Hey there, fellow investors! Are you ready to take your MSTR investing to the next level using Bitcoin market data? Ever since Michael Saylor and his team at Strategy (formerly MicroStrategy) delved into the world of Bitcoin, their returns have been soaring. But how can you supercharge your MSTR investments even more? Let's dive in and discover how leveraging key metrics and strategies can help you maximize your returns.

Exploring the Power of MSTR's Outperformance

The Magic Behind MSTR's Success

Picture this: MicroStrategy, now known as Strategy, has been making waves with its Bitcoin investments, boasting returns over 3,000%. In comparison, Bitcoin itself has seen growth of around 700%. This stark difference showcases the immense potential of investing in companies heavily vested in Bitcoin.

Cracking the Code: Key Metrics for MSTR Investment

Mastering Metrics for Enhanced Returns

When it comes to refining your MSTR investment game plan, incorporating various data points is key. Let's shed light on some crucial metrics:

- MVRV Z-Score: An indicator to assess Bitcoin's valuation for strategic buying and selling.

- Active Address Sentiment Indicator: Tracking user activity to gauge market sentiment for timely decisions.

- Crosby Ratio: Pinpointing market peaks and troughs for precise trade timing.

- Global Liquidity: Monitoring worldwide liquidity shifts to foresee MSTR stock movements.

Unveiling the Potential of MVRV Z-Score in MSTR Investing

Diving Deeper into MVRV Z-Score

The MVRV Z-Score, a game-changer in assessing Bitcoin's market dynamics, can also work wonders for MSTR. The color zones signal prime buying or selling opportunities, aligning with Bitcoin's trends.

Decoding the Active Address Sentiment Indicator

Understanding Active Address Sentiment

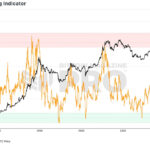

The Active Address Sentiment Indicator keeps tabs on network user shifts against Bitcoin's price fluctuations. Utilize this tool to sense market overheating or cooling, guiding your profit-taking or accumulation moves.

Global Liquidity's Influence on MSTR Performance

Impact of Global Liquidity on MSTR

Global liquidity trends hold sway over MSTR's trajectory. By tracking these trends, you can predict price shifts impacting MSTR. Adjusting the analysis timeframe can further enhance insights.

Empowering Your Strategy with Value Days Destroyed Indicator

Utilizing Value Days Destroyed

This indicator correlates Bitcoin price actions with MSTR's performance, aiding in spotting lucrative trade moments. Its effectiveness on MSTR could be linked to its leverage on Bitcoin's volatility.

Crafting Data-Driven MSTR Strategies

Strategizing for Success

By aligning with Bitcoin's metrics, MSTR investors can navigate the market terrain with confidence. Harness the MVRV Z-Score, Active Address Sentiment Indicator, and global liquidity insights to fine-tune your MSTR investments.

As Michael Saylor continues his Bitcoin accumulation journey, MSTR's potential for growth remains promising. Stay informed, watch those indicators closely, and steer your investments towards success!

Ready to dive deeper? Explore additional resources and analytics to stay ahead of the Bitcoin and MSTR game. Let data be your guiding light on this investment voyage!

Disclaimer: Remember, this article offers insights, not financial advice. Always conduct thorough research before making investment decisions.

This article on Maximizing MSTR Returns Using Bitcoin Market Data was originally published on Bitcoin Magazine.

Frequently Asked Questions

How to Open a Precious Metal IRA

The first step is to decide if you want an Individual Retirement Account (IRA). If you do, you must open the account by completing Form 8606. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form should not be completed more than 60 days after the account is opened. Once this is done, you can start investing. You can also contribute directly to your paycheck via payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

To be eligible for a precious metals IRA, you will need to meet certain requirements. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. Your annual earnings cannot exceed $110,000 ($220,000 if you are married and file jointly) for any tax year. Contributions must be made on a regular basis. These rules apply to contributions made directly or through employer sponsorship.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, physical bullion will not be available for purchase. This means you can't trade shares of stock and bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option may be offered by some IRA providers.

There are two major drawbacks to investing via an IRA in precious metals. First, they aren't as liquid than stocks and bonds. It is therefore harder to sell them when required. They also don't pay dividends, like stocks and bonds. You'll lose your money over time, rather than making it.

Should You Buy Gold?

Gold was a safe investment option for those who were in financial turmoil. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Some experts believe that this could change very soon. They say that gold prices could rise dramatically with another global financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

These are some important things to remember if your goal is to invest in gold.

- Consider whether you will actually need the money that you are saving for retirement. It is possible to save for retirement while still investing your gold savings. However, when you retire at age 65, gold can provide additional protection.

- Second, be sure to understand your obligations before you purchase gold. Each offers varying levels of flexibility and security.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. Losing your gold coins could result in you never being able to retrieve them.

Don't buy gold unless you have done your research. Protect your gold if you already have it.

Who holds the gold in a gold IRA?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

Consult a financial advisor or accountant to determine your options.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

bbb.org

finance.yahoo.com

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

The History of Gold as an Asset

Gold was a currency from ancient times until the early 20th century. It was universally accepted due to its purity and divisibility, beauty, scarcity, and durability. In addition, because of its value, it was traded internationally. However, since there were no international standards for measuring gold at this point, different weights and measures existed worldwide. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. This caused a drop in foreign currency demand which resulted in an increase of their prices. At this point, the United States minted large amounts of gold coins, causing the price of gold to drop. Because the U.S. government had too much money coming into circulation, they needed to find a way to pay off some debt. To do this, they decided that some of their excess gold would be sold back to Europe.

Since most European countries were not confident in the U.S. dollar they began accepting gold as payment. However, after World War I, many European countries stopped taking gold and began using paper money instead. The price of gold has risen significantly since then. Even though gold's price fluctuates, it is still one of the most secure investments you could make.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Unlocking Maximum MSTR Returns with Bitcoin Market Insights

Sourced From: bitcoinmagazine.com/markets/pro-tips-mstr-bitcoin-market-data

Published Date: Wed, 07 May 2025 14:20:25 +0000