Hey there, crypto enthusiasts! Today, we're diving into the recent rollercoaster ride of Bitcoin prices while exploring the potential impact of the upcoming FOMC rate cuts. Strap in as we uncover valuable insights to navigate the cryptosphere with confidence.

Bitcoin Price Movement Breakdown

The Tale of Support and Resistance

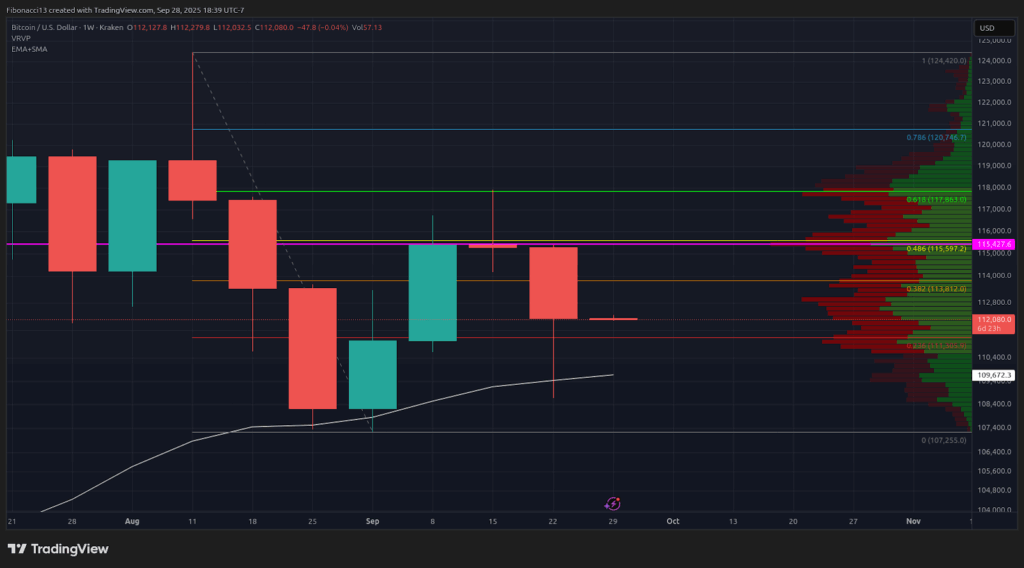

Let's rewind to last week's saga: Bitcoin witnessed a dramatic plunge to $111,800 before staging a recovery dance towards the $113,800 resistance and the 21-day EMA at $114,000. The bulls' attempts to break above were thwarted, leading to a dip below the $111,300 support. As the week unfolded, the price journeyed south, kissing the $109,500 weekly support before wrapping up at $112,225.

Key Price Levels to Watch

Strategic Support and Resistance Zones

With the week concluding above the critical 21-week EMA at $109,500, all eyes are on this level for a bullish stronghold. Maintaining above $109,500 paves the way for a potential turnaround, with $105,000 as the subsequent support. A breach below $102,000 could spell a deeper descent towards the long-standing $96,000 support.

On the flip side, breaching the $115,500 resistance will signal a bullish resurgence. Surpassing $118,000 opens doors to new highs, with $121,000 emerging as the next frontier. Bear in mind, a weekly closure above $118,000 could trigger further positive momentum.

Anticipated Trends for the Week

Market Insights and Future Projections

Expect a retest of the $109,500 support early in the week, followed by a potential uptrend towards $113,800. Breaking above the $115,500 barrier may require robust buying pressure, with the $113,800 hurdle likely to test the bulls' mettle. While the weekly bias leans bearish, a green candle this week could validate a higher low from the previous week.

Caution looms as the $113,800 resistance remains formidable in the short term. A breach below $109,500 could trigger a significant downturn, testing the $105,000-$102,000 support range.

Market Sentiment: Bearish — With bears firmly dictating the trend, a strong bullish stance is imperative to safeguard the 21-week EMA support.

Looking Ahead

Market Dynamics and Rate Cut Speculations

The weekly chart retains a bearish tone, awaiting a bullish resurgence for a positive price trajectory. A robust finish this week could tilt the scales in favor of the bulls. Following September's rate cut, all eyes are on the October and December FOMC meetings for potential rate adjustments. Market participants eagerly await US financial data to gauge the necessity of further cuts. Any hindrances to rate cuts could trigger additional selling pressure and bearish market movements.

Understanding the Jargon

Before we wrap up, here's a quick guide to key terms:

- Bulls/Bullish: Optimistic investors expecting price hikes.

- Bears/Bearish: Pessimistic traders foreseeing price declines.

- Support Level: A price threshold expected to bolster asset value initially.

- Resistance Level: A price point likely to impede asset value, at least temporarily.

- EMA: Exponential Moving Average, offering insights into recent price trends.

As you navigate the dynamic crypto landscape, stay informed, stay cautious, and brace yourself for potential market shifts. Happy trading!

Frequently Asked Questions

What are the benefits of a gold IRA

The benefits of a gold IRA are many. You can diversify your portfolio with this investment vehicle. You have control over how much money goes into each account.

You have the option of rolling over funds from other retirement account into a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best part? You don’t need to have any special skills to invest into gold IRAs. They're readily available at almost all banks and brokerage firms. Withdrawals are made automatically without having to worry about fees or penalties.

That said, there are drawbacks too. The volatility of gold has been a hallmark of its history. It is important to understand why you are investing in gold. Is it for growth or safety? Are you trying to find safety or growth? Only by knowing the answer, you will be able to make an informed choice.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. One ounce doesn't suffice to cover all your needs. Depending on your plans for using your gold, you may need multiple ounces.

If you're planning to sell off your gold, you don't necessarily need a large amount. Even one ounce is enough. These funds won't allow you to purchase anything else.

Are You Ready to Invest in Gold?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. You can invest in both options if you aren't sure which option is best for you.

Gold offers potential returns and is therefore a safe investment. Retirees will find it an attractive investment.

While most investments offer fixed rates of return, gold tends to fluctuate. As a result, its value changes over time.

However, this does not mean that gold should be avoided. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit to gold is its tangible value. Gold is much easier to store than bonds and stocks. It is also easily portable.

You can always access gold as long your place it safe. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold tends to rise when the stock markets fall.

Investing in gold has another advantage: you can sell it anytime you want. You can easily liquidate your investment, just as with stocks. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't buy too many at once. Start with a few ounces. Continue adding more as necessary.

It's not about getting rich fast. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

What Is a Precious Metal IRA?

You can diversify your retirement savings by investing in precious metal IRAs. This allows you to invest in gold, silver and platinum as well as iridium, osmium and other rare metals. These are called “precious” metals because they're very hard to find and very valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Bullion is often used for precious metals. Bullion refers only to the actual metal.

Bullion can be bought via various channels, such as online retailers, large coin dealers and grocery stores.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. This ensures that you will receive dividends each and every year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. Instead, you pay a small percentage tax on the gains. You can also access your funds whenever it suits you.

Should You Buy Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Experts think this could change quickly. They say that gold prices could rise dramatically with another global financial crisis.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

These are some things you should consider when considering gold investing.

- First, consider whether or not you need the money you're saving for retirement. It's possible to save for retirement without putting your savings into gold. The added protection that gold provides when you retire is a good option.

- Second, be sure to understand your obligations before you purchase gold. Each account offers different levels of security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. Losing your gold coins could result in you never being able to retrieve them.

If you are thinking of buying gold, do your research. Make sure to protect any gold you already own.

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. To open the account, complete Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be completed within 60 days after opening the account. Once this is done, you can start investing. You may also choose to contribute directly from your paycheck using payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. Otherwise, it will be the same process as an ordinary IRA.

To be eligible for a precious metals IRA, you will need to meet certain requirements. The IRS says you must be 18 years old and have earned income. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Contributions must be made on a regular basis. These rules apply to contributions made directly or through employer sponsorship.

You can use a precious metals IRA to invest in gold, silver, palladium, platinum, rhodium, or even platinum. However, you won't be able purchase physical bullion. This means you won't be allowed to trade shares of stock or bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is offered by some IRA providers.

There are two major drawbacks to investing via an IRA in precious metals. They aren't as liquid as bonds or stocks. This makes it harder to sell them when needed. They don't yield dividends like bonds and stocks. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

Do You Need to Open a Precious Metal IRA

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. There are no ways to recover the money you lost in an investment. This includes any loss of investments from theft, fire, flood or other circumstances.

You can protect yourself against such losses by purchasing physical gold and silver coins. These items can be lost because they have real value and have been around for thousands years. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

Consider a reputable business that offers low rates and good products when opening an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Do not open an account unless you're ready to retire. Don't forget the future!

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

irs.gov

bbb.org

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

How To

The History of Gold as an Asset

From the ancient days to the early 20th Century, gold was a common currency. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Due to its value, it was also internationally traded. However, since there were no international standards for measuring gold at this point, different weights and measures existed worldwide. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This resulted in a decline of foreign currency demand and an increase in the price. This was when the United States started minting large quantities of gold coins. The result? Gold prices began to fall. The U.S. government was unable to pay its debts due to too much money being in circulation. They sold some of their excess gold to Europe to pay off the debt.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. However, many European nations stopped using gold to pay after World War I and started using paper currency instead. The value of gold has significantly increased since then. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

By: Ethan Greene – Feral Analysis

Title: Bitcoin Analysis: Impending FOMC Rate Cuts and Resilient $109,500 EMA

Sourced From: bitcoinmagazine.com/markets/fomc-rate-cuts-loom-as-bitcoin-holds-above-109500-ema

Published Date: Tue, 30 Sep 2025 23:36:05 +0000