As Argentina grapples with staggering inflation rates, its citizens are increasingly turning to Bitcoin as a hedge against economic uncertainty. Let's delve into how this trend is unfolding in the South American nation.

Bitcoin Adoption Surges in Response to Economic Turmoil

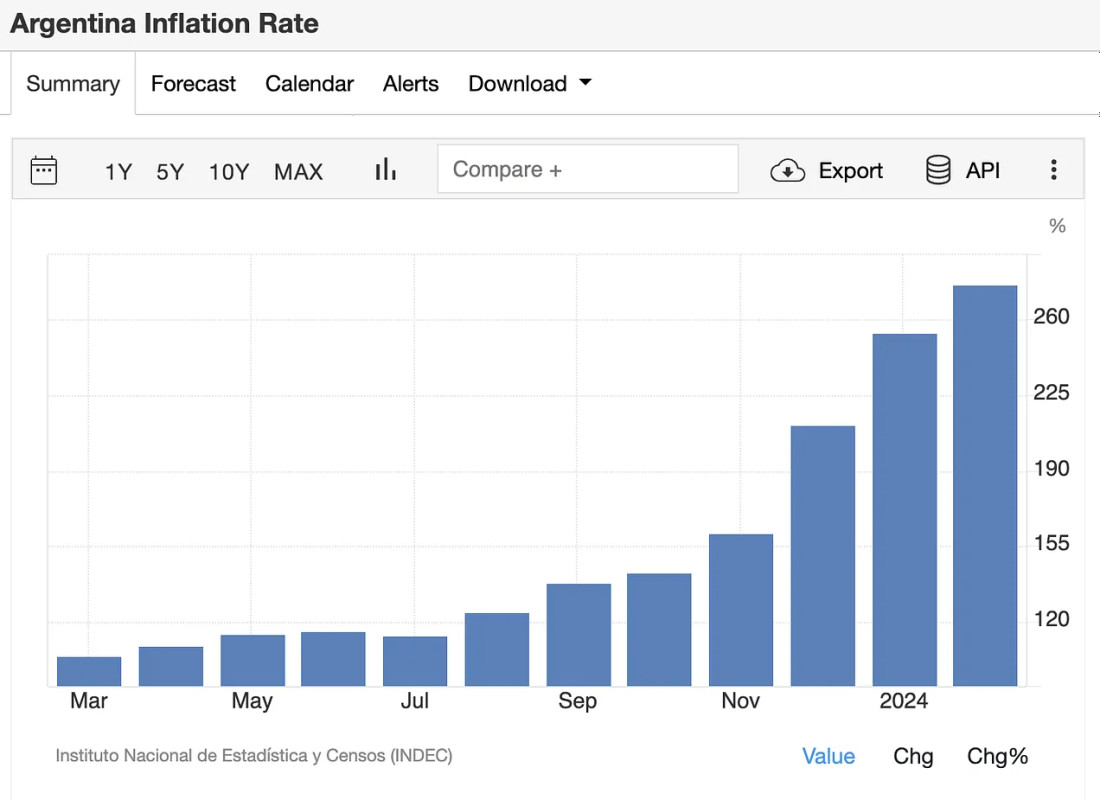

The Argentine economy, known for its persistent inflation hovering around 25% over the years, witnessed a dramatic spike in inflation rates due to the pandemic. In 2022, inflation soared to 70%, followed by a staggering 100% in February the next year. The situation worsened in 2023, with inflation surpassing 200% and currently standing at a staggering 274%. This economic turmoil has eroded the purchasing power of ordinary citizens, prompting them to explore alternative financial avenues.

Rising Popularity of Bitcoin as a Store of Value

In light of the economic crisis, Argentinians are increasingly embracing Bitcoin as a store of value. The decentralized nature of Bitcoin offers a level of security and stability amidst the country's volatile economic landscape. Local exchanges such as Lemon Cash and Belo have reported a significant surge in Bitcoin transactions, surpassing previous records.

President Milei's Impact on Bitcoin Adoption

President Javier Milei's economic policies, aimed at curbing inflation and stabilizing the economy, have inadvertently contributed to the rise of Bitcoin in Argentina. By implementing reforms to reduce government spending and privatize state-owned enterprises, Milei has inadvertently steered citizens towards Bitcoin as a more reliable asset compared to the depreciating dollar.

Regulatory Developments and Market Response

While Bitcoin adoption continues to soar, Argentina has introduced new regulations to govern virtual asset service providers. The Senate passed a law mandating consumer protection and anti-fraud measures, sparking concerns within the Bitcoin community regarding market consolidation. However, efforts are underway to provide tax exemptions for digital asset holders to mitigate potential challenges.

President Milei's Approach Amid Economic Challenges

Despite his initial pro-Bitcoin stance, President Milei has maintained a low profile on Bitcoin-related developments. Focused on implementing economic reforms and austerity measures, Milei aims to stabilize the economy and address rising poverty levels. While his policies have shown some positive impact on curbing inflation, they have also led to social and economic challenges.

The Future of Bitcoin in Argentina

As Argentina navigates through economic uncertainties, the future of Bitcoin in the country remains uncertain. With a growing community of Bitcoin users and businesses, the potential for a thriving Bitcoin ecosystem is evident. Whether Bitcoin continues to gain momentum post-recovery or faces regulatory hurdles remains to be seen, but the innovative spirit of the global Bitcoin community remains resilient.

In conclusion, as Argentina grapples with economic upheavals, Bitcoin has emerged as a beacon of financial solace for its citizens. The evolving landscape of cryptocurrency adoption in the country underscores the transformative potential of digital assets in mitigating economic challenges.

Frequently Asked Questions

What are the benefits of a Gold IRA?

You can save money on retirement by putting your money into an Individual Retirement Account. You can withdraw it at any time, but it is tax-deferred. You are in complete control of how much you take out each fiscal year. There are many types available. Some are better suited for college students. Some are better suited for investors who want higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. But once they start withdrawing funds, those earnings aren't taxed again. This type of account might be a good choice if your goal is to retire early.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. That means you won't have to think about making deposits every month. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold is one of the safest investment choices available today. Because it's not tied to any particular country, its value tends to remain steady. Even during economic turmoil the gold price tends to remain fairly stable. Therefore, gold is often considered a good investment to protect your savings against inflation.

How much of your IRA should include precious metals?

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. It doesn't matter how rich you are to invest in precious metals. There are many ways to make money on silver and gold investments without spending too much.

You may consider buying physical coins such as bullion bars or rounds. Also, you could buy shares in companies producing precious metals. You might also want to use an IRA rollover program offered through your retirement plan provider.

You will still reap the benefits of owning precious metals, regardless of which option you choose. Although they aren’t stocks, they offer the possibility for long-term gains.

And, unlike traditional investments, their prices tend to rise over time. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

How much money should I put into my Roth IRA?

Roth IRAs can be used to save taxes on your retirement funds. These accounts cannot be withdrawn until you turn 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, you cannot touch your principal (the original amount deposited). This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

You cannot withhold your earnings from income taxes. Also, taxes will be due on any earnings you take. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let's say you earn $10,000 each year after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. You would have $6,500 less. The amount you can withdraw is limited to the original contribution.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types: Roth IRAs that are traditional and Roth. Traditional IRAs allow for pre-tax deductions from your taxable earnings. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. You can withdraw as much as you want from a traditional IRA.

Roth IRAs won't let you deduct your contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

How much is gold taxed under a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

These accounts are subject to different rules depending on where you live. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. Massachusetts allows you up to April 1st. New York has a maximum age limit of 70 1/2. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

How is gold taxed within an IRA?

The fair market value of gold sold is the basis for tax. When you purchase gold, you don't have to pay any taxes. It's not considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

Gold can be used as collateral for loans. Lenders look for the highest return when you borrow against assets. This often means selling gold. However, there is no guarantee that the lender would do this. They might just hold onto it. They might decide that they want to resell it. Either way you will lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. It is better to leave it alone.

Do you need to open a Precious Metal IRA

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. If you lose money in your investment, nothing can be done to recover it. This includes any loss of investments from theft, fire, flood or other circumstances.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items can be lost because they have real value and have been around for thousands years. You would probably get more if you sold them today than you paid when they were first created.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. Consider using a third-party custody company to keep your assets safe and allow you to access them at any time.

Remember that you will not see any returns unless you are retired if you open an Account. Remember the future.

What is the benefit of a gold IRA?

There are many advantages to a gold IRA. You can diversify your portfolio with this investment vehicle. You can control how much money is deposited into each account as well as when it's withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This is a great way to make a smooth transition if you want to retire earlier.

The best thing about investing in gold IRAs is that you don’t need any special skills. They're available at most banks and brokerage firms. You don't have to worry about penalties or fees when withdrawing money.

There are, however, some drawbacks. Gold has always been volatile. So it's essential to understand why you're investing in gold. Is it for growth or safety? Is it for security or long-term planning? Only once you know, that will you be able to make an informed decision.

You might want to buy more gold if you intend to keep your gold IRA for a long time. One ounce doesn't suffice to cover all your needs. Depending on the purpose of your gold, you might need more than one ounce.

You don't have to buy a lot of gold if your goal is to sell it. You can even manage with one ounce. These funds won't allow you to purchase anything else.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

cftc.gov

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It's not exactly legal – WSJ

investopedia.com

irs.gov

How To

How to Keep Physical Gold in an IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. But this investment method has many risks as there is no guarantee of survival. Even if they survive, there's always the risk that they will lose money due fluctuations in gold prices.

The alternative is to buy physical gold. You will need to either open an online or bank account or simply buy gold from a reliable seller. This option is convenient because you can access your gold when it's low and doesn't require you to deal with stock brokers. It is also easier to check how much gold you have stored. You will receive a receipt detailing exactly what you paid. You are also less likely to be robbed than investing in stocks.

However, there are disadvantages. You won't be able to benefit from investment funds or interest rates offered by banks. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. Finally, tax man may want to ask where you put your gold.

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————-

By: Landon Manning

Title: Argentinians Embrace Bitcoin Amid Soaring Inflation and Regulatory Changes

Sourced From: bitcoinmagazine.com/markets/argentinians-buy-bitcoin-to-combat-inflation-pass-friendly-legislation

Published Date: Tue, 26 Mar 2024 19:30:00 GMT