Have you heard the buzz? Metaplanet is making waves as Bitcoin smashes through price records! It's like watching a rocket launch with Bitcoin on one side and Metaplanet on the other, both reaching for the stars.

Metaplanet's Meteoric Rise

The Bitcoin Treasury Titan

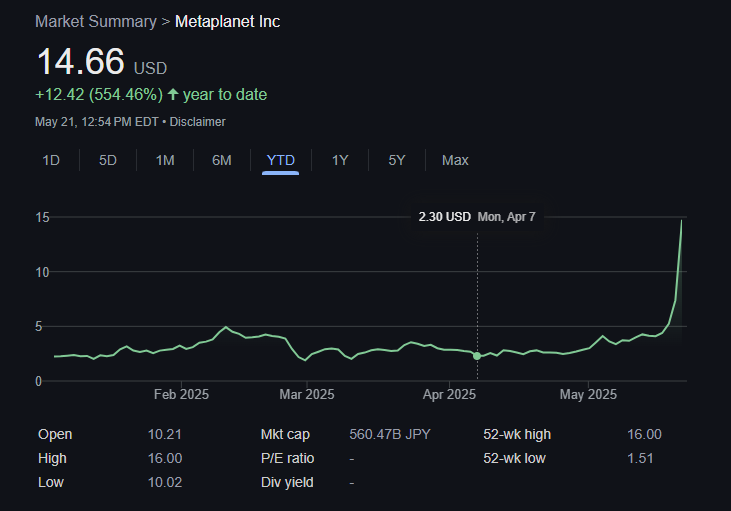

Picture this: Metaplanet, Japan's top Bitcoin treasury powerhouse, is on fire, hitting a mind-blowing all-time high in market capitalization. How did they do it? Well, it's a mix of brilliance, bold moves, and investor trust that fueled their valuation to an impressive ¥470.3 billion. That's a jaw-dropping 554.5% surge since the year kicked off, mirroring Bitcoin's meteoric rise to an extraordinary new ATH of $109,500 today.

The Bitcoin Acquisition Odyssey

A Treasure Trove of BTC

Fast forward one year, and Metaplanet's Bitcoin stash has bloomed from 98 BTC to a whopping 7,800 BTC (as of May 19, 2025), snagged at an average price of $103,873 per coin. That treasure chest now shines over $800 million, thanks to Bitcoin's epic bull run.

The Innovative 21 Million Plan

A Financial Odyssey

Metaplanet's recent surge came after they completed the 13th to 17th series of stock acquisition rights under their innovative "21 Million Plan." This financial adventure raked in a cool ¥93.3 billion in just 60 trading days, powering more Bitcoin buys without watering down shareholder value. It's like finding buried gold without losing your map!

Metaplanet's Unstoppable Journey

An OTCQX Triumph

Since their OTCQX Market debut, Metaplanet's growth has been unstoppable. It's like they've strapped a rocket to their back and launched into the stratosphere. Simon Gerovich, Metaplanet's President, couldn't be more thrilled: "Joining the OTCQX Market is a game-changer, offering U.S. investors a front-row seat to Metaplanet's epic voyage. As Asia's Bitcoin Treasury trailblazer, we're here to boost global Bitcoin adoption and pump up shareholder value!"

Metaplanet's Financial Odyssey

A Profitable Quest

Metaplanet isn't just riding Bitcoin's coat-tails; they're surfing the wave of Bitcoin's success. Shifting gears to a Bitcoin-centric strategy in 2024, they've clocked jaw-dropping quarterly BTC returns of 41.7%, 309.8%, 95.6%, and 47.8%. These stellar gains have jacked up their net asset value by 103.1 times and their market cap by a whopping 138.1 times, all thanks to Bitcoin's stellar climb.

Metaplanet's Financial Triumph

A Record Quarter

Q1 FY2025 was Metaplanet's golden hour. Revenue shot up 8% to ¥877 million, while operating profit jumped 11% to ¥593 million. Net income skyrocketed to ¥5.0 billion, powered by unrealized gains of ¥13.5 billion from their Bitcoin stash, beefing up their financial muscle.

Bitcoin's Dance and Metaplanet's Symphony

A Profitable Melody

Even when Bitcoin stumbled briefly in March, causing a ¥7.4 billion hiccup in valuation, Metaplanet swiftly regained ground as Bitcoin soared to new heights. This close dance with Bitcoin's rhythm has made Metaplanet a go-to investment vehicle for those eyeing Bitcoin action on the Tokyo Stock Exchange.

So, are you ready to ride this rocket ship with Metaplanet? Buckle up, hold on tight, and let's reach for the stars together!

Frequently Asked Questions

Should You Purchase Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Experts believe this could change soon. They believe gold prices could increase dramatically if there is another global financial crises.

They also point out that gold is becoming popular because of its perceived value and potential return.

Consider these things if you are thinking of investing in gold.

- Consider first whether you will need the money to save for retirement. It is possible to save enough money to retire without investing in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, ensure you fully understand the risks involved in buying gold. Each type offers varying levels and levels of security.

- Last but not least, gold doesn't provide the same level security as a savings account. It is possible to lose your gold coins.

So, if you're thinking about buying gold, make sure you do your research first. Protect your gold if you already have it.

Can I purchase gold with my self directed IRA?

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts can be described as financial instruments that are determined by the gold price. These financial instruments allow you to speculate about future prices without actually owning the metal. You can only hold physical bullion, which is real silver and gold bars.

What precious metal should I invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Gold is a traditional haven investment. However, it is not always the most profitable. You might not want to invest in gold if you're looking for quick returns. If you have the patience to wait, then you might consider investing in silver.

If you don’t want to be rich fast, gold might be the right choice. Silver might be a better investment option if steady returns are desired over a long period of time.

How Do You Make a Withdrawal from a Precious Metal IRA?

You first need to decide if you want to withdraw money from an IRA account. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. Traditional IRAs allow you to withdraw funds tax-free when you turn 59 1/2 while Roth IRAs charge income taxes upfront but let you access those earnings later without paying additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage areas will accept bullion, while others require you to purchase individual coins. Before you choose one, weigh the pros and cons.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. But, each coin must be counted separately. However, keeping individual coins in a separate place allows you to easily track their values.

Some people like to keep their coins in vaults. Others prefer to store their coins in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

Is it a good retirement strategy to buy gold?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

The most popular form of investing in gold is through physical bullion bars. However, there are many other ways to invest in gold. You should research all options thoroughly before making a decision on which option you prefer.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. Owning gold stocks should work well if you need cash flow from your investment.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs often include stocks of gold miners, precious metals refiners, and commodity trading companies.

What does gold do as an investment?

Supply and demand determine the gold price. Interest rates can also affect the gold price.

Due to the limited supply of gold, prices for gold are highly volatile. You must also store physical gold somewhere to avoid the risk of it becoming stale.

How much should your IRA include precious metals

It's important to understand that precious metals aren't only for wealthy people. You don’t need to have a lot of money to invest. In fact, there are many ways to make money from gold and silver investments without spending much money.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. Shares in precious metals-producing companies could be an option. Your retirement plan provider may offer an IRA rollingover program.

You will still reap the benefits of owning precious metals, regardless of which option you choose. Although they aren’t stocks, they offer the possibility for long-term gains.

And unlike traditional investments, they tend to increase in value over time. If you decide to sell your investment, you will likely make more than with traditional investments.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

cftc.gov

finance.yahoo.com

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

How To

Investing In Gold vs. Investing In Stocks

It might seem risky to invest in gold as an investment vehicle these days. This is because most people believe that it is no longer economically profitable to invest gold. This belief comes from the fact most people see gold prices falling due to the global economy. They fear that investing in gold will result in a loss of money. However, investing in gold can still provide significant benefits. Let's take a look at some of the benefits.

One of the oldest currencies known to man is gold. It has been in use for thousands of year. It has been used as a store for value by people all over the globe. It's still used by countries like South Africa as a method of payment.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although the price of gold has dropped, production costs have not.

Another thing to remember when thinking about whether or not you should buy gold is the amount of gold you plan on purchasing. If you intend to only purchase enough gold to cover your wedding rings it may be a smart decision to not buy any gold. If you plan to do so as long-term investments, it is worth looking into. If you sell your gold for more than you paid, you can make a profit.

We hope our article has given you a better understanding of gold as an investment tool. We recommend you do your research before making any final decisions. Only after doing so can you make an informed decision.

—————————————————————————————————————————————————————————————-

By: Oscar Zarraga Perez

Title: Metaplanet: Soaring High Alongside Bitcoin's Record Price Surge

Sourced From: bitcoinmagazine.com/news/metaplanet-hits-new-all-time-high-as-bitcoin-hits-record-price

Published Date: Wed, 21 May 2025 17:33:11 +0000