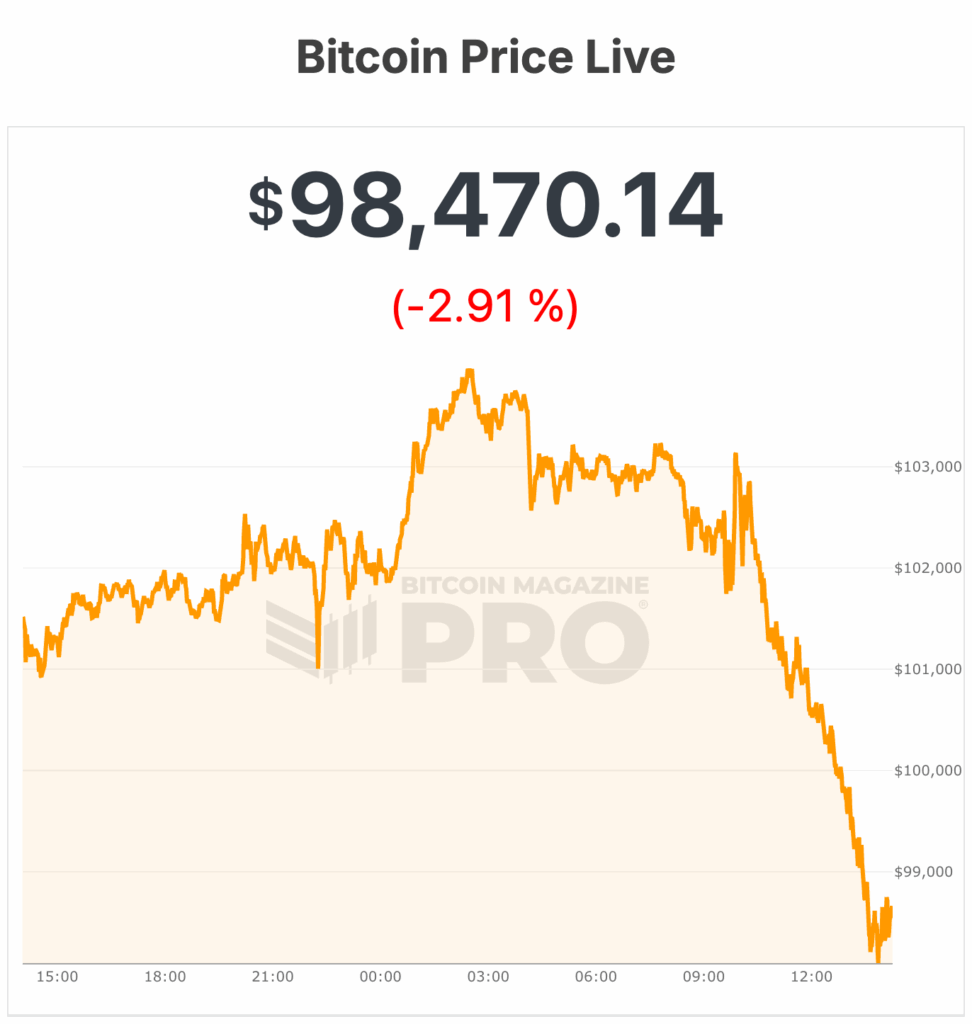

Hey there, crypto enthusiasts! Today, we're diving into the recent rollercoaster ride of Bitcoin's price, which nosedived to under $98,000, approaching levels not seen in the past six months. Buckle up as we explore the insights and implications of this dramatic drop.

The Bitcoin Price Rollercoaster: A Closer Look

Market Volatility Strikes Again

Picture this: Bitcoin's price took a steep tumble from an intraday high of $104,000 to $98,113, erasing earlier gains and signaling a significant shift in market dynamics.

The Impact of Long-Term Holders

What's causing this plunge? Well, long-term holders are offloading their holdings at unprecedented rates. Recent data reveals a staggering 815,000 BTC sold in just 30 days, reminiscent of early 2024 levels. As profit-taking frenzy ensues, the market sentiment is under pressure.

Expert Insights and Predictions

Experts suggest that failing to maintain the crucial 365-day moving average around $102,000 could lead to further price drops. Analysts at Bitfinex draw parallels to historical retracements, projecting a potential relief rally but emphasizing the necessity of fresh demand for a sustainable recovery.

Bitcoin's Dance with Nasdaq: A Complicated Tango

Decoding the Market Relationship

Bitcoin's intricate relationship with Nasdaq has taken an intriguing turn. While typically correlated, recent data suggests that Bitcoin reacts more intensely to stock market downturns than upswings. This unusual behavior hints at investor fatigue and shifting capital dynamics.

Thin Liquidity and Market Resilience

The thinning liquidity in the crypto sphere, coupled with a slowdown in stablecoin issuance and ETF inflows, is amplifying downside movements. Despite these challenges, Bitcoin remains resilient, showcasing its maturity as a macro asset even amid market turbulence.

What Lies Ahead for Bitcoin?

As Bitcoin hovers around $98,470, uncertainty looms over its immediate trajectory. Will it reclaim its bullish momentum, or are further dips on the horizon? The crypto landscape awaits the next chapter in Bitcoin's gripping saga.

Ready to navigate the twists and turns of the crypto market? Stay tuned for more updates and expert insights to guide you through the ever-evolving world of digital assets!

Frequently Asked Questions

What is a gold IRA account?

Individuals who want to invest with precious metals may use the Gold Ira accounts, which are tax-free.

You can purchase gold bullion coins in physical form at any moment. To invest in gold, you don't need to wait for retirement.

An IRA lets you keep your gold for life. Your gold holdings will not be subject to tax when you are gone.

Your heirs inherit your gold without paying capital gains taxes. Your gold is not part of your estate and you don't have to include it in the final estate report.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). After you have done this, an IRA custodian will be assigned to you. This company acts like a middleman between the IRS and you.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reporting.

Once your gold IRA is established, you can purchase gold bullion coins. Minimum deposit is $1,000 However, you'll receive a higher interest rate if you put in more.

Taxes will apply to gold that you take out of an IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

If you only take out a very small percentage of your income, you may not need to pay tax. However, there are some exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

It is best to not take out more than 50% annually of your total IRA assets. You'll be facing severe financial consequences if you do.

How is gold taxed within a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

You don't pay tax if you have the money in a traditional IRA/401k. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

These accounts are subject to different rules depending on where you live. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . In Massachusetts, you can wait until April 1st. New York is open until 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Do You Need to Open a Precious Metal IRA

It is essential to be aware of the fact that precious metals do not have insurance coverage before opening an IRA. It is impossible to get back money if you lose your investment. All your investments can be lost due to theft, fire or flood.

Protect yourself against this type of loss by investing in physical gold or silver coins. These coins have been around for thousands and represent a real asset that can never be lost. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. Consider using a third-party custody company to keep your assets safe and allow you to access them at any time.

If you decide to open an account, remember that you won't see any returns until after you retire. Keep your eyes open for the future.

How much of your portfolio should be in precious metals?

First, let's define precious metals to answer the question. Precious metals have elements with an extremely high worth relative to other commodity. This makes them very valuable in terms of trading and investment. Gold is today the most popular precious metal.

However, many other types of precious metals exist, including silver and platinum. The price volatility of gold can be unpredictable, but it is generally stable during periods of economic turmoil. It is also unaffected significantly by inflation and Deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. That said, they do not always move in lockstep with each other. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. Investors expect lower interest rate, making bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. Because they are rare, they become more pricey and lose value.

You must therefore diversify your investments in precious metals to reap the maximum profits. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

Can the government take your gold

The government cannot take your gold because you own it. You worked hard to earn it. It is yours. However, there may be some exceptions to this rule. If you are convicted of fraud against the federal government, your gold can be forfeit. Your precious metals can also be lost if you owe tax to the IRS. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

How much should you have of gold in your portfolio

The amount that you want to invest will dictate how much money it takes. Start small with $5k-10k. You could then rent out desks and office space as your business grows. You don't need to worry about paying rent every month. You only pay one month.

Consider what type of business your company will be running. My website design company charges clients $1000-2000 per month depending on the order. This is why you should consider what you expect from each client if you're doing this kind of thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. You might get paid only once every six months.

Decide what kind of income do you want before you calculate how much gold is needed.

I suggest starting with $1k-2k gold and building from there.

What are the benefits of a Gold IRA?

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It's tax-deferred until you withdraw it. You can decide how much money you withdraw each year. There are many types available. Some are better suited for people who want to save for college expenses. Others are designed for investors looking for higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. These earnings don't get taxed if they withdraw funds. This type of account might be a good choice if your goal is to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. You won't have the hassle of making deposits each month. Direct debits could be set up to ensure you don't miss a single payment.

Gold is one of today's most safest investments. Because it's not tied to any particular country, its value tends to remain steady. Even during economic turmoil, gold prices tend to stay relatively stable. This makes it a great investment option to protect your savings from inflation.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

bbb.org

finance.yahoo.com

irs.gov

investopedia.com

How To

Investing in gold or stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe that gold investment is no longer profitable. This belief comes from the fact most people see gold prices falling due to the global economy. They think that they would lose money if they invested in gold. However, investing in gold can still provide significant benefits. Here are some examples.

The oldest form of currency known to mankind is gold. It has been in use for thousands of year. It is a valuable store of value that has been used by many people throughout the world. As a means of payment, South Africa and many other countries still rely on it.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. You must determine how much gold bullion you can afford per gram before you consider buying it. You can always ask a local jeweler what the current market rate is if you don't have it.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. So, although gold prices have declined in recent years, the cost of producing it has not changed.

The amount of gold that you are planning to purchase is another important consideration when deciding whether or not gold should be bought. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. It is worth considering if you intend to use it for long-term investment. Selling your gold at a higher value than what you bought can help you make money.

We hope our article has given you a better understanding of gold as an investment tool. Before making any investment decisions, we strongly advise that you thoroughly research all options. Only after doing so can you make an informed decision.

—————————————————————————————————————————————————————————————-

By: Micah Zimmerman

Title: Bitcoin Price Plummets Below $98,000, Nearing Six-Month Lows: What's Next?

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-crashes-to-98000

Published Date: Thu, 13 Nov 2025 20:32:13 +0000