Hey there, fellow crypto enthusiasts! Let's dive into the fascinating world of Bitcoin and its remarkable journey to becoming a financial powerhouse. Back in 2010, when Bitcoin was a mere $0.07, who could have predicted its meteoric rise to over $100,000 by 2025? This digital currency has not only defied expectations but has also revolutionized investment strategies, solidifying its position as a game-changer in the financial landscape.

The Unstoppable Ascent of Bitcoin

The Power of Consistent Gains

Bitcoin's track record speaks for itself. Out of over 5,400 trading days, a staggering 99.98% have been profitable, showcasing the unwavering success of this cryptocurrency. Early believers who weathered the storm of market volatility have reaped the rewards of their foresight, witnessing history in the making.

Bitcoin as a Valuable Asset

What sets Bitcoin apart is its reliability. With over 80% of its trading days ending in profit, Bitcoin has proven to be a dependable long-term investment. This consistency instills confidence in hodlers, reinforcing Bitcoin's status as a secure store of wealth.

Bitcoin: A Hedge Against Inflation

The Rise Against the Tide

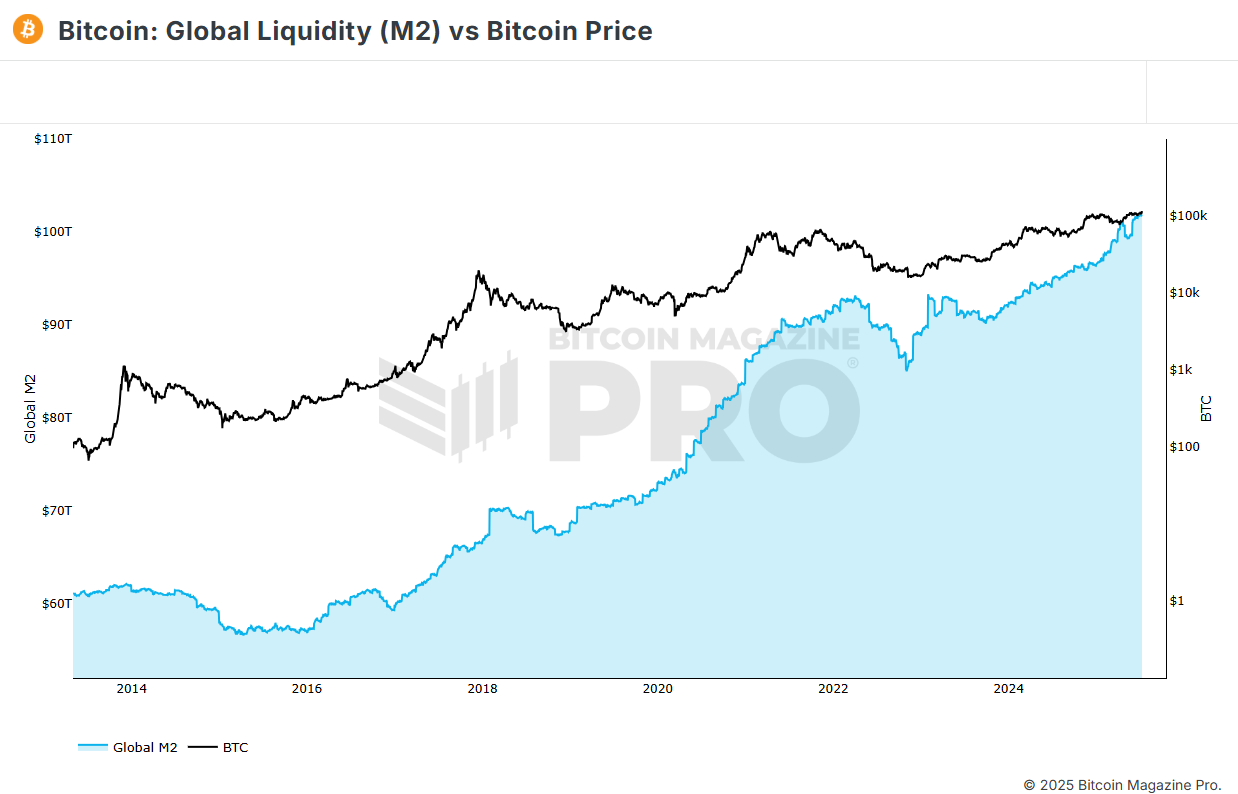

Over the years, as the global money supply (M2) swelled from $61 trillion to over $102 trillion, Bitcoin's value surged from $113 to a peak of over $118,000. This correlation underscores Bitcoin's role as a safeguard against inflation, positioning it as a valuable hedge in times of economic uncertainty.

The Power of Dollar-Cost Averaging

Strategic Investment Unveiled

Imagine investing $100 monthly in Bitcoin since 2013. Today, your total investment of $10,900 would have grown to a staggering $230,670, delivering a remarkable return of over 2,016%. In comparison, traditional assets like gold, Apple stock, and the DJI pale in comparison, showcasing Bitcoin's unparalleled growth potential.

Here's a quick snapshot of the returns:

- Gold: 103% return – $22,152

- Apple Stock: 204% return – $33,081

- Dow Jones Industrial (DJI): 56% return – $16,993

Exploring Bitcoin Investment Strategies

Empowering Investors with Data

Curious about Bitcoin's performance relative to other assets like the US dollar, gold, Apple stock, and the DJI? Look no further than the Dollar Cost Average Strategies tool from Bitcoin Magazine Pro. This tool enables users to evaluate Bitcoin's potential as a premier store of value in a well-rounded investment portfolio.

For those eager to delve into the world of Bitcoin investing, Bitcoin Magazine Pro offers a wealth of data and insights. Take a peek at the possibilities here.

Join the Bitcoin revolution and unlock the door to unprecedented financial growth. The world of crypto awaits!

Frequently Asked Questions

How much should I contribute to my Roth IRA account?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. You cannot withdraw funds from these accounts until you reach 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, your principal (the deposit amount originally made) is not transferable. No matter how much money you contribute, you cannot take out more than was originally deposited to the account. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule is that you cannot withdraw your earnings without paying income taxes. You will pay income taxes when you withdraw your earnings. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's also say that you earn $10,000 per annum after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. You would have $6,500 less. Since you're limited to taking out only what you initially contributed, that's all you could take out.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types: Roth IRAs that are traditional and Roth. A traditional IRA allows for you to deduct pretax contributions of your taxable income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs don't allow you deduct contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. Unlike a traditional IRA, there is no minimum withdrawal requirement. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

How much gold can you keep in your portfolio

The amount of money you need to make depends on how much capital you are looking for. Start small with $5k-10k. Then as you grow, you could move into an office space and rent out desks, etc. You don't need to worry about paying rent every month. You only pay one month.

You also need to consider what type of business you will run. My website design company charges clients $1000-2000 per month depending on the order. You should also consider the expected income from each client when you do this type of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. So you might only get paid once every 6 months or so.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I recommend starting with $1k-$2k of gold and growing from there.

What is the best way to hold physical gold?

Gold is money. Not just paper currency. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

One reason is that gold historically performs better than other assets during financial panics. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Gold is one of the few assets that has virtually no counterparty risks. Even if your stock portfolio is down, your shares are still yours. You can still own your gold even if the company where you invested fails to pay its debt.

Finally, the liquidity that gold provides is unmatched. This means you can easily sell your gold any time, unlike other investments. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows you to profit from short-term fluctuations on the gold market.

How much are gold IRA fees?

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes the account maintenance fees and any investment costs associated with your chosen investments.

If you want to diversify, you may be required to pay extra fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge annual management costs. These fees range between 0% and 1 percent. The average rate is.25% annually. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

How does a gold IRA work?

Individuals who want to invest with precious metals may use the Gold Ira accounts, which are tax-free.

You can buy physical gold bullion coins at any time. To start investing in gold, it doesn't matter if you are retired.

An IRA allows you to keep your gold forever. When you die, your gold assets won't be subjected to taxes.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). After you do this, you will be granted an IRA custodian. This company acts as a middleman between you and the IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

After you have established your gold IRA you will be able purchase gold bullion coin. The minimum deposit required to purchase gold bullion coins is $1,000 However, you'll receive a higher interest rate if you put in more.

Taxes will be charged on gold you have withdrawn from an IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

If you only take out a very small percentage of your income, you may not need to pay tax. However, there are exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. You could end up with severe financial consequences.

Should you open a Precious Metal IRA

You should be aware that precious metals cannot be covered by insurance. It is impossible to get back money if you lose your investment. This includes investments that have been damaged by fire, flooding, theft, and so on.

This type of loss can be avoided by investing in physical silver and gold coins. These items have been around for thousands of years and represent real value that cannot be lost. They are likely to fetch more today than the price you paid for them in their original form.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. Consider using a third-party custody company to keep your assets safe and allow you to access them at any time.

If you decide to open an account, remember that you won't see any returns until after you retire. Remember the future.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

irs.gov

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- You want to keep gold in your IRA at home? It's not legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Tips for Investing Gold

Investing in Gold remains one of the most preferred investment strategies. This is due to the many benefits of investing in gold. There are many ways to invest gold. Some people purchase physical gold coins. Others prefer to invest their money in gold ETFs.

Before you buy any type of gold, there are some things that you should think about.

- First, find out if your country allows gold ownership. If it is, you can move on. You might also consider buying gold in foreign countries.

- The second thing you need to do is decide what type of gold coins you want. You can go for yellow gold, white gold, rose gold, etc.

- You should also consider the price of gold. It is best to begin small and work your ways up. It is important to diversify your portfolio whenever you purchase gold. You should invest in different assets such as stocks, bonds, real estate, mutual funds, and commodities.

- Last but not least, remember that gold prices fluctuate frequently. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————-

By: Oscar Zarraga Perez

Title: Unlocking Bitcoin's Unprecedented Success: A Wealth-Building Phenomenon

Sourced From: bitcoinmagazine.com/news/bitcoin-breaks-records-with-100-profitable-days-and-unmatched-returns

Published Date: Fri, 11 Jul 2025 19:26:02 +0000