As we move further into 2025, investors are closely studying Bitcoin's price history and trends to forecast what February might bring. With Bitcoin's cyclical nature often influenced by its halving events, analyzing historical data can provide valuable insights into what to expect in the upcoming month. By examining past data, such as Bitcoin's average monthly returns and its performance in previous Februarys following halving events, we can gain a clearer understanding of what February 2025 could entail.

Understanding Bitcoin’s Seasonality

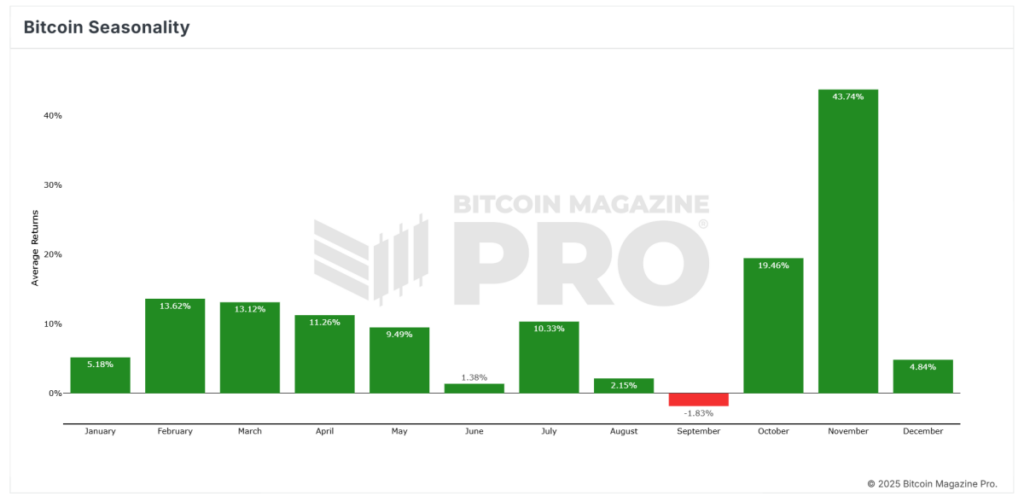

Looking at the "Bitcoin Seasonality" chart showcasing average monthly returns from 2010 to the most recent close, we can identify Bitcoin's best-performing months and its cyclical patterns. Historically, February has demonstrated an average return of 13.62%, positioning it as one of Bitcoin's stronger months in terms of performance.

Notably, November has been the standout month with the highest average return at 43.74%, followed by October at 19.46%. On the contrary, September has historically been the weakest month with an average return of -1.83%. February's consistent performance places it among the top months in Bitcoin's seasonality, offering optimism for positive returns in February 2025.

Historical Performance of February in Post-Halving Years

A deeper analysis of Bitcoin's historical February returns in years following halving events unveils intriguing insights. Bitcoin's halving, occurring approximately every four years, halves block rewards and triggers a supply shock that typically leads to price surges. February's performance in these post-halving years has consistently been positive:

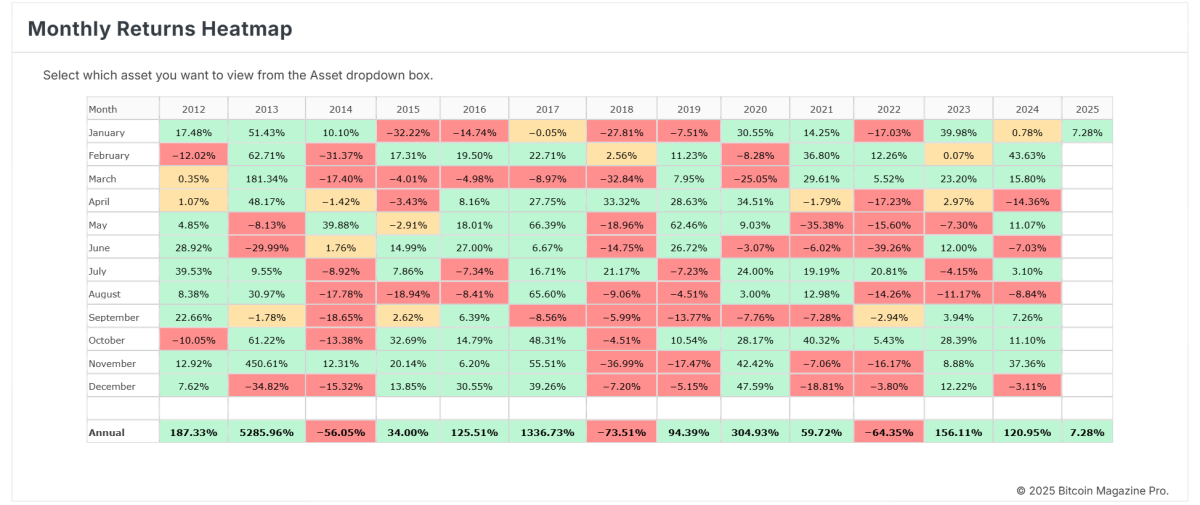

- 2013 (Post-2012 Halving): 62.71%

- 2017 (Post-2016 Halving): 22.71%

- 2021 (Post-2020 Halving): 36.80%

The average return across these three years stands at an impressive 40.74%. Each of these Februarys reflects the bullish momentum often witnessed after halving events, driven by reduced Bitcoin supply and increased market demand.

January 2025’s Performance Sets the Stage

Although February 2025 lies ahead, the year commenced with a modest 7.28% return in January, as illustrated in the "Monthly Returns Heatmap." January's positive performance suggests a continuation of bullish sentiment in early 2025, aligning with historical post-halving trends. If February 2025 mirrors past post-halving years, returns could range between 22% and 63%, with an average expectation of around 40%.

Driving Factors Behind February’s Post-Halving Strength

Several factors contribute to February's historical robust performance in post-halving years:

- Supply Shock: The halving reduces new Bitcoin supply, boosting scarcity and driving price appreciation.

- Market Momentum: Investors typically respond to halving events with increased enthusiasm, leading to price uptrends in the following months.

- Institutional Interest: Recent cycles have witnessed accelerated institutional adoption post-halving, resulting in significant capital inflows.

Key Insights for February 2025

Approaching February 2025 with cautious optimism is advisable for investors. Historical and seasonal data indicate strong potential for positive returns in the month, especially within the context of Bitcoin's post-halving cycles. With an average return of 40.74% in previous post-halving Februarys, investors can anticipate similar performance this year, barring any major macroeconomic or regulatory challenges.

Bitcoin's history offers valuable insights into its future performance. February 2025 appears poised for another positive month, driven by the post-halving dynamics that historically fuel significant gains. When combined with historical data and a favorable regulatory landscape, along with news of The Financial Accounting Standards Board (FASB) issuing a new guideline (ASU 2023-08) impacting Bitcoin accounting, 2025 presents itself as a transformative year for Bitcoin. Investors are advised to supplement these insights with comprehensive market analysis and readiness for Bitcoin's inherent volatility.

By leveraging historical lessons and seasonal patterns, Bitcoin investors can make well-informed decisions as they navigate this crucial year in the cryptocurrency market. To access real-time data and stay updated on the latest analyses, visit bitcoinmagazinepro.com.

Disclaimer: This article serves for informational purposes only and should not be construed as financial advice. Always conduct thorough research before making any investment decisions.

Frequently Asked Questions

What proportion of your portfolio should you have in precious metals

To answer this question we need to first define precious metals. Precious elements are those elements which have a high price relative to other commodities. This makes them valuable in investment and trading. Gold is by far the most common precious metal traded today.

But, there are other types of precious metals available, including platinum and silver. The price volatility of gold can be unpredictable, but it is generally stable during periods of economic turmoil. It is also not affected by inflation and depression.

As a general rule, the prices for all precious metals tend to increase with the overall market. However, the prices of precious metals do not always move in sync with one another. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors choose safe assets such Treasury Bonds over precious metals. These precious metals are rare and become more costly.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

What are the benefits of having a gold IRA?

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It is tax-deferred until it's withdrawn. You have total control over how much each year you take out. There are many types and types of IRAs. Some are better suited for college students. Others are intended for investors seeking higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. Once they start withdrawing money, however, the earnings aren’t subject to tax again. So if you're planning to retire early, this type of account may make sense.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. You won't have the hassle of making deposits each month. Direct debits could be set up to ensure you don't miss a single payment.

Gold is one of today's most safest investments. It is not tied to any country so its value tends stay steady. Even during economic turmoil, gold prices tend to stay relatively stable. It is therefore a great choice for protecting your savings against inflation.

Is gold a good IRA investment?

If you are looking for a way to save money, gold is a great investment. You can also diversify your portfolio by investing in gold. There's more to gold that meets the eye.

It's been used as a form of payment throughout history. It is often called “the oldest currency in the world.”

Gold, unlike other paper currencies created by governments is mined directly from the earth. This makes it highly valuable as it is hard and rare to produce.

Gold prices fluctuate based on demand and supply. The strength of the economy means people spend more, and so, there is less demand for gold. This results in gold prices rising.

On the flipside, people may save cash rather than spend it when the economy slows. This increases the production of gold, which in turn drives down its value.

This is why it makes sense to invest in gold for individuals and companies. If you invest in gold, you'll benefit whenever the economy grows.

In addition to earning interest on your investments, this will allow you to grow your wealth. Additionally, you won't lose cash if the gold price falls.

What is a Precious Metal IRA (IRA)?

You can diversify your retirement savings by investing in precious metal IRAs. This allows you to invest in gold, silver and platinum as well as iridium, osmium and other rare metals. These are “precious metals” because they are hard to find, and therefore very valuable. They are great investments for your money, and they can protect you from inflation or economic instability.

Precious metals often refer to themselves as “bullion.” Bullion is the physical metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. You'll get dividends each year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. You pay only a small percentage of your gains tax. Plus, you can access your funds whenever you like.

Can the government take your gold

Because you have it, the government can't take it. It is yours because you worked hard for it. It is yours. But, this rule is not universal. You could lose your gold if convicted of fraud against a federal government agency. Your precious metals can also be lost if you owe tax to the IRS. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

Can I own a gold ETF inside a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

A traditional IRA allows contributions from both employee and employer. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

A Individual Retirement Annuity is also possible. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs can be made without tax.

How is gold taxed within an IRA?

The fair market price of gold when it is sold determines the tax due on its sale. You don't have tax to pay when you buy or sell gold. It isn't considered income. If you sell it later you will have a taxable profit if the price goes down.

For loans, gold can be used to collateral. When you borrow against your assets, lenders try to find the highest return possible. In the case of gold, this usually means selling it. It's not guaranteed that the lender will do it. They may keep it. Or they might decide to resell it themselves. Either way you will lose potential profit.

You should not lend against your gold if it is intended to be used as collateral. You should leave it alone if you don't intend to lend against it.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

cftc.gov

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

The History of Gold as an Asset

Gold was a currency from ancient times until the early 20th century. It was universally accepted and loved for its beauty, durability, purity and divisibility. Because of its intrinsic value, it was also widely traded. There were different measures and weights for gold, as there was no standard to measure it. One pound sterling in England was equivalent to 24 carats silver, while one livre tournois in France was equal 25 carats. In Germany, one mark was equivalent to 28 carats.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. This resulted in a decline of foreign currency demand and an increase in the price. The United States began minting large quantities gold coins at this time, which led to a drop in the price. The U.S. government needed to find a solution to their debt because there was too much money in circulation. They decided to return some of the gold they had left to Europe.

Many European countries didn't trust the U.S. dollars and started to accept gold for payment. Many European countries started to accept paper money as a substitute for gold after World War I. The price of gold has risen significantly since then. Although the price of gold fluctuates today, it remains one of your most safe investments.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Bitcoin Price Forecast for February 2025

Sourced From: bitcoinmagazine.com/markets/what-bitcoin-price-history-predicts-for-february-2025

Published Date: Thu, 16 Jan 2025 18:24:39 GMT