Last week, the U.S. Securities and Exchange Commission (SEC) approved the launch of 11 diverse spot bitcoin exchange-traded funds (ETFs). These ETFs generated a significant trading volume of $7.65 billion within their initial two days on the market. While many of these new funds experienced strong inflows, Grayscale's GBTC faced notable outflows. This coincided with the fund's discount to net asset value (NAV) reaching its lowest point since February 2021.

Reduced NAV Discount Prompts GBTC Outflows

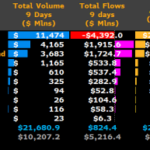

On Saturday, Bloomberg's senior ETF analyst, Eric Balchunas, shared insights on the "nine newborn" spot bitcoin exchange-traded funds. These funds have gathered an impressive $1.4 billion in cash, surpassing the $579 million outflow from the Grayscale Bitcoin Trust (GBTC). As a result, there has been a net investment growth of $819 million. Balchunas also noted that these trades boasted an average premium of 20 basis points.

When asked about the significant withdrawal from GBTC, Balchunas responded:

Lots of traders came in to play the discount closing, so they are leaving to take profits. There are also average investors who may have decided to stomach the tax hit in order to flee the 1.5% fee. I would expect more outflows over time.

Balchunas' observations align with the recent outflows from the Grayscale Bitcoin Trust (GBTC). Onchain analysts have noticed a significant movement of 4,000 BTC worth $175 million exiting GBTC's bitcoin wallet holdings on Friday. This coincides with GBTC's discount to its net asset value (NAV) reaching its lowest point since February 2021. This is a significant shift from its prior premium status before February 23, 2021. Additionally, Grayscale's ETF management fees are the highest among the 11 ETFs approved last week.

It is worth noting that seven of the newly approved funds have management fees below 0.30%, with Bitwise's BITB leading at a minimal 0.20% fee. Ark's ARKB, Fidelity's FBTC, Blackrock's IBIT, Valkyrie's BRRR, and Vaneck's HODL each offer a competitive 0.25% fee. Franklin Templeton's EZBC charges a fee of 0.29%, and Wisdomtree's BTCW charges 0.30%. Invesco's fee is slightly higher at 0.39%. Hashdex's DEFI fund stands out with a 0.94% fee, which is closer to GBTC's substantial 1.5% management fee. These more favorable fees may be a contributing factor in investors shifting away from GBTC.

Furthermore, seven of the 11 newly approved spot bitcoin ETFs in the U.S. are offering a temporary waiver of management fees, allowing early investors to participate without any fees for a limited time. This is a significant change from GBTC, which traded over-the-counter (OTC) and charged a 2% management fee. GBTC reduced its management fee in anticipation of its ETF transition. Despite the competition from these new funds, GBTC still holds a formidable 618,000 BTC, far surpassing the recent inflows to the new ETFs.

What are your thoughts on GBTC's outflows? Share your opinions in the comments section below.

Frequently Asked Questions

Is gold a good investment IRA option?

For anyone who wants to save some money, gold can be a good investment. You can diversify your portfolio with gold. There's more to gold that meets the eye.

It has been used as a currency throughout history and is still a popular method of payment. It is often called “the oldest currency in the world.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. This makes it highly valuable as it is hard and rare to produce.

Gold prices fluctuate based on demand and supply. When the economy is strong, people tend to spend more money, which means fewer people mine gold. The value of gold rises as a consequence.

The flip side is that people tend to save money when the economy slows. This leads to more gold being produced which decreases its value.

This is why it makes sense to invest in gold for individuals and companies. If you invest in gold, you'll benefit whenever the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. You won't lose your money if gold prices drop.

Which precious metal is best to invest in?

This question depends on how risky you are willing to take, and what return you want. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. For example, if you need a quick profit, gold may not be for you. If you have the patience to wait, then you might consider investing in silver.

If you don’t desire to become rich quickly, gold may be your best option. Silver might be a better investment option if steady returns are desired over a long period of time.

Can I own a gold ETF inside a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

An IRA traditional allows both employees and employers to contribute. You can also invest in publicly traded businesses by creating an Employee Stock Ownership Plan (ESOP).

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

A Individual Retirement Annuity (IRA), is also available. With an IRA, you make regular payments to yourself throughout your lifetime and receive income during retirement. Contributions to IRAs do not have to be taxable

Can I have physical gold in my IRA

Gold is money. Not just paper currency. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Many Americans now invest in precious metals. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

One reason is that gold has historically performed better than other assets during periods of financial panic. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. You still have your shares even if your stock portfolio falls. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold is liquid. This allows you to sell your gold whenever you want, unlike many other investments. You can buy gold in small amounts because it is so liquid. This allows you to profit from short-term fluctuations on the gold market.

What's the advantage of a Gold IRA?

There are many benefits to a gold IRA. You can diversify your portfolio with this investment vehicle. You control how much money goes into each account and when it's withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. This makes for an easy transition if you decide to retire early.

The best part? You don’t need to have any special skills to invest into gold IRAs. They are offered by most banks and brokerage companies. Withdrawals can be made instantly without the need to pay fees or penalties.

There are, however, some drawbacks. Gold is historically volatile. It is important to understand why you are investing in gold. Are you looking for growth or safety? Is it for security or long-term planning? Only once you know, that will you be able to make an informed decision.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. One ounce doesn't suffice to cover all your needs. Depending upon what you plan to do, you could need several ounces.

If you're planning to sell off your gold, you don't necessarily need a large amount. You can even live with just one ounce. But, those funds will not allow you to buy anything.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

bbb.org

irs.gov

finance.yahoo.com

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads, Example, and Risk Metrics

How To

The History of Gold as an Asset

From ancient times to the beginning of the 20th century, gold was used as a currency. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. In addition, because of its value, it was traded internationally. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. One pound sterling in England was equivalent to 24 carats silver, while one livre tournois in France was equal 25 carats. In Germany, one mark was equivalent to 28 carats.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This resulted in a decline of foreign currency demand and an increase in the price. In this period, large amounts of gold coin were minted by the United States, which caused the gold price to drop. The U.S. government needed to find a solution to their debt because there was too much money in circulation. To do this, they decided that some of their excess gold would be sold back to Europe.

Since most European countries were not confident in the U.S. dollar they began accepting gold as payment. However, after World War I, many European countries stopped taking gold and began using paper money instead. Since then, the price of gold has increased significantly. Even though the price of gold fluctuates, it remains one the best investments you can make.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: GBTC’s Closing NAV Discount and Steep Fees Trigger Outflows, ETF Analyst Expects ‘More Over Time’

Sourced From: news.bitcoin.com/gbtcs-closing-nav-discount-and-steep-fees-trigger-outflows-etf-analyst-expects-more-over-time/

Published Date: Sat, 13 Jan 2024 14:30:07 +0000