Bitcoin is wrapping up an exceptional month in its history, skyrocketing over $30,000 in November and signaling a revived optimistic sentiment in the market. Looking forward to December and beyond, investors are keen on deciphering if Bitcoin's current momentum can endure into 2025. With macroeconomic factors, historical patterns, and on-chain data aligning favorably for Bitcoin, let's delve into the current scenario and its implications for the future.

November’s Unprecedented Performance

November 2024 stood out as a monumental month for Bitcoin. The price of Bitcoin surged from approximately $67,000 to almost $100,000, reflecting an impressive peak-to-trough increase of around 50%. This surge marked the most substantial monthly dollar gain in Bitcoin's history. Long-term holders, who weathered months of consolidation post Bitcoin's previous all-time high of $74,000 earlier in the year, were handsomely rewarded.

The Influence of the Dollar and Global Liquidity

Notably, Bitcoin's surge coincided with a strengthening U.S. Dollar Strength Index (DXY), a scenario typically associated with Bitcoin's underperformance. Traditionally, Bitcoin and the DXY exhibit an inverse correlation: when the dollar strengthens, Bitcoin tends to weaken, and vice versa.

Parallels with Previous Bull Cycles

Bitcoin's current trajectory bears striking resemblances to past bull markets, especially the 2016–2017 cycle. This cycle commenced with gradual price hikes before surpassing crucial resistance levels and entering an exponential growth phase.

Institutional Adoption and Accumulation

An essential factor supporting Bitcoin's strength is the ongoing accumulation by institutional players. Bitcoin ETFs are incorporating billions of dollars' worth of BTC into their portfolios, while companies like MicroStrategy have intensified their Bitcoin holdings, now possessing nearly 400,000 BTC. Despite BTC hitting new all-time highs, institutional investors are actively accumulating, indicating a growing confidence in Bitcoin's long-term value proposition.

Concluding Thoughts

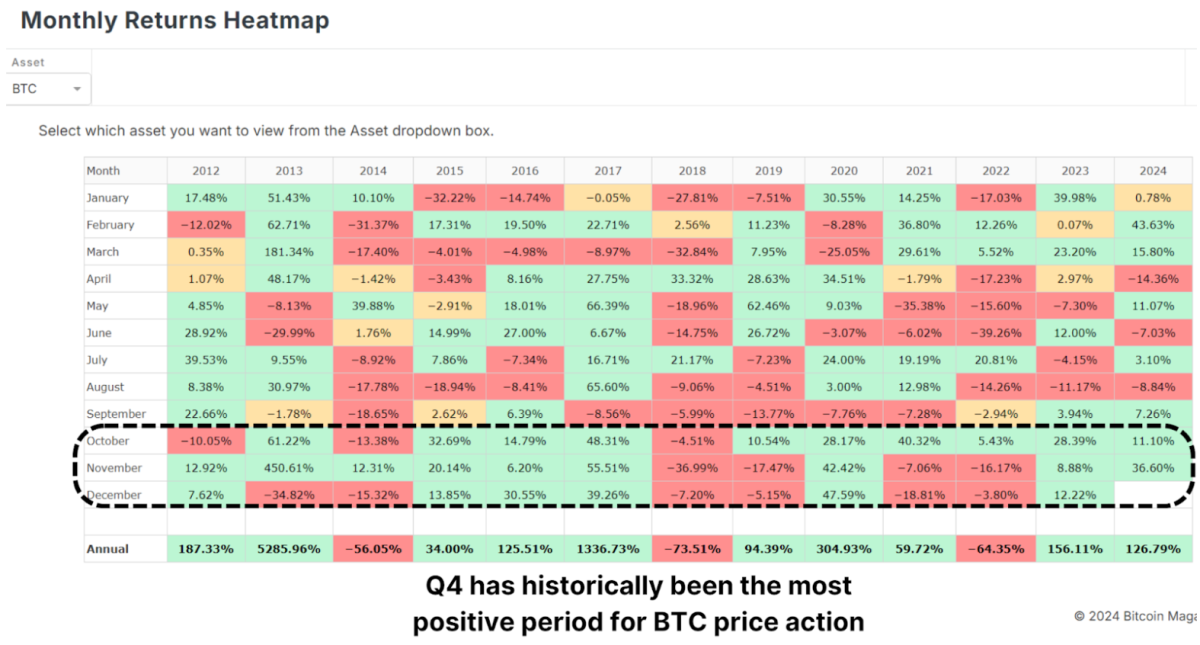

December historically emerges as a robust month for Bitcoin; however, short-term volatility may moderate gains as the market absorbs November's rapid surge. Nevertheless, with institutional players aggressively accumulating Bitcoin, the long-term outlook remains exceedingly bullish. The breach of the $100,000 milestone could set the stage for a substantial rally in 2025. Bitcoin is poised to enter an exciting phase, with favorable alignments across macroeconomic, technical, and on-chain indicators.

For a more comprehensive analysis of this subject, you can watch a recent YouTube video titled: The BIGGEST Bitcoin Month EVER – So What Happens Next?

Frequently Asked Questions

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. But, this type of investment comes with its own set of disadvantages.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. If you do withdraw funds, you'll need to pay a penalty.

A disadvantage to managing your IRA is the fact that fees must be paid. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management charges ranging anywhere from $10 to $50.

Insurance will be required if you would like to keep your cash out of banks. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. You may be limited in the amount of gold you can have by some providers. Others allow you the freedom to choose your own weight.

You will also have to decide whether to purchase futures or physical gold. Futures contracts for gold are less expensive than physical gold. Futures contracts provide flexibility for purchasing gold. They allow you to set up a contract with a specific expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. It does provide coverage for damage from natural disasters, however. You might consider purchasing additional coverage if your area is at high risk.

Apart from insurance, you should consider the costs of storing your precious metals. Storage costs will not be covered by insurance. In addition, most banks charge around $25-$40 per month for safekeeping.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians cannot sell your assets. They must instead keep them for as long as you ask.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. Also, you should specify how much each month you plan to invest.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. After receiving your application, the company will review it and mail you a confirmation letter.

A financial planner is a good idea when opening a gold IRA. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

Can the government steal your gold?

Your gold is yours and the government cannot take it. You earned it through hard work. It belongs exclusively to you. However, there may be some exceptions to this rule. You could lose your gold if convicted of fraud against a federal government agency. Additionally, your precious metals may be forfeited if you owe the IRS taxes. You can keep your gold even if your taxes are not paid.

Can I buy gold using my self-directed IRA

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. You can speculate on future prices, but not own the metal. You can only hold physical bullion, which is real silver and gold bars.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

irs.gov

cftc.gov

bbb.org

How To

The History of Gold as an Asset

Gold was a currency from ancient times until the early 20th century. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Because of its intrinsic value, it was also widely traded. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

In the 1860s, the United States began to issue American coins made from 90% copper, 10% Zinc, and 0.942 Fine Gold. This led to a decline in demand for foreign currencies, which caused their price to increase. The price of gold dropped because the United States began to mint large quantities of gold coins. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. To do so, they decided to sell some of the excess gold back to Europe.

Because most European countries did not trust the U.S. dollar, they started accepting gold as payment. After World War I, however, many European countries started using paper money to replace gold. The value of gold has significantly increased since then. Even though gold's price fluctuates, it is still one of the most secure investments you could make.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Bitcoin's Spectacular November Surge: What Lies Ahead for 2025?

Sourced From: bitcoinmagazine.com/markets/will-december-surpass-novembers-record-breaking-bitcoin-price-increase

Published Date: Fri, 29 Nov 2024 14:00:00 GMT