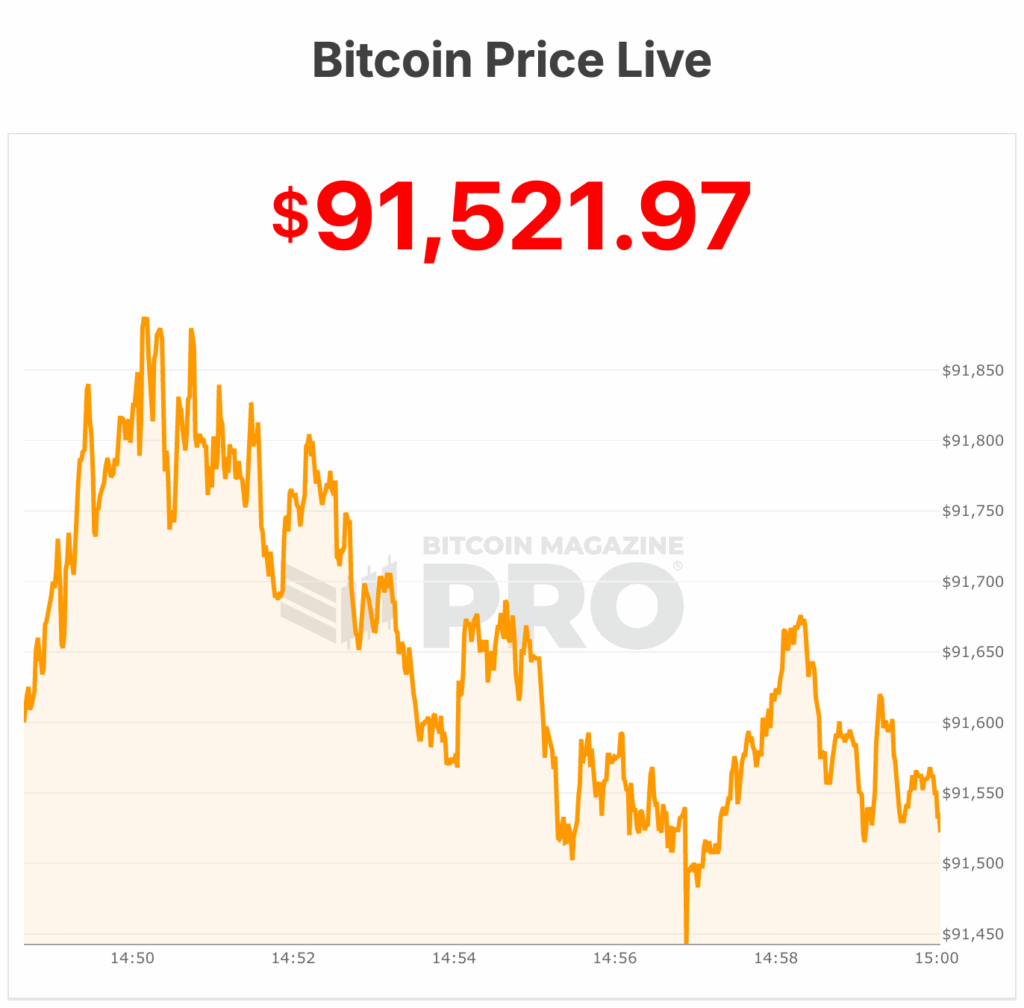

Hey there, crypto enthusiasts! If you've been keeping an eye on the Bitcoin market, you might have noticed the recent nosedive in prices. Bitcoin, once soaring near $126,000 in October, has now taken a sharp plunge to the tune of about 30%. Today, the lowest recorded Bitcoin price stands at $91,158, according to Bitcoin Magazine data.

The Federal Reserve's Influence on Bitcoin Prices

Uncertainty Looms Over Interest Rate Cuts

What's causing this downward spiral? Well, the Federal Reserve's upcoming December meeting has cast a shadow of uncertainty. With economic data still recovering from the recent government shutdown, policymakers are hesitant to commit to interest rate cuts. Fed Chair Jerome Powell even mentioned that a rate reduction isn't guaranteed.

The Impact of Market Sentiment

Market sentiment is also a key player here. The crypto landscape is feeling the heat as the Fed adopts a more cautious stance. Big institutions are pulling back, with crypto ETFs witnessing significant outflows. Even the excitement over Donald Trump's pro-crypto stance has fizzled out, impacting Bitcoin prices further.

The Technological Tumble

Market Indicators and Altcoin Woes

Technical indicators are flashing warning signs, with Bitcoin experiencing a "death cross" pattern. This market phenomenon, though bearish, has historically hinted at upcoming rebounds. Altcoins like Ethereum and Solana are following suit, contributing to a broader decline across the crypto market.

The Road Ahead

So, what's next for the market? The Federal Open Market Committee's December rate decision could be the game-changer. Will Bitcoin prices continue to fall, or is there a chance for a year-end rally? Only time will tell.

Bitcoin's Ripple Effect on Crypto Stocks

Stock Prices in Tandem with Bitcoin

It's not just Bitcoin feeling the heat; crypto-linked stocks are also taking a hit. Companies like Coinbase, MARA Holdings, and Riot Platforms are seeing declines in sync with Bitcoin's performance. Strategy Inc. recently made a substantial Bitcoin purchase, reaffirming its commitment to cryptocurrency amidst market turmoil.

Strategic Moves in a Volatile Market

Strategy Inc.'s strategic Bitcoin acquisitions and financial maneuvers demonstrate a bold approach to navigating the volatile crypto landscape. With a keen focus on building Bitcoin exposure, the company is setting the stage for long-term growth and stability.

As we ride the waves of uncertainty in the crypto market, staying informed and strategic is key. Keep a close watch on market trends and be prepared to adapt to the ever-changing crypto climate. Here's to weathering the storm and emerging stronger on the other side!

Frequently Asked Questions

How much gold should you have in your portfolio?

The amount of capital that you require will determine how much money you can make. If you want to start small, then $5k-$10k would be great. As your business grows, you might consider renting out office space or desks. This way, you don't have to worry about paying rent all at once. You only pay one month.

It is also important to decide what kind of business you want to run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. So if you do this kind of thing, you need to consider how much income you expect from each client.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. This means that you may only be paid once every six months.

Decide what kind of income do you want before you calculate how much gold is needed.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Which precious metals are best to invest in retirement?

The best precious metal investments are gold and silver. They are both easy to trade and have been around for years. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: Gold is one the oldest forms currency known to man. It's also very safe and stable. It's a great way to protect wealth in times of uncertainty.

Silver: Silver has been a favorite among investors for years. It is an excellent choice for investors who wish to avoid volatility. Unlike gold, silver tends to go up instead of down.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It's resistant to corrosion and durable, similar to gold and silver. It is, however, more expensive than its competitors.

Rhodium: Rhodium can be used in catalytic convertors. It is also used as a jewelry material. It is relatively affordable when compared to other types.

Palladium: Palladium, which is a form of platinum, is less common than platinum. It's also more affordable. It's a popular choice for investors who want to add precious metals into their portfolios.

How much do gold IRA fees cost?

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes the account maintenance fees and any investment costs associated with your chosen investments.

If you want to diversify, you may be required to pay extra fees. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

Many providers also charge annual management fees. These fees vary from 0% to 11%. The average rate is.25% each year. However, these rates are typically waived if you use a broker like TD Ameritrade.

What are the pros and cons of a gold IRA?

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. However, there are also disadvantages to this type of investment.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

Another problem is the cost of managing your IRA. Most banks charge 0.5% to 2.0% per annum. Others charge management fees that range from $10 to $50 per month.

If you prefer your money to be kept out of a bank, then you will need insurance. Insurance companies will usually require that you have at least $500,000. You might be required to buy insurance that covers losses up to $500,000.

If you choose to have a gold IRA you will need to establish how much gold to use. You may be limited in the amount of gold you can have by some providers. Others allow you the freedom to choose your own weight.

You will also have to decide whether to purchase futures or physical gold. Physical gold is more expensive than gold futures contracts. Futures contracts, however, allow for greater flexibility in buying gold. You can set up futures contracts with a fixed expiration date.

It is also important to choose the type of insurance coverage that you need. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. The policy does not cover natural disasters. You may consider adding additional coverage if you live in an area at high risk.

Additional to your insurance, you will need to consider how much it costs to store your gold. Insurance doesn't cover storage costs. Banks charge between $25 and $40 per month for safekeeping.

You must first contact a qualified custodian before you open a gold IRA. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians cannot sell your assets. Instead, they must keep your assets for as long you request.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). Also, you should specify how much each month you plan to invest.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. Once the company has received your application, they will review it and send you a confirmation email.

Consider consulting a financial advisor when opening a golden IRA. A financial planner can help you decide the type of IRA that is right for your needs. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

Is gold a good investment IRA option?

Anyone who is looking to save money can make gold an excellent investment. It is also an excellent way to diversify you portfolio. But there is more to gold than meets the eye.

It's been used as a form of payment throughout history. It is often called “the oldest currency in the world.”

Gold is not created by governments, but it is extracted from the earth. It's hard to find and very rare, making it extremely valuable.

Gold prices fluctuate based on demand and supply. If the economy is strong, people will spend more money which means less people can mine gold. Gold's value rises as a result.

On the flipside, people may save cash rather than spend it when the economy slows. This results in more gold being produced, which drives down its value.

It is this reason that gold investing makes sense for businesses and individuals. If you invest in gold, you'll benefit whenever the economy grows.

Also, your investments will earn you interest which can help increase your wealth. You won't lose your money if gold prices drop.

Can I hold physical gold in my IRA?

Gold is money and not just paper currency. It's an asset that people have used for thousands of years as a store of value, a way to keep wealth safe from inflation and economic uncertainty. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. Gold was one asset that outperformed stocks in turbulent market conditions.

The best thing about gold investing is the fact that there's virtually no counterparty risk. Even if your stock portfolio is down, your shares are still yours. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, gold offers liquidity. This allows you to sell your gold whenever you want, unlike many other investments. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows one to take advantage short-term fluctuations within the gold price.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

How To

Guidelines for Gold Roth IRA

The best way to invest for retirement is by starting early. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. It is important to invest enough money each and every year to ensure you get adequate growth.

You may also wish to take advantage of tax-free investments such as a SIMPLE IRA, SEP IRA, and traditional 401(k). These savings vehicles let you make contributions and not pay taxes until the earnings are withdrawn. This makes them a great choice for people who don’t have access employer matching funds.

Save regularly and continue to save over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.

—————————————————————————————————————————————————————————————-

By: Micah Zimmerman

Title: Bitcoin Price Plummets to $91,000, Hitting New Lows

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-continues-fall-to-910000

Published Date: Mon, 17 Nov 2025 20:27:36 +0000