When it comes to understanding the true value of Bitcoin, traditional valuation methods fall short. Bitcoin isn't just a commodity or a currency; it's a whole new ball game. Its unique blend of characteristics opens the door to a myriad of valuation approaches, setting it apart from traditional assets.

The Momentum Behind Bitcoin Adoption

Individuals Embracing Change

Picture this: rising consumer price inflation gnawing away at your purchasing power year after year. Since the fiat standard took the stage in 1971, the erosion has been evident, especially in essential areas like housing. But here's the kicker – those who shift to Bitcoin as their primary wealth store witness a surge in their purchasing power, leaving their peers in the dust.

As this trend catches on, it creates a domino effect. People start mirroring this behavior to stay ahead – a classic case of "keeping up with the Joneses" in the realm of behavioral economics. Bitcoin becomes the North Star guiding people's financial decisions.

The Asset Management Revolution

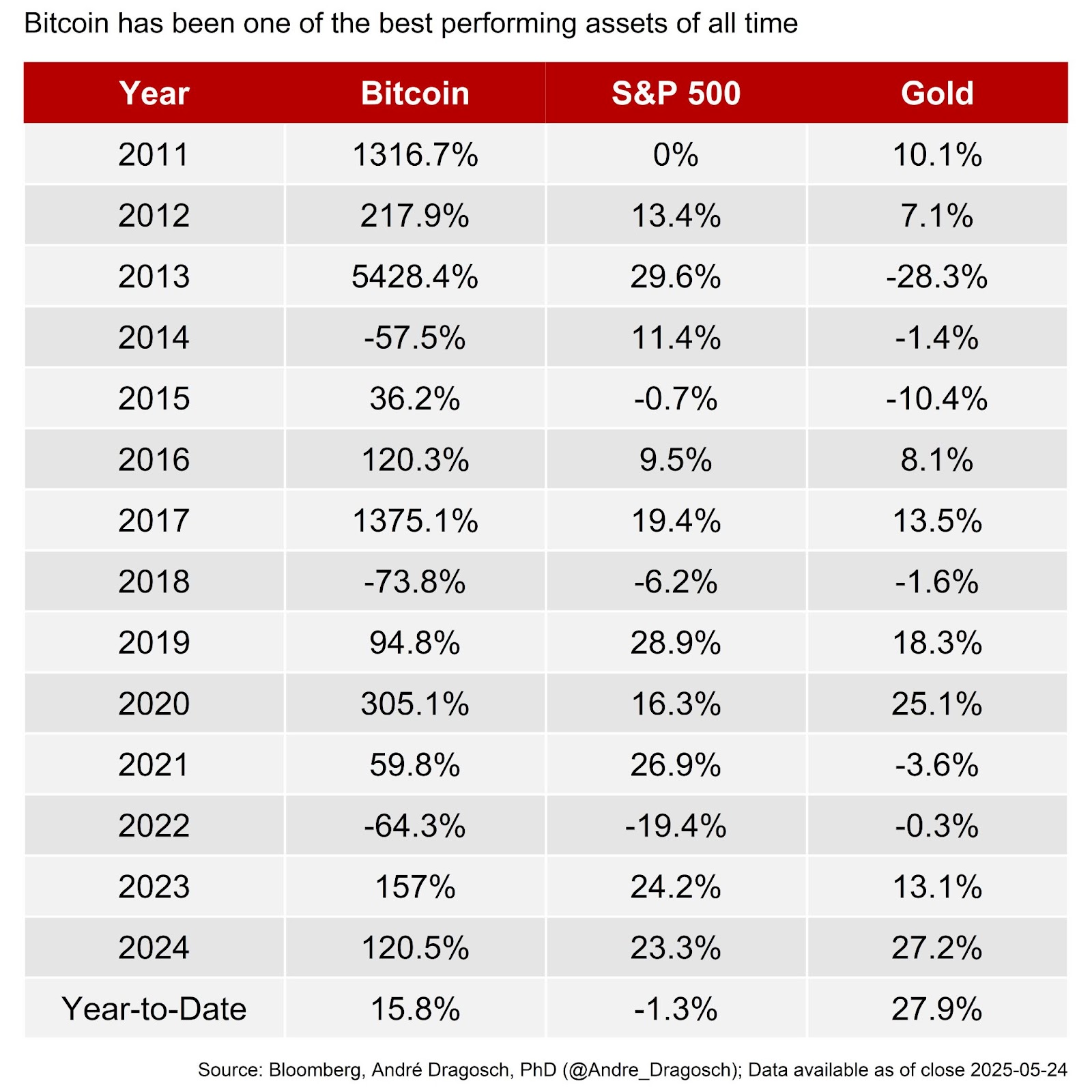

Did you know that even a tiny slice of Bitcoin in your investment pie can work wonders for your portfolio's performance? Asset managers are catching on to this phenomenon. In 2024, Bitcoin outshone every major asset with a whopping 121% return, beating the S&P 500 and elite hedge funds. Asset managers who hopped on the Bitcoin train early enjoyed a stellar performance, leaving their peers in the dust.

The pressure on asset managers to integrate Bitcoin into their portfolios will only escalate. The fear of lagging behind those who do is a potent motivator. To stay competitive, adding Bitcoin to the mix is a no-brainer for superior performance.

Corporate Players Making Bold Moves

Enter the corporate world, where the rationale for stashing Bitcoin in your treasury mirrors that of individuals – safeguarding against purchasing power erosion. Take Metaplanet's game-changing move in 2024. This underdog unleashed a strategic masterstroke by adopting a Bitcoin standard and investing a cool billion JPY into the digital gold.

Fast forward to October 2024, and Metaplanet reigns as Asia's Bitcoin kingpin, reaping a jaw-dropping 2,629% return. Its success story is a testament to the growing allure of Bitcoin in corporate treasury playbooks.

Nations Embracing Bitcoin's Potential

Even sovereign nations are hopping aboard the Bitcoin bandwagon, albeit with a twist. El Salvador's groundbreaking move to embrace Bitcoin as legal tender in 2021 sparked a chain reaction. By embracing Bitcoin, El Salvador witnessed a surge in credit ratings, tourist footfalls, and GDP growth – all fueled by the magic of Bitcoin adoption.

As the world watches, other nations are eyeing Bitcoin for its potential to bolster FX reserves, slash sovereign debt default risks, and prop up credit ratings. The ripple effects of Bitcoin adoption on sovereign wealth could reshape the global economic landscape.

The Human Side of Bitcoin Adoption

Unpacking the Forces Driving Bitcoin's Rise

Bitcoin's journey is not just a tale of numbers; it's a saga of human behavior. The interplay of network effects, the Lindy effect, and the Dunning-Kruger effect shapes Bitcoin's trajectory.

Network Effects: Picture a snowball effect – as Bitcoin's network grows, its utility skyrockets, drawing in more users. This virtuous cycle propels Bitcoin into the spotlight, making it more irresistible by the day.

The Lindy Effect: Age equals resilience – that's the Lindy effect at play. The longer Bitcoin thrives, the stronger its odds of enduring the test of time. This battle-tested resilience cements Bitcoin's position in the financial landscape.

The Dunning-Kruger Effect: Ever underestimated a game-changer? The Dunning-Kruger effect shines a light on our tendency to undervalue new tech initially. But as understanding grows, so does the pace of adoption. Bitcoin's journey mirrors this evolution.

Decoding Bitcoin's Growth Trajectory

"People influence people. Affecting others' actions shapes our own path." – Thomas Schelling

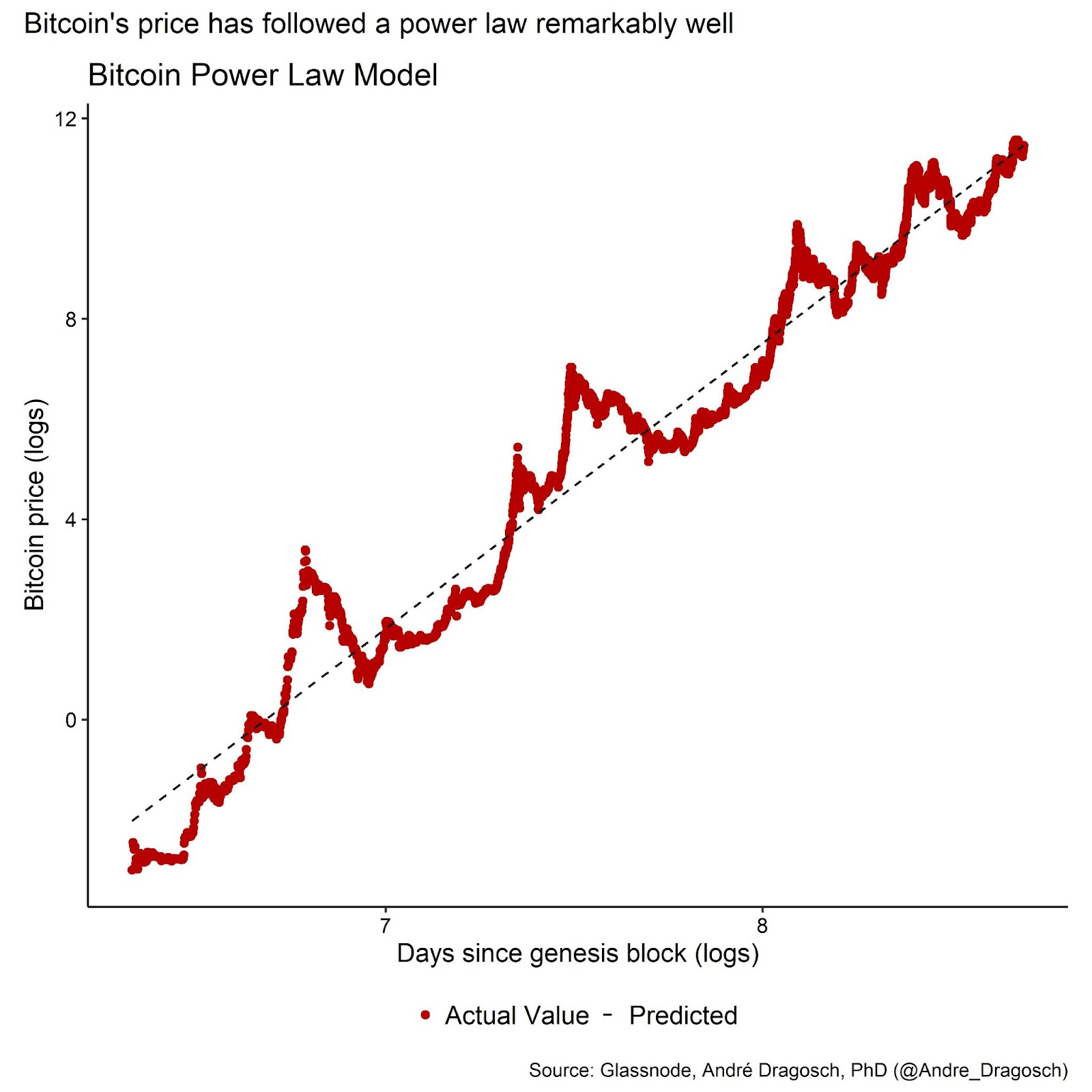

Researchers have uncovered a fascinating pattern in Bitcoin's price evolution – a power law. This mathematical phenomenon sheds light on how Bitcoin's adoption mirrors the dynamics seen in city sizes, corporate structures, and viral outbreaks.

Bitcoin's journey echoes that of a spreading virus, gaining momentum with each passing day. The fractal nature of Bitcoin's market hints at lower volatility, paving the way for increased institutional adoption and market maturity.

As Bitcoin's influence expands, brace yourself for a financial landscape transformed by digital gold. The rise of institutional capital marks a new chapter in the Bitcoin saga, promising a future where traditional assets take a backseat to the crypto revolution.

Frequently Asked Questions

Should You Buy or Sell Gold?

Gold was once considered an investment safe haven during times of economic crisis. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Experts think this could change quickly. According to them, gold prices could soar if there is another financial crisis.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

Consider these things if you are thinking of investing in gold.

- Consider whether you will actually need the money that you are saving for retirement. It is possible to save enough money to retire without investing in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each account offers different levels of security and flexibility.

- Remember that gold is not as safe as a bank account. If you lose your gold coins, you may never recover them.

Do your research before you buy gold. And if you already own gold, ensure you're doing everything possible to protect it.

What Does Gold Do as an Investment Option?

The supply and demand for gold affect the price of gold. It is also affected by interest rates.

Gold prices are volatile due to their limited supply. Additionally, physical gold can be volatile because it must be stored somewhere.

How is gold taxed by Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

Each state has its own rules regarding these accounts. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you to wait until April 1. New York is open until 70 1/2. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

Should you Invest In Gold For Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. If you're unsure about which option to choose then consider investing in both.

Gold offers potential returns and is therefore a safe investment. Retirees will find it an attractive investment.

Gold is more volatile than most other investments. Therefore, its value is subject to change over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit to gold is its tangible value. Gold can be stored more easily than stocks and bonds. It can be easily transported.

As long as you keep your gold in a secure location, you can always access it. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. As gold prices rise in tandem with other commodities it can be a good hedge against rising cost.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold usually rises when the stock market falls.

Another benefit to investing in gold? You can always sell it. You can also liquidate your gold position at any time you need cash, just like stocks. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Don't buy too many at once. Start by purchasing a few ounces. Continue adding more as necessary.

Don't expect to be rich overnight. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Which precious metals are best to invest in retirement?

Gold and silver are the best precious metal investments. Both are easy to sell and can be bought easily. They are a great way to diversify your portfolio.

Gold: This is the oldest form of currency that man has ever known. It's also very safe and stable. This makes it a good option to preserve wealth in uncertain times.

Silver: Investors have always loved silver. It's an ideal choice for those who prefer to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It's resistant to corrosion and durable, similar to gold and silver. It's however much more costly than any of its counterparts.

Rhodium. Rhodium is used as a catalyst. It is also used to make jewelry. It is also very affordable in comparison to other types.

Palladium: Palladium has a similarity to platinum but is more rare. It's also more accessible. Investors looking to add precious and rare metals to their portfolios love it for these reasons.

What is a gold IRA account?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

You can purchase physical gold bullion coins anytime. To invest in gold, you don't need to wait for retirement.

The beauty of owning gold as an IRA is you can hold on to it forever. When you die, your gold assets won't be subjected to taxes.

Your heirs inherit your gold without paying capital gains taxes. Your gold is not part of your estate and you don't have to include it in the final estate report.

To open a gold IRA, you will first need to create an individual retirement account (IRA). After you have done this, an IRA custodian will be assigned to you. This company acts as a mediator between you, the IRS.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

After you have established your gold IRA you will be able purchase gold bullion coin. Minimum deposit is $1,000 You'll get a higher rate of interest if you deposit more.

Taxes will be charged on gold you have withdrawn from an IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

A small percentage may mean that you don't have to pay taxes. There are exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. If you do, you could face severe financial consequences.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

cftc.gov

bbb.org

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

How To

Investing In Gold vs. Investing In Stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe gold is no longer financially profitable. This belief comes from the fact most people see gold prices falling due to the global economy. They believe they would lose their money if they invested gold. In reality, however, there are still significant benefits that you can get when investing in gold. Below are some of them.

Gold is one of the oldest forms of currency known to man. It has been used for thousands of years. People around the world have used it as a store of value. Even today, countries such as South Africa continue to rely heavily on it as a form of payment for their citizens.

When deciding whether to invest in gold, the first thing you need to do is to decide what price per gram you are willing to pay. If you're interested in buying gold bullion, it is crucial that you decide how much per gram. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

Noting that gold prices have fallen in recent years, it is worth noting that the cost to produce gold has gone up. The price of gold may have fallen, but the production costs haven’t.

When deciding whether to buy gold, another thing to consider is how much gold you intend on buying. It makes sense to save any gold you don't need to purchase if your goal is to use it for wedding rings. If you plan to do so as long-term investments, it is worth looking into. Selling your gold at a higher value than what you bought can help you make money.

We hope this article has given you an improved understanding of gold investment tools. Before making any investment decisions, we strongly advise that you thoroughly research all options. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————-

By: André Dragosh

Title: Unlocking Bitcoin's Potential: The Rise of Institutional Capital

Sourced From: bitcoinmagazine.com/bigread/institutional-capital-bitcoin-bigread

Published Date: Fri, 18 Jul 2025 15:30:00 +0000