Bitcoin mining has experienced tremendous growth since the introduction of ASIC miners in 2013, with hardware efficiency significantly improving. However, as silicon-based semiconductors reach their limits in terms of efficiency gains, the focus is shifting towards optimizing other aspects of mining operations, particularly the power setup.

Understanding Single-Phase and Three-Phase Power

Single-phase power, commonly used in residential settings, consists of two wires and provides power that oscillates sinusoidally. In contrast, three-phase power, prevalent in industrial and commercial environments, offers a more constant and reliable power flow, leading to higher efficiency and reliability.

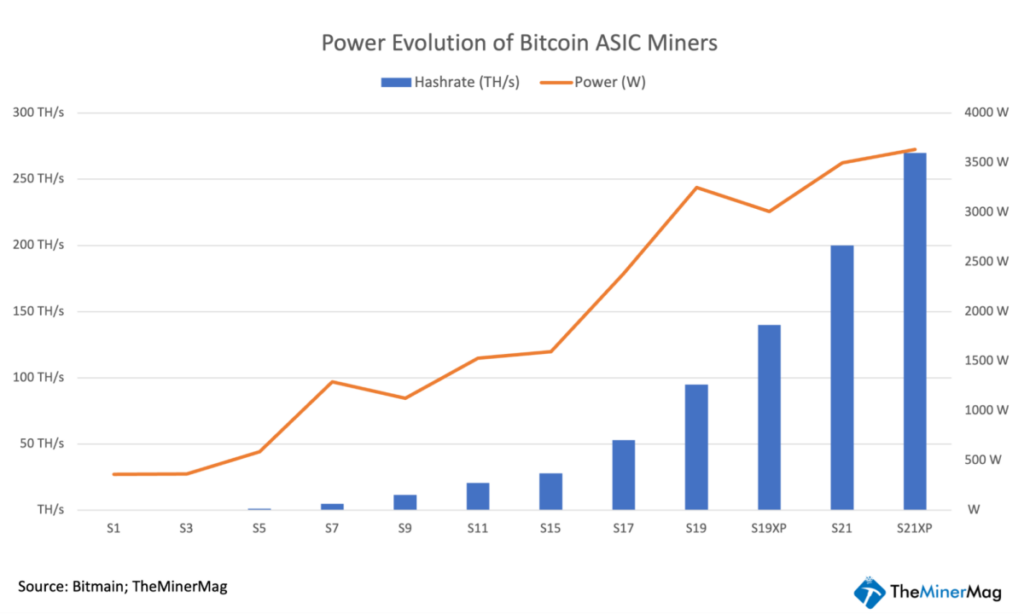

The Evolution of Bitcoin Mining Power Requirements

Over the years, the power requirements for bitcoin mining have significantly changed. The transition from CPUs and GPUs to ASIC miners has led to increased power demands, making the adoption of three-phase power systems a logical step to support the industry's growing energy needs.

480v Three-Phase in Bitcoin Mining

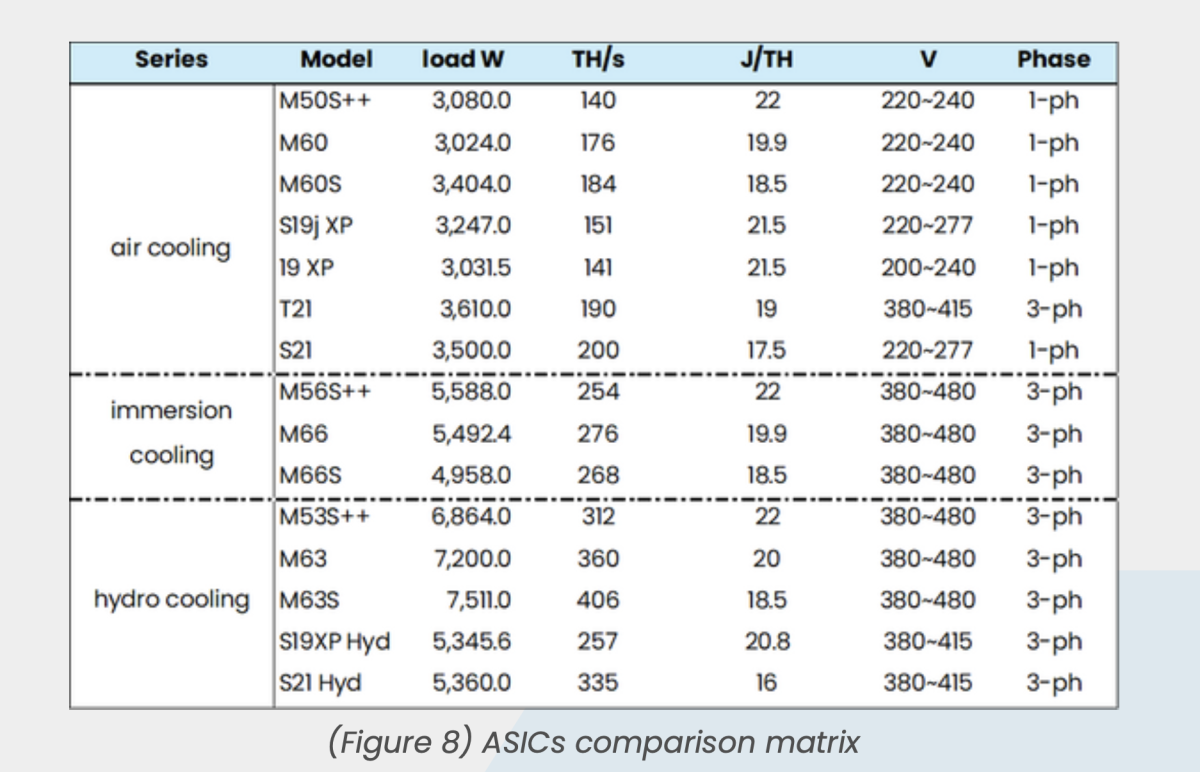

480v three-phase power has become the standard in industrial settings due to its efficiency, cost savings, and scalability. This power system delivers higher power density, reduces energy losses, and offers significant savings in electrical infrastructure costs, making it ideal for high-demand operations like bitcoin mining.

Implementing Three-Phase Power in Bitcoin Mining Operations

Transitioning to a three-phase power system involves assessing power requirements, upgrading electrical infrastructure, configuring ASIC miners, implementing redundancy and backup systems, and conducting monitoring and maintenance. By embracing three-phase power, miners can enhance operational efficiency and ensure sustainable and profitable operations.

In conclusion, the adoption of three-phase power systems can revolutionize bitcoin mining operations by providing numerous advantages such as higher power density, improved efficiency, reduced costs, and scalability. With careful planning and execution, miners can leverage the benefits of three-phase power to stay ahead in the competitive landscape of bitcoin mining.

Written by Christian Lucas, Strategy at Bitdeer. Opinions expressed are solely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

What Precious Metals Can You Invest in for Retirement?

It is gold and silver that are the best precious metal investment. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: The oldest form of currency known to man is gold. It is very stable and secure. It's a great way to protect wealth in times of uncertainty.

Silver: The popularity of silver has always been a concern for investors. It's a great option for those who want stability. Unlike gold, silver tends to go up instead of down.

Platinum: A new form of precious metal, platinum is growing in popularity. It's resistant to corrosion and durable, similar to gold and silver. It's also more expensive than the other two.

Rhodium: Rhodium can be used in catalytic convertors. It is also used as a jewelry material. It is also very affordable in comparison to other types.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also more accessible. This is why it has become a favourite among investors looking for precious metals.

How much should your IRA include precious metals

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. You don’t need to have a lot of money to invest. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You may consider buying physical coins such as bullion bars or rounds. Also, you could buy shares in companies producing precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

No matter what your preference, precious metals will still be of benefit to you. Even though they aren't stocks, they still offer the possibility of long-term growth.

Their prices are more volatile than traditional investments. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

How much money should my Roth IRA be funded?

Roth IRAs can be used to save taxes on your retirement funds. These accounts cannot be withdrawn until you turn 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, you can't touch your principal (the initial amount that was deposited). This means that you can't take out more money than you originally contributed. If you take out more than the initial contribution, you must pay tax.

The second rule is that your earnings cannot be withheld without income tax. So, when you withdraw, you'll pay taxes on those earnings. Let's suppose that you contribute $5,000 annually to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. This would mean that you would have to pay $3,500 in federal income tax. The remaining $6,500 is yours. Since you're limited to taking out only what you initially contributed, that's all you could take out.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types of Roth IRAs: Traditional and Roth. A traditional IRA allows for you to deduct pretax contributions of your taxable income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs won't let you deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal requirement, unlike traditional IRAs. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

Should You Buy Gold?

Gold was a safe investment option for those who were in financial turmoil. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Experts think this could change quickly. They believe gold prices could increase dramatically if there is another global financial crises.

They also point out that gold is becoming popular because of its perceived value and potential return.

Here are some things to consider if you're considering investing in gold.

- First, consider whether or not you need the money you're saving for retirement. You can save money for retirement even if you don't invest in gold. However, you can still save for retirement without putting your savings into gold.

- Second, be sure to understand your obligations before you purchase gold. Each type offers varying levels and levels of security.

- Keep in mind that gold may not be as secure as a bank deposit. You may lose your gold coins and never be able to recover them.

If you are thinking of buying gold, do your research. Make sure to protect any gold you already own.

How much tax is gold subject to in an IRA

The fair value of gold sold to determines the price at which tax is due. If you buy gold, there are no taxes. It's not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

Gold can be used as collateral for loans. Lenders try to maximize the return on loans that you take against your assets. Selling gold is usually the best option. There's no guarantee that the lender will do this. They might just hold onto it. They may decide to resell it. In either case, you risk losing potential profits.

You should not lend against your gold if it is intended to be used as collateral. It is better to leave it alone.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

finance.yahoo.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

From the beginning of history, gold was a popular currency. It was universally accepted due to its purity and divisibility, beauty, scarcity, and durability. Aside from its inherent value, it could be traded internationally. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. For example in England, a pound sterling equals 24 carats. In France, a livre tournois equals 25. Carats of golden. Germany had one mark which equals 28. Carats.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. The result was a decrease in foreign currency demand, which led to an increase in their price. This was when the United States started minting large quantities of gold coins. The result? Gold prices began to fall. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. To do so, they decided to sell some of the excess gold back to Europe.

Because most European countries did not trust the U.S. dollar, they started accepting gold as payment. Many European countries began to use paper money and stopped accepting gold as payment after World War I. The price of gold rose significantly over the years. Even though the price fluctuates, gold is still one of best investments.

—————————————————————————————————————————————————————————————-

By: Christian Lucas

Title: The Power of Three-Phase Systems in Bitcoin Mining Operations

Sourced From: bitcoinmagazine.com/technical/revolutionizing-bitcoin-mining-the-power-of-three-phase-systems

Published Date: Thu, 12 Sep 2024 13:00:00 GMT