Since their debut in January 2024, Bitcoin ETFs have been closely watched by the market. The big question on everyone's mind is whether these investment products have lived up to the initial hype and expectations. Let's delve into the details to see if Bitcoin ETFs have truly delivered on their promise.

Impressive Start for Bitcoin ETFs

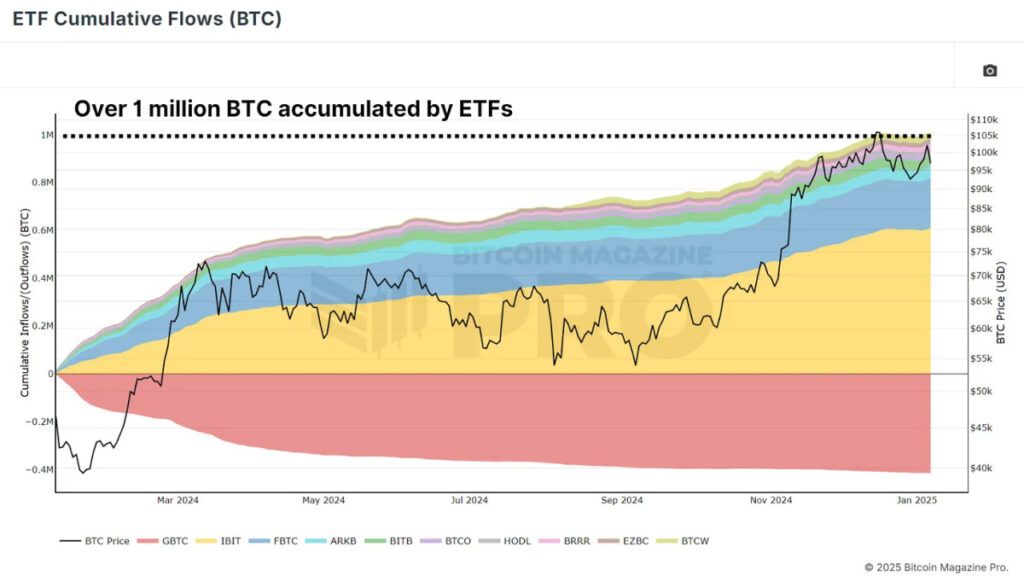

Bitcoin ETFs have gathered momentum since their launch, amassing over 1 million BTC, translating to around $40 billion in assets under management. Despite some outflows from competing products like the Grayscale Bitcoin Trust (GBTC), which experienced withdrawals of over 400,000 BTC, the net inflows have remained substantial at approximately 540,000 BTC. This significant influx of funds showcases the strong institutional interest in Bitcoin as a viable financial asset.

Bitcoin's Growth Trajectory

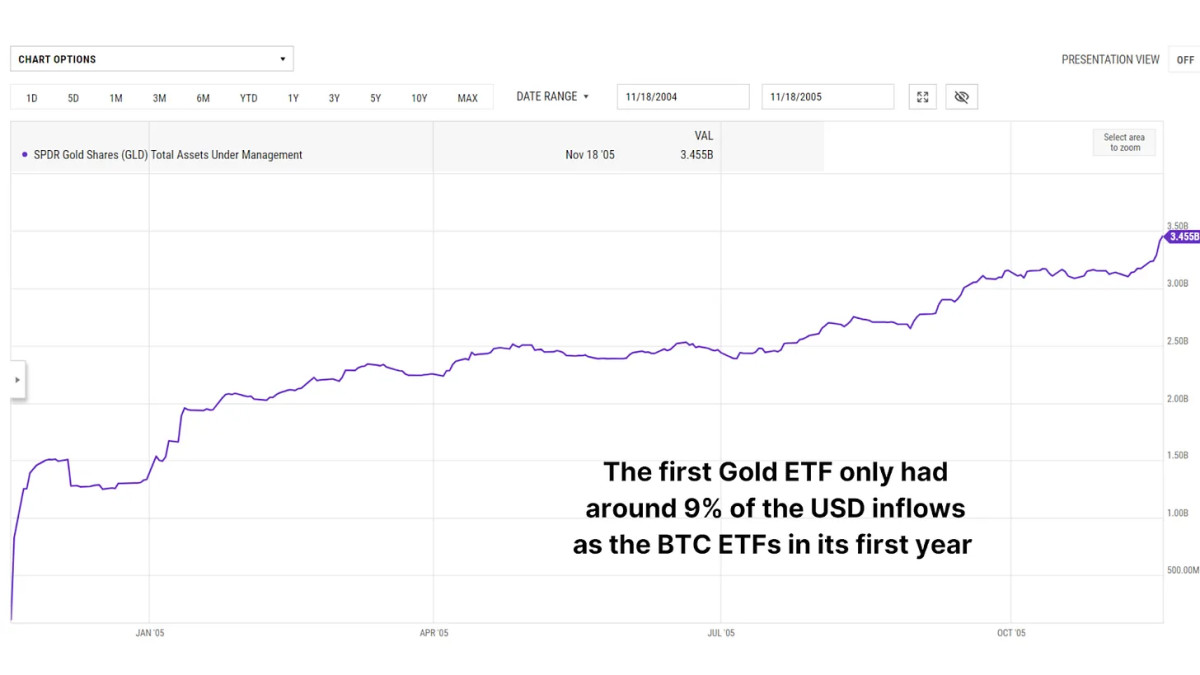

Following the introduction of Bitcoin ETFs, the initial price movements were met with mixed reactions, with Bitcoin briefly dipping by almost 20% in a classic "buy the rumor, sell the news" scenario. However, this downward trend was short-lived. Over the past year, Bitcoin prices have surged by about 120%, reaching new record highs. In comparison, the first year after the launch of gold ETFs saw a modest 9% increase in gold prices.

Comparing Bitcoin to Gold

When considering Bitcoin's round-the-clock trading schedule, which provides approximately 5.3 times more trading hours per year compared to gold, interesting parallels can be drawn. By overlaying Bitcoin's ETF price movements with historical gold data (adjusted for trading hours), we observe strikingly similar percentage returns. If Bitcoin continues to mirror gold's trajectory, we may witness an additional 83% price surge by mid-2025, potentially propelling Bitcoin's price to around $188,000.

Institutional Investment Strategies

One noteworthy observation from the realm of Bitcoin ETFs is the correlation between fund inflows and price fluctuations. A simple strategy of purchasing Bitcoin on days with positive ETF inflows and selling on days with outflows has consistently outperformed a conventional buy-and-hold approach. From January 2024 to date, this strategy has yielded returns of 130%, surpassing the ~100% return for buy-and-hold investors by nearly 10%.

Supply and Demand Dynamics

Despite Bitcoin ETFs accumulating over 1 million BTC, this constitutes only a small fraction of the total circulating supply of 19.8 million BTC. While corporations like MicroStrategy have contributed to institutional adoption by holding significant BTC reserves, the decentralized nature of Bitcoin ownership ensures that market dynamics are still influenced by decentralized supply and demand forces.

Looking Ahead

After one year in existence, Bitcoin ETFs have surpassed initial expectations. With substantial inflows, a notable impact on price appreciation, and a growing institutional presence, they have solidified their position as a key driver of Bitcoin's market narrative. While early doubters may have been underwhelmed by the initial lack of dramatic price movements, the long-term outlook remains optimistic.

The parallels drawn with gold ETFs offer a promising roadmap for Bitcoin's future trajectory. If history repeats itself, we could be on the brink of another significant rally. Coupled with favorable macroeconomic conditions and increasing institutional interest, the outlook for Bitcoin appears brighter than ever.

For real-time data, comprehensive charts, key indicators, and detailed analysis to stay informed about Bitcoin's price trends, consider exploring Bitcoin Magazine Pro.

Disclaimer: This article is intended for informational purposes only and should not be construed as financial advice. It is always recommended to conduct thorough research before making any investment decisions.

Frequently Asked Questions

How much gold should your portfolio contain?

The amount you make will depend on the amount of capital you have. For a small start, $5k to $10k is a good range. Then as you grow, you could move into an office space and rent out desks, etc. So you don't have all the hassle of paying rent. Rent is only paid per month.

It's also important to determine what type business you'll run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. You may get paid just once every 6 months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Should you Invest In Gold For Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. Consider investing in both.

In addition to being a safe investment, gold also offers potential returns. It's a great investment for retirees.

Gold is more volatile than most other investments. Its value fluctuates over time.

This does not mean you shouldn’t invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another benefit to gold is its tangible value. Unlike stocks and bonds, gold is easier to store. It can also be carried.

As long as you keep your gold in a secure location, you can always access it. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold tends to rise when the stock markets fall.

Gold investment has another advantage: You can sell it anytime. Just like stocks, you can liquidate your position whenever you need cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Also, don't buy too much at once. Start small, buying only a few ounces. Continue adding more as necessary.

Keep in mind that the goal is not to quickly become wealthy. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Is gold a good choice for an investment IRA?

Anyone who is looking to save money can make gold an excellent investment. You can diversify your portfolio with gold. There is much more to gold than meets your eye.

It's been used as a form of payment throughout history. It is often called “the most ancient currency in the universe.”

But gold is mined from the earth, unlike paper currencies that governments create. It's hard to find and very rare, making it extremely valuable.

The supply-demand relationship determines the gold price. When the economy is strong, people tend to spend more money, which means fewer people mine gold. The value of gold rises as a consequence.

The flip side is that people tend to save money when the economy slows. This means that more gold is produced, which reduces its value.

It is this reason that gold investing makes sense for businesses and individuals. You'll reap the benefits of investing in gold when the economy grows.

Your investments will also generate interest, which can help you increase your wealth. Additionally, you won't lose cash if the gold price falls.

How much of your IRA should include precious metals?

It's important to understand that precious metals aren't only for wealthy people. You don’t need to have a lot of money to invest. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. You could also buy shares in companies that produce precious metals. You might also want to use an IRA rollover program offered through your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. These metals are not stocks, but they can still provide long-term growth.

And unlike traditional investments, they tend to increase in value over time. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

How does a gold IRA work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase physical gold bullion coins anytime. To invest in gold, you don't need to wait for retirement.

Owning gold as an IRA has the advantage of allowing you to keep it forever. You won't have to pay taxes on your gold investments when you die.

Your heirs can inherit your gold and avoid capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a IRA for gold, you must first create an individual retirement plan (IRA). Once you've done so, you'll be given an IRA custodian. This company acts as an intermediary between you and IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reporting.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. The minimum deposit required to purchase gold bullion coins is $1,000 If you make more, however, you will get a higher interest rate.

Taxes will be charged on gold you have withdrawn from an IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

You may not be required to pay taxes if you take out only a small amount. There are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

You shouldn't take out more then 50% of your total IRA assets annually. If you do, you could face severe financial consequences.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

investopedia.com

finance.yahoo.com

cftc.gov

bbb.org

How To

Gold IRAs: A Growing Trend

As investors seek to diversify their portfolios while protecting themselves from inflation, the trend towards gold IRAs is on the rise.

Owners can invest in gold bars and bullion with the gold IRA. It can be used for tax-free growth and provides an alternative investment option for those concerned about stocks and bonds.

A gold IRA allows investors to manage their assets without worrying about market volatility. They can also use the gold IRA as a protection against potential problems like inflation.

Investors also get the unique benefits of owning physical Gold, including its durability, portability, flexibility, and divisibility.

Additionally, the gold IRA has many benefits. It allows you to quickly transfer your gold ownership to your heirs. The IRS doesn't consider gold a commodity or currency.

Investors who seek financial stability and a safe haven are finding the gold IRA increasingly attractive.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Are Bitcoin ETFs Meeting Expectations in 2024?

Sourced From: bitcoinmagazine.com/markets/have-bitcoin-etfs-lived-up-to-the-hype

Published Date: Fri, 10 Jan 2025 13:30:00 GMT