The Impact of BRC-20s and Image Inscriptions on Bitcoin Miners

Bitcoin miners have been facing unusual circumstances in recent months due to the high demand on Bitcoin's blockchain. This demand can be attributed to the use of BRC-20s and image inscriptions, made possible by the Ordinals protocol. This protocol allows users to inscribe unique data on small denominations of bitcoin, creating new "tokens" directly on the blockchain. While this innovation has increased the trading volume of bitcoin, it has also put a strain on miners who need to process these transactions. Additionally, the initial minting process has seen high demand.

The Role of Bitcoin Miners in the Digital Economy

Bitcoin miners play a crucial role in verifying transactions and ensuring the smooth flow of the digital economy. These specialized mining hardware not only generate new bitcoin but also process blockchain transactions. With the current high network usage, miners have ample opportunities to earn revenue from transaction processing alone. The actual production of newly-issued bitcoin has taken a backseat to transaction processing. Despite the increased mining difficulty, miners are still reaping significant profits.

The US Government's Survey on Bitcoin Miners

In January 2024, federal regulators announced a new mandate requiring all miners operating in the United States to share data on their energy usage. The survey conducted by the EIA, a subsidiary of the US Department of Energy, aims to understand the evolving energy demand for cryptocurrency mining and identify areas of high growth. While the goals seem straightforward, the language used and the reference to an "emergency collection of data request" have raised concerns among the Bitcoin community. The survey's focus on examining potential public harm from the mining industry has led to apprehension about future government actions.

The Impending Bitcoin Halving and its Impact on Miners

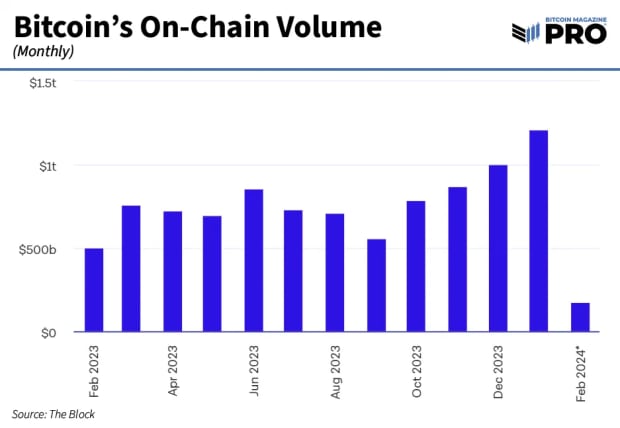

In addition to government pressure, miners are also preparing for the upcoming Bitcoin halving, scheduled to occur in April 2024. The halving is an automatic protocol that cuts mining rewards in half. Some pessimists predict that this event alone could potentially put the entire industry out of business. However, well-capitalized firms have been preparing for the halving and using the increased trading volume to upgrade their equipment. While smaller firms operating on slim margins may struggle, the overall growth in Bitcoin trading volume ensures that revenue opportunities will continue to exist.

The Market Conditions and the Bitcoin Ecosystem

Regardless of government actions, market conditions are likely to shift for miners. While transactions using BRC-20s may decrease, regular bitcoin transactions are on the rise. The trading volume of bitcoin has reached its highest point since late 2022, indicating continued demand for the minting of new bitcoin. The impending halving may present challenges for miners, but it is not an unexpected event. The most well-capitalized firms are better positioned to survive and adapt to the changing market conditions. The closure of less efficient mining companies may be a desired outcome from a regulatory standpoint.

The Resilience of the Mining Industry and Bitcoin's Ability to Change

The mining industry is prepared to fight against any attempts to crackdown on the industry, as evidenced by the open letters from leading firms. While the survey conducted by the EIA raises concerns, it is important to consider that the Bitcoin ecosystem is constantly evolving. The industry has thrived on its ability to adapt to new rules and market conditions. Bitcoin's opponents are unlikely to have a significant impact compared to the resilience and innovation of the Bitcoin community.

In conclusion, Bitcoin miners face various challenges and opportunities in the future. The demand for bitcoin and the evolving market conditions will continue to shape the mining industry. While government actions and the upcoming halving pose potential risks, the well-prepared and efficient mining firms are likely to survive and thrive. The ability of the Bitcoin ecosystem to adapt and innovate will be crucial in determining the mining industry's future success.

Frequently Asked Questions

What Does Gold Do as an Investment Option?

Supply and demand determine the gold price. It is also affected negatively by interest rates.

Due to the limited supply of gold, prices for gold are highly volatile. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Should you Invest In Gold For Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you are unsure which option to choose, consider investing in both options.

In addition to being a safe investment, gold also offers potential returns. Retirees will find it an attractive investment.

While many investments promise fixed returns, gold is subject to fluctuations. Its value fluctuates over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit to gold is its tangible value. Gold is much easier to store than bonds and stocks. It is also easily portable.

You can always access your gold if it is stored in a secure place. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. When the stock market drops, gold usually rises instead.

Gold investment has another advantage: You can sell it anytime. You can easily liquidate your investment, just as with stocks. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start with just a few drops. Continue adding more as necessary.

It's not about getting rich fast. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

Even though gold is not the best investment, it could be an excellent addition to any retirement plan.

Can the government take your gold?

Because you have it, the government can't take it. You earned it through hard work. It belongs entirely to you. But, this rule is not universal. Your gold could be taken away if your crime was fraud against federal government. Your precious metals can also be lost if you owe tax to the IRS. You can keep your gold even if your taxes are not paid.

Should You Purchase Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

This could be changing, according to some experts. They say that gold prices could rise dramatically with another global financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

These are some things you should consider when considering gold investing.

- Before you start saving money for retirement, think about whether you really need it. It is possible to save for retirement while still investing your gold savings. Gold does offer an extra layer of protection for those who reach retirement age.

- Second, ensure you fully understand the risks involved in buying gold. Each offer varying degrees of security and flexibility.

- Don't forget that gold does not offer the same safety level as a bank accounts. If you lose your gold coins, you may never recover them.

You should do your research before buying gold. If you already have gold, make sure you protect it.

How does a Gold IRA account work?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

Physical gold bullion coin can be purchased at any time. To start investing in gold, it doesn't matter if you are retired.

An IRA lets you keep your gold for life. Your gold holdings will not be subject to tax when you are gone.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

First, an individual retirement account will be set up to allow you to open a golden IRA. After you have done this, an IRA custodian will be assigned to you. This company acts like a middleman between the IRS and you.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reporting.

Once your gold IRA is established, you can purchase gold bullion coins. Minimum deposit is $1,000 You'll get a higher rate of interest if you deposit more.

You will pay taxes when you withdraw your gold from your IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

You may not be required to pay taxes if you take out only a small amount. However, there are some exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. You could end up with severe financial consequences.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

finance.yahoo.com

How To

Tips for Investing with Gold

Investing in Gold has become a very popular investment strategy. There are many benefits to investing in gold. There are several ways to invest in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before you purchase any type or gold, here are some things to think about.

- First, check to see if your country permits you to possess gold. If the answer is yes, you can go ahead. Or, you might consider buying gold overseas.

- The second thing you need to do is decide what type of gold coins you want. There are many options for gold coins: yellow, white, and rose.

- The third factor to consider is the price for gold. It is best to begin small and work your ways up. One thing that you should never forget when purchasing gold is to diversify your portfolio. Diversify your investments in stocks, bonds or real estate.

- You should also remember that gold prices can change often. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

By: Landon Manning

Title: The Future of Bitcoin Mining: Challenges and Opportunities

Sourced From: bitcoinmagazine.com/markets/eia-mining-survey-looms-large-over-bitcoin-mining-industry

Published Date: Wed, 07 Feb 2024 16:33:16 GMT