The recent conflicts in Ukraine and Israel have led to a sharp surge in the stock prices of publicly-listed defense companies. Amid this, it seems U.S. government officials are not just supporting significant war expenses but are also reportedly benefiting financially from investments in defense companies like Palantir, L3Harris, Lockheed Martin, and Northrop Grumman.

The Rising Stocks of Defense Giants Amid Ongoing Global Disputes

From February 24, 2022, the U.S. administration under President Biden has shown unwavering support for Ukraine in its face-off with Russia, allocating around $75 billion for aiding Ukraine's military efforts. The tension between Hamas and Israel further complicates the situation, with several U.S. politicians pushing for military intervention. As a consequence, the stock prices of defense companies have skyrocketed, outperforming most equities on Wall Street. For instance, in the last 30 days alone, Lockheed Martin's (NYSE: LMT) stock has jumped by 3.8%.

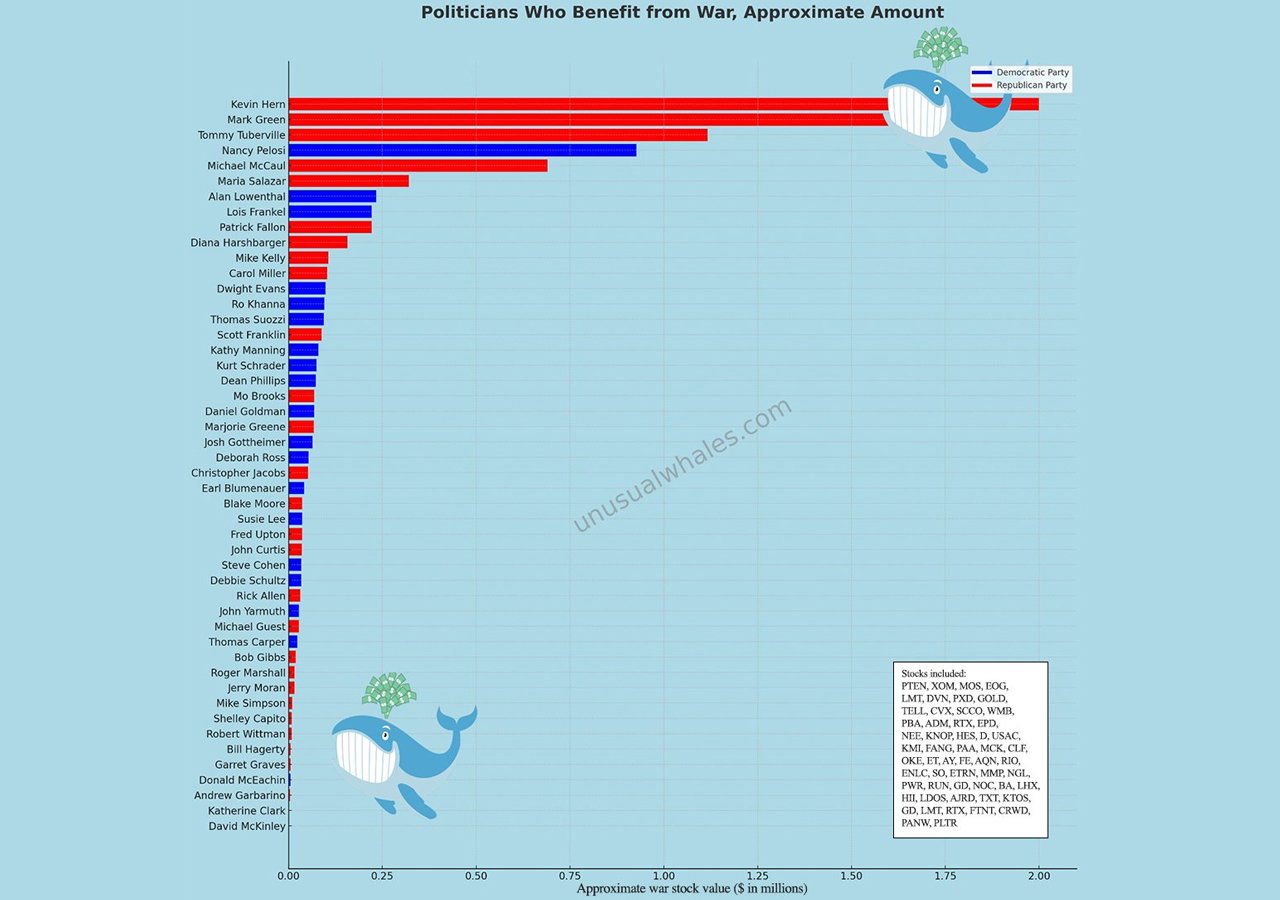

Other defense companies have also seen a significant rise in their stock prices. Northrop Grumman (NYSE: NOC) has seen a rise of over 13%, Palantir (NYSE: PLTR) stock has spiked by 10%, and L3Harris (NYSE: LHX) has expanded by 4.4% against the U.S. dollar in the past month. An account named "Unusual Whales" on the social media platform X (previously known as Twitter) has been highlighting the investments of U.S. officials in defense companies amidst these conflicts.

Investments of U.S. Officials in Defense Stocks: A Closer Look

As per the X account, "Just in, another U.S. Congressman has ONCE AGAIN bought war stocks before the Israel and Palestine conflict,". The account also mentions that Representative Josh Gottheimer bought up to $15,000 of Northrop Grumman Corp, NOC, on Sept. 26, 2023. He is a member of the National Security Agency and Intelligence Committees. The account has also named a long list of politicians from both Democratic and Republican parties who have invested millions in defense corporation stocks.

The investments of Gottheimer and other policymakers in defense stocks can be tracked on quiverquant.com. This site also reveals other high-ranking investors in Wall Street, particularly those investing in defense corporation shares. Other NOC investors include Democratic Congressman Daniel Goldman and Democratic Congresswoman Kathie Manning. Republican Congressman Kevin Hern holds Lockheed Martin shares and also bought shares of RTX (Raytheon) on September 7, 2023. Senate Republican Markwayne Mullin also invested between $15K to $50K in RTX a week later.

The Ethical Dilemma of Policymakers' Investments in Defense Stocks

The conflicts of Ukraine-Russia and Israel-Hamas have seen a significant number of U.S. politicians profiting from their investments in defense corporations. The issue with such investments is that defense corporations often devote considerable resources for lobbying. They engage in lobbying activities to influence Congress and other U.S. government sectors. Their lobbying ambitions vary from securing defense contracts, influencing defense policy, to ensuring continuous high military spending.

Many perceive a glaring conflict of interest in U.S. politicians investing in defense stocks while supporting several wars. Anti-war activists argue that this presents a moral dilemma. They find it disturbing that the very individuals charged with the nation's welfare are profiting from the escalation of war and violence. This entanglement of war politics and personal gain undermines the ethical foundation of governance, casting a grim light on the integrity of political decision-making.

What are your thoughts on U.S. politicians profiting from war stocks? Share your perspective on this subject below.

Frequently Asked Questions

How does a gold IRA account work?

Individuals who want to invest with precious metals may use the Gold Ira accounts, which are tax-free.

You can purchase physical bullion gold coins at any point in time. You don't have to wait until retirement to start investing in gold.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold holdings won't be subject to taxes when you pass away.

Your heirs can inherit your gold and avoid capital gains taxes. Your gold is not part of your estate and you don't have to include it in the final estate report.

To open a IRA for gold, you must first create an individual retirement plan (IRA). Once you've done so, you'll be given an IRA custodian. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. The minimum deposit required to purchase gold bullion coins is $1,000 However, you'll receive a higher interest rate if you put in more.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

A small percentage may mean that you don't have to pay taxes. However, there are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

It's best not to take out more 50% of your total IRA investments each year. If you do, you could face severe financial consequences.

How can you withdraw from an IRA of Precious Metals?

First, decide if it is possible to withdraw funds from an IRA. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. This option will require you to pay taxes on the amount that you withdraw.

Next, figure out how much money will be taken out of your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. To encourage customers to open accounts, brokers often offer signup bonuses and promotions. However, a debit card is better than a card. This will save you unnecessary fees.

When it's time to make withdrawals from your precious-metal IRA, you'll need a place to keep your coins safe. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Before you choose one, weigh the pros and cons.

Bullion bars require less space, as they don't contain individual coins. You will need to count each coin individually. You can track their value by keeping individual coins.

Some people prefer to keep their coins in a vault. Some prefer to keep them in a vault. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

What are the pros and cons of a gold IRA?

An Individual Retirement account (IRA) is a better option than regular savings accounts in that interest earned is exempted from tax. An IRA is a good choice for those who want a way to save some money but don’t want the tax. There are some disadvantages to this investment.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. A penalty fee will be charged if you decide to withdraw funds.

You will also need to pay fees for managing your IRA. Many banks charge between 0.5%-2.0% per year. Other providers may charge monthly management fees, ranging between $10 and $50.

If you prefer your money to be kept out of a bank, then you will need insurance. Most insurers require you to own a minimum amount of gold before making a claim. Insurance that covers losses upto $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers restrict the amount you can own in gold. Others allow you to pick your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Futures contracts for gold are less expensive than physical gold. Futures contracts offer flexibility for buying gold. They enable you to establish a contract with an expiration date.

It is also important to choose the type of insurance coverage that you need. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. It does include coverage for damage due to natural disasters. You may consider adding additional coverage if you live in an area at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Insurance doesn't cover storage costs. Safekeeping costs can be as high as $25-40 per month at most banks.

To open a IRA in gold, you will need to first speak with a qualified custodian. Custodians keep track of your investments and ensure compliance with federal regulations. Custodians cannot sell your assets. Instead, they must maintain them for as long a time as you request.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. It is also important to specify how much money you will invest each month.

After completing the forms, send them along with a check or a small deposit to your chosen provider. The company will review your application and send you a confirmation letter.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

How much do gold IRA fees cost?

The Individual Retirement Account (IRA), fee is $6 per monthly. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

Diversifying your portfolio may require you to pay additional fees. These fees can vary depending on which type of IRA account you choose. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

A majority of providers also charge annual administration fees. These fees vary from 0% to 11%. The average rate is.25% each year. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Can I buy Gold with my Self-Directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts can be described as financial instruments that are determined by the gold price. You can speculate on future prices, but not own the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

irs.gov

finance.yahoo.com

bbb.org

How To

Investing In Gold vs. Investing In Stocks

Gold investing as an investment vehicle can seem extremely risky these days. This is because most people believe that it is no longer economically profitable to invest gold. This belief arises because most people believe that the global economy is driving down gold prices. They feel that gold investment would cause them to lose money. In reality, however, there are still significant benefits that you can get when investing in gold. Below we'll look at some of them.

The oldest form of currency known to mankind is gold. There are thousands of records that show gold was used over the years. It was used by many people around the globe as a currency store. It continues to be used in South Africa, as a way of paying their citizens.

It is important to determine the price per Gram that you will pay for gold when making a decision about whether or not to invest. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

It is also worth noting that although gold prices have declined recently, the cost of producing gold has increased. Although gold's price has fallen, its production costs have not.

When deciding whether to buy gold, another thing to consider is how much gold you intend on buying. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. But, if your goal is to make long-term investments in gold, this might be worth considering. You can profit if you sell your gold at a higher price than you bought it.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. It is important to research all options before you make any decision. Only then can informed decisions be made.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: U.S. Politicians' Stake in Defense Stocks Amid Global Strife: An Ethical Dilemma

Sourced From: news.bitcoin.com/congressional-investments-in-defense-stocks-raise-ethical-eyebrows-amidst-ongoing-wars/

Published Date: Tue, 17 Oct 2023 16:30:46 +0000