The Historical Significance of Gold

Gold has been highly sought after for centuries, with its allure and value captivating civilizations throughout history. However, the environmental cost of gold mining is often overlooked. With the continuous degradation of the environment and the increasing demand for a store of value, it is crucial to compare the environmental impact of gold mining to alternative options such as Bitcoin.

The Rise of Bitcoin as a Store of Value

In recent years, Bitcoin has emerged as a popular alternative to traditional fiat currencies. Advocates of Bitcoin argue that it offers a commodity-based solution that preserves value and is resistant to debasement. With the upcoming halving of the block subsidy in 2024, Bitcoin's inflation rate is expected to be lower than that of gold, making it an attractive option for investors.

Debunking the Environmental Concerns

One common argument against Bitcoin as a store of value is its perceived negative impact on the environment. However, research suggests that Bitcoin mining can actually enhance renewable energy expansion and incentivize methane emissions reduction. Furthermore, the carbon footprint of Bitcoin mining is significantly lower than that of gold mining.

The Environmental Reality of Gold Mining

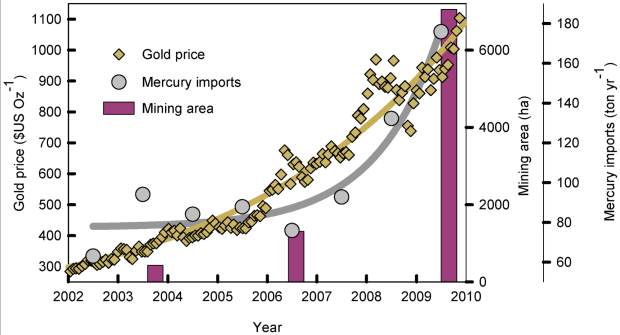

While gold is often considered a pure and clean substance, the reality of gold production tells a different story. Gold mining is one of the most polluting industries in the world, ranking second only to coal mining in terms of land coverage. The use of toxic chemicals, such as cyanide and mercury, in gold mining processes has devastating effects on the environment and the ecosystems it supports.

The Devastating Effects of Gold Mining

Gold mining sites cover more land than the next three metal sites combined, resulting in significant deforestation and habitat destruction. The contaminated water from gold mining, known as acid mine drainage, poses a serious threat to aquatic life and enters the food chain. Additionally, the production and transport of cyanide, a toxic material used in gold mining, contribute to environmental pollution and potential human harm.

The Global Impact of Gold Mining

The environmental impact of gold mining extends far beyond local areas. Tailings dam failures and the use of mercury in gold mining have caused widespread ecological damage and human health issues. Artisanal and small-scale gold mining in the global South is responsible for a significant portion of global mercury emissions, leading to mercury poisoning and its associated neurological problems.

The Shift to Developing Countries

In response to stricter environmental and labor regulations in Western countries, mining companies have increasingly moved their operations to developing countries. This shift exacerbates environmental destruction in these regions and highlights the need for alternative options that do not rely on destructive mining practices.

Bitcoin as an Environmentally Friendly Alternative

Bitcoin offers a promising alternative to gold as a store of value. Unlike gold mining, Bitcoin mining can be powered by non-rival energy sources, promoting renewable expansion. By shifting towards digital commodities like Bitcoin, we can reduce the environmental impact associated with traditional gold mining and promote sustainable practices.

Conclusion

It is essential to consider the environmental impact of our choices, especially when it comes to storing value. The environmental cost of gold mining is significant and widespread, causing ecological harm across the world. As we navigate today's digital landscape, it is crucial to embrace innovative solutions like Bitcoin that prioritize sustainability and minimize environmental degradation.

This is a guest post by Weezel. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

Can the government take your gold?

You own your gold and therefore the government cannot seize it. You earned it through hard work. It belongs to you. However, there may be some exceptions to this rule. You could lose your gold if convicted of fraud against a federal government agency. Also, if you owe taxes to the IRS, you can lose your precious metals. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

How much money should I put into my Roth IRA?

Roth IRAs allow you to deposit your money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, your principal (the original deposit amount) cannot be touched. No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule says that you cannot withdraw your earnings without paying income tax. Also, taxes will be due on any earnings you take. Let's assume that you contribute $5,000 each year to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 The remaining $6,500 is yours. The amount you can withdraw is limited to the original contribution.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. In addition, 50% of your earnings will be subject to tax again (half of 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

There are two types if Roth IRAs: Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. You can withdraw as much as you want from a traditional IRA.

Roth IRAs are not allowed to allow you deductions for contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal limit, unlike traditional IRAs. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

What is the benefit of a gold IRA?

There are many advantages to a gold IRA. It's an investment vehicle that lets you diversify your portfolio. You can control how much money is deposited into each account as well as when it's withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This makes for an easy transition if you decide to retire early.

The best part? You don’t need to have any special skills to invest into gold IRAs. They're readily available at almost all banks and brokerage firms. Withdrawals can happen automatically, without any fees or penalties.

There are also drawbacks. Gold has always been volatile. Understanding why you want to invest in gold is essential. Are you looking for growth or safety? Are you looking for growth or insurance? Only by knowing the answer, you will be able to make an informed choice.

You might want to buy more gold if you intend to keep your gold IRA for a long time. A single ounce will not be sufficient to meet all your requirements. You may need several ounces, depending on what you intend to do with your precious gold.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even get by with less than one ounce. You won't be capable of buying anything else with these funds.

How is gold taxed in Roth IRA?

The tax on an investment account is based on its current value, not what you originally paid. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

Each state has its own rules regarding these accounts. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. Massachusetts allows you up to April 1st. New York has a maximum age limit of 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

What Does Gold Do as an Investment Option?

The supply and the demand for gold determine how much gold is worth. Interest rates can also affect the gold price.

Due to the limited supply of gold, prices for gold are highly volatile. There is also a risk in owning gold, as you must store it somewhere.

Should you Invest In Gold For Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you're unsure about which option to choose then consider investing in both.

Not only is it a safe investment but gold can also provide potential returns. It is a good choice for retirees.

While most investments offer fixed rates of return, gold tends to fluctuate. Therefore, its value is subject to change over time.

This does not mean you shouldn’t invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is less difficult to store than stocks or bonds. It's also portable.

You can always access your gold as long as it is kept safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold rises in the face of a falling stock market.

You can also sell gold anytime you like by investing in it. Just like stocks, you can liquidate your position whenever you need cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't place all your eggs in the same basket.

Don't purchase too much at once. Start with a few ounces. Then add more as needed.

Keep in mind that the goal is not to quickly become wealthy. It is to create enough wealth that you no longer have to depend on Social Security.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

Is it possible to hold a gold ETF within a Roth IRA

A 401(k) plan may not offer this option, but you should consider other options, such as an Individual Retirement Account (IRA).

An IRA traditional allows both employees and employers to contribute. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

An Individual Retirement Annuity (IRA) is also available. An IRA allows for you to make regular income payments during your life. Contributions to IRAs don't have to be taxable

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

investopedia.com

irs.gov

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- How do you keep your IRA Gold at Home? It's not exactly legal – WSJ

How To

How to Keep Physical Gold in an IRA

The best way to invest in Gold is by purchasing shares of companies that produce it. But, this approach comes with risks. These companies may not survive the next few years. Even if they do survive, there is still the possibility of losing money to fluctuating gold prices.

Alternative options include buying physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option is convenient because you can access your gold when it's low and doesn't require you to deal with stock brokers. It is also easier to check how much gold you have stored. You will receive a receipt detailing exactly what you paid. You are also less likely to be robbed than investing in stocks.

There are however some disadvantages. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. It won't allow you to diversify any of your holdings. Instead, you'll be stuck with what's been bought. Finally, the taxman may ask you about where you have put your gold.

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————-

By: Weezel

Title: The Environmental Impact of Gold Mining: A Comparison to Bitcoin

Sourced From: bitcoinmagazine.com/markets/the-environmental-cost-of-gold-mining

Published Date: Wed, 17 Jan 2024 12:30:00 GMT