Understanding Bitcoin as the Benchmark Asset

Bitcoin has consistently outperformed all major asset classes over the past decade, solidifying its role as the benchmark for digital asset investors. For those committed to Bitcoin’s long-term vision, the ultimate financial goal often shifts from acquiring more dollars to maximizing their Bitcoin holdings.

Bitcoin is to digital assets what treasury bonds are to the legacy financial system—a foundational benchmark. While no investment is without risk, Bitcoin held in self-custody eliminates counterparty risk, dilution risk, and other systemic risks common in traditional finance.

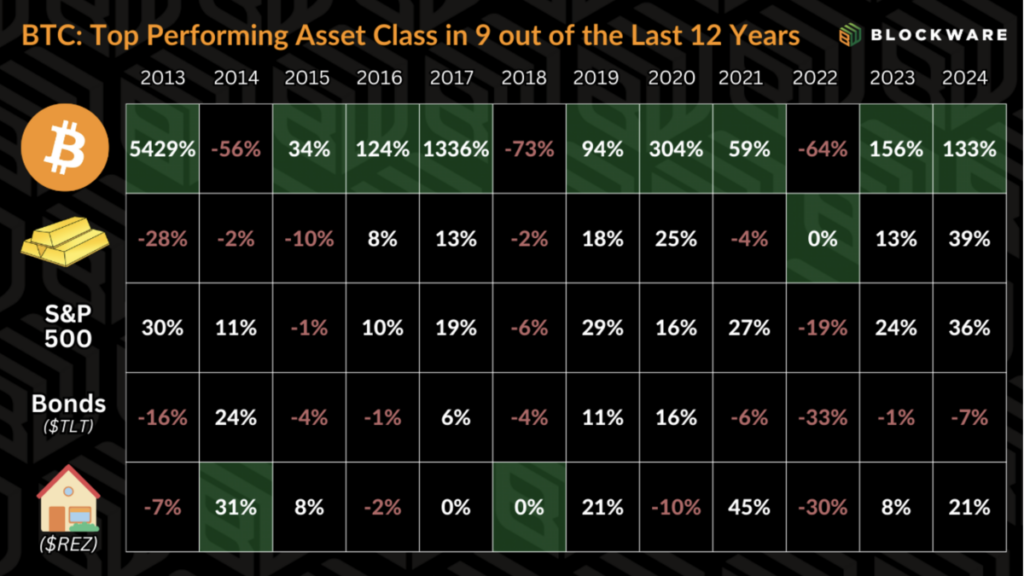

With BTC outperforming every other asset class in 9 of the past 12 years (by orders of magnitude), it’s no surprise that it has usurped treasury bonds as the "risk-free rate" in the minds of many investors – especially those knowledgeable about monetary history and thus the appeal of Bitcoin’s verifiable scarcity.

Shifting Focus: Acquiring Bitcoin over Dollars

Another way to phrase this would be that the financial objective of digital asset investors is to acquire more BTC rather than acquire more dollars. All investments or spending are viewed through the lens of BTC being the opportunity cost.

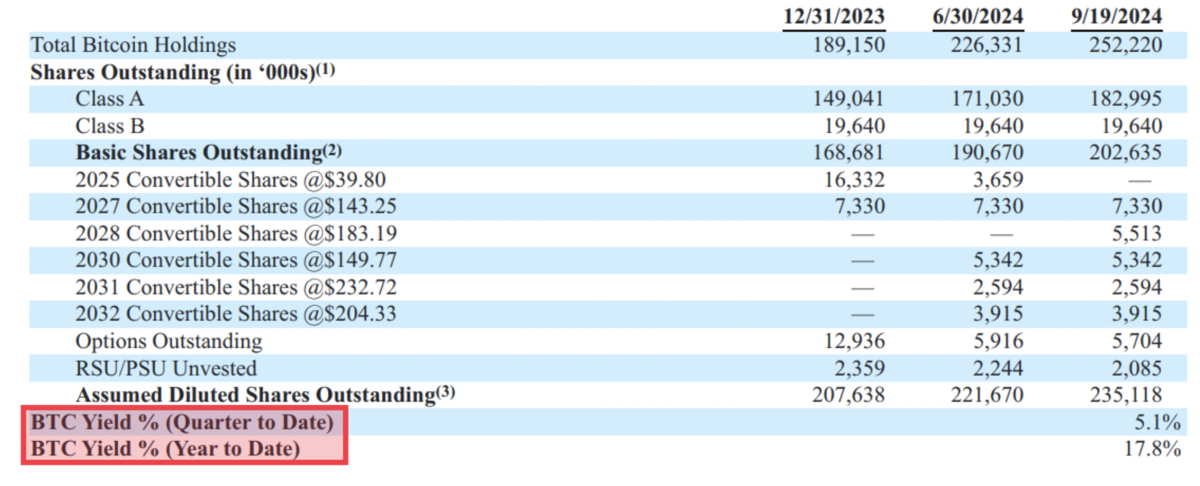

MicroStrategy has demonstrated what this looks like in the corporate world with their new KPI: BTC Yield. To quote from their September 20th, 8-K form: "The Company uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders." MicroStrategy has taken full advantage of the tools available to them as a multi-billion dollar public company: access to low-interest-rate debt and the ability to issue new shares. This KPI shows that they are acquiring more BTC per outstanding share despite the fact that they are engaging in the traditionally dilutive activity of new share issuance.

Mission accomplished: they are acquiring more bitcoin.

Strategies for Bitcoin Accumulation

But MicroStrategy has an advantage that the average fund manager or retail investor does not: they are a publicly traded company with the ability to tap into capital markets at little to no relative cost. Individual holders are unable to issue shares into the public market in order to raise capital and acquire BTC. Nor can we issue convertible notes and borrow dollars at a near-zero % interest rate.

So that begs the question: how can we accumulate more bitcoin? How can we have a positive ‘BTC Yield’?

Utilizing Bitcoin Mining for Accumulation

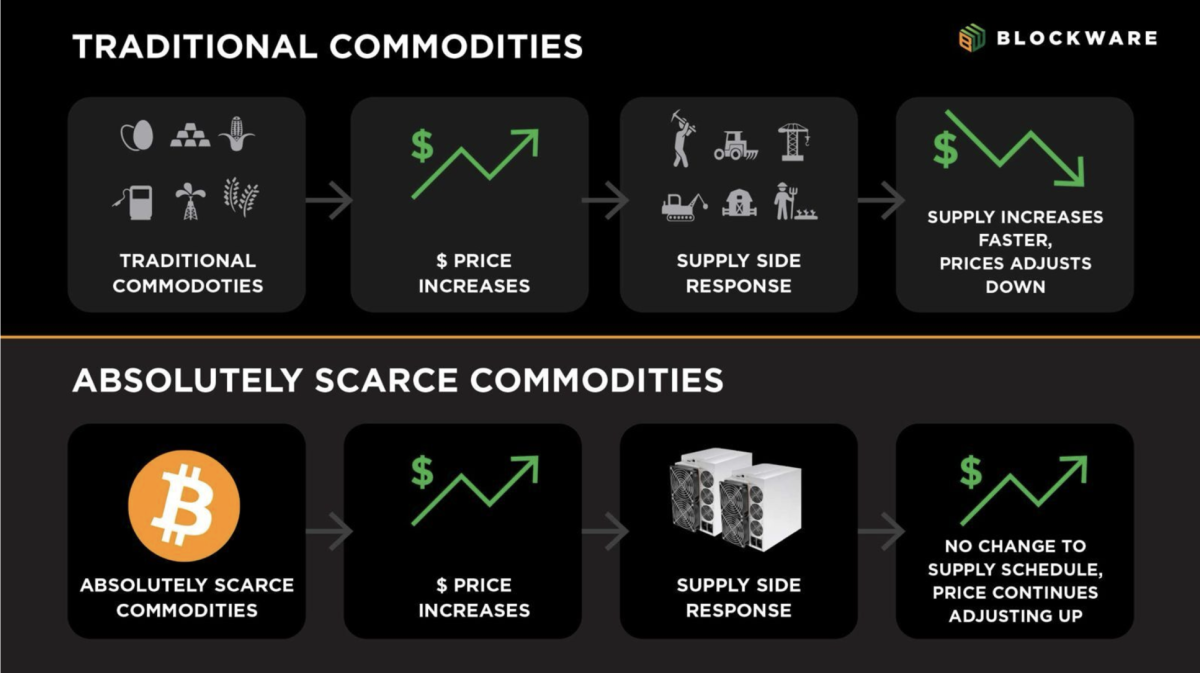

Bitcoin miners acquire BTC by contributing computational power to the Bitcoin network, and receiving a greater amount of BTC than what it costs in electricity to operate their machine(s). Now this is easier said than done. The Bitcoin protocol enforces a predetermined supply schedule using "difficulty adjustments" – meaning that more computational power dedicated towards Bitcoin mining results in the finite block rewards getting split up into smaller pieces.

The most effective Bitcoin miners are those that maximize their computational power while minimizing their operational costs. This is accomplished by acquiring the latest, most-efficient Bitcoin mining hardware, and operating with the lowest possible electricity rate.

Under current market conditions (as of 11/21/2024), 1 bitcoin has a price of ~$98,000. However, an Antminer S21 Pro mining with an electricity rate of $0.078/kWh is able to produce 1 BTC for ~$40,000 in electricity. This is an operating margin of nearly 145%. A business is typically considered to have "healthy profit margins" if they are in the 5-10% range – mining beats this easily. This is in spite of the fact that as of the April 2024 Bitcoin halving, they earn half as much BTC per unit of compute.

Capitalizing on Price Growth and Volatility

The price of a financial asset – specifically bitcoin – is set at the margin. This means that the asset’s price is determined by the most recent transactions between buyers and sellers. In other words, the price reflects what the last buyer is willing to pay and what the last seller is willing to accept.

Consequently, the velocity at which the Bitcoin price can move is much higher than that of network mining difficulty. Substantial growth in network mining difficulty is not achieved by marginal bid/ask spreads, it is achieved by the culmination of ASIC manufacturing, energy production, and mining infrastructure development. There is no shortcutting the time and human capital necessary to increase the total computational power on the Bitcoin network.

This dynamic is what creates opportunities for Bitcoin miners to accumulate vast amounts of bitcoin.

In addition to wider profit margins during bull markets, Bitcoin miners have the simultaneous benefit of the fact that ASIC prices tend to move in tandem with the Bitcoin price. During the 2020 – 2024 cycle, the Antminer S19 (most efficient ASIC at the time) began trading at ~$24/T. By November 2021 – when the BTC price was peaking – they began trading for north of $120/T.

Bitcoin mining hardware retaining resale value is becoming increasingly the case with each new generation of hardware. In the early days of Bitcoin mining, technological advancements were swift and forceful – to the point that new ASICs would make older models obsolete overnight. However, the marginal gains of new ASICs have diminished to the point that older models are able to remain competitive for multiple years after release.

Exploring Blockware Marketplace for Mining Solutions

Blockware developed this platform to enable any investor – institutional or retail – the opportunity to gain direct exposure to Bitcoin mining. Users of the marketplace are able to purchase Bitcoin mining rigs that are hosted at one of Blockware’s tier 1 data centers and have access to industrial power prices. These machines are online already, eliminating lengthy lead times that have historically caused some miners to miss out on those key months in the cycle in which price is outpacing network difficulty.

Moreover, this platform is built by Bitcoiners, for Bitcoiners. Which means that machines are purchased using Bitcoin as the medium of exchange, and mining rewards are never held by Blockware – they are sent directly to the user's own wallet.

Lastly, this provides miners with the aforementioned opportunity, but not obligation, to sell their machines at any time and price. This enables miners to capitalize on volatility in ASIC prices, recoup the cost of their machines, and accumulate more BTC faster than they would with a traditional "pure play" approach.

For institutional investors looking for bulk pricing on mining hardware, contact the Blockware team directly.

Frequently Asked Questions

Which precious metals are best to invest in retirement?

Silver and gold are two of the most valuable precious metals. They are both easy to trade and have been around for years. You should add them to your portfolio if you are looking to diversify.

Gold: Gold is one the oldest forms currency known to man. It is also extremely safe and stable. Because of this, it is considered a great way of preserving wealth during times when there are uncertainties.

Silver: Silver has always been popular among investors. It's a great option for those who want stability. Silver tends to move up, not down, unlike gold.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. Like gold and silver, it's very durable and resistant to corrosion. It is however more expensive than its counterparts.

Rhodium: The catalytic converters use Rhodium. It is also used to make jewelry. It's also relatively inexpensive compared to other precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It's also less expensive. This is why it has become a favourite among investors looking for precious metals.

Is it a good retirement strategy to buy gold?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

The most popular form of investing in gold is through physical bullion bars. You can also invest in gold in other ways. You should research all options thoroughly before making a decision on which option you prefer.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

Can I keep a Gold ETF in a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

A traditional IRA allows contributions from both employee and employer. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

Also available is an Individual Retirement Annuity. With an IRA, you make regular payments to yourself throughout your lifetime and receive income during retirement. Contributions made to IRAs are not taxable.

Should You Invest Gold in Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you're unsure about which option to choose then consider investing in both.

Not only is it a safe investment but gold can also provide potential returns. This makes it a worthwhile choice for retirees.

Most investments have fixed returns, but gold's volatility is what makes it unique. Therefore, its value is subject to change over time.

This doesn't mean that you should not invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another benefit to gold? It's a tangible asset. Gold is much easier to store than bonds and stocks. It can also be transported.

As long as you keep your gold in a secure location, you can always access it. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold rises in the face of a falling stock market.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

Also, don't buy too much at once. Start with just a few drops. Then add more as needed.

It's not about getting rich fast. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

How To

The best place online to buy silver and gold

Understanding how gold works is essential before you buy it. Gold is a precious metallic similar to Platinum. It's very rare, and it is often used as money for its durability and resistance. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They are not exchangeable in any currency exchange system. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Every dollar spent on gold purchases, the buyer receives one gram of gold.

You should also know where to buy your gold. There are many options for buying gold directly from dealers. First, you can visit your local coin store. You can also try going through a reputable website like eBay. You can also look into buying gold online from private sellers.

Private sellers are individuals that offer gold at wholesale or retail prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. That means you would get back less money from a private seller than from a coin shop or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

The other option is to purchase physical gold. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. It is important to keep your physical gold safe in an impenetrable box such as a vault, safety deposit box or other secure container.

A bank or pawnshop can help you buy gold. A bank can give you a loan up to the amount you intend to invest in Gold. These are small businesses that let customers borrow money against the items they bring to them. Banks typically charge higher interest rates than pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold is simple too. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————-

By: Blockware

Title: Maximizing Bitcoin Accumulation for Optimal Returns

Sourced From: bitcoinmagazine.com/guides/maximizing-bitcoin-accumulation-beyond-the-benchmark-

Published Date: Tue, 26 Nov 2024 21:52:20 GMT