Bitcoin's four-year cycle is well-documented and widely acknowledged, but have you considered the possibility of a more extended cycle at play? Could this prolonged cycle mirror the adoption patterns of innovative technologies, similar to the internet? This article proposes a new theory: Bitcoin is moving through a unique 16-year cycle that could potentially forecast future Bitcoin price trends.

Unpacking the Standard 4-Year Cycle

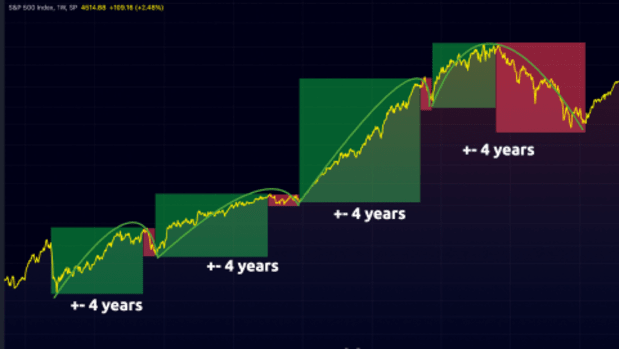

Bitcoin's characteristic four-year cycles typically comprise two distinct phases: an uptrend and a downtrend. Each cycle generally involves a three-year uptrend, followed by a one-year downtrend, commonly referred to as a bear market. The consistency and accuracy of these four-year cycles have captured the attention of market participants.

The DOTCOM Cycle: A Mirror to Bitcoin?

The similarities between the market structure of the S&P500 during the DOTCOM cycle and the Bitcoin cycle are noteworthy. Traditional financial markets also experience clear four-year cycles, predominantly characterized by an uptrend and a brief bear market.

Observing the DOTCOM cycle, initiated around 1986 with Microsoft's public debut, reveals striking resemblances to Bitcoin's first three 4-year cycles. Both periods signify the adoption of revolutionary technologies that fundamentally changed how society accesses and utilizes information.

The question then arises: Can the DOTCOM cycle's structure help predict Bitcoin's future path? While market cycles provide valuable rough price predictions, it's essential to underscore their speculative nature. The saying "history doesn’t repeat itself, but it often rhymes" rings true here. Although we cannot expect a perfect replication of past events, they can offer a rough estimate of potential outcomes.

Charting a Possible Path for Bitcoin

Examining the DOTCOM cycle structure, we notice a pattern of three similar four-year cycles, each featuring a long bull market followed by a brief bear market. The last cycle, however, flips this trend, starting with a price acceleration, followed by a multi-year bear market. Could Bitcoin follow a similar trajectory, shattering the expectation of a regular four-year cycle with a prolonged bear market?

The Microsoft Trajectory: A Potential Blueprint for Bitcoin?

Microsoft's price journey may offer some insights. After three right-translated four-year cycles, Microsoft entered a prolonged bear market, despite enjoying a robust bull market for years. It wasn't until 15 years after the 2000 peak, that the price level was surpassed. Could Bitcoin experience a similar price journey?

Connecting the Dots Between Cycles

Analyzing these cycles suggests potential forecasts for Bitcoin and how to prepare for these scenarios. A typical four-year cycle predicts an uptrend until 2025, followed by a one-year decline, which aligns with Bitcoin's history.

Conversely, the 16-year cycle suggests that Bitcoin could follow the DOTCOM bubble trajectory, peaking by late 2024, and entering a multi-year decline until 2026.

Identifying a Cycle's Peak

Bitcoin funding rates can serve as a valuable indicator for traders, showing whether market participants are mainly shorting or longing for Bitcoin. This metric can help identify market conditions and potential changes. Another method to identify a cycle's peak is timing. Breaking below a swing-low during a potential cycle's topping period could indicate a cycle top.

Additional Factors Influencing Bitcoin's Price

Besides these cycles, other factors can impact Bitcoin's price. For instance, the Federal Reserve's decision to print vast sums of money in 2020 led many investors to seek refuge in financial markets and Bitcoin. However, when the money printing ceased in 2022, Bitcoin entered a one-year decline. These substantial economic shifts are likely to influence Bitcoin's price and cycle patterns.

Frequently Asked Questions

How much should you have of gold in your portfolio

The amount of capital that you require will determine how much money you can make. If you want to start small, then $5k-$10k would be great. As you grow, it is possible to rent desks or office space. So you don't have all the hassle of paying rent. Only one month's rent is required.

It's also important to determine what type business you'll run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. You should also consider the expected income from each client when you do this type of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. You may get paid just once every 6 months.

You need to determine what kind or income you want before you decide how much of it you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

How much is gold taxed under a Roth IRA

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

The rules that govern these accounts differ from one state to the next. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you up to April 1st. New York allows you to wait until age 70 1/2. To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

How can I withdraw from a Precious metal IRA?

First decide if your IRA account allows you to withdraw funds. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, you need to determine how much money is going to be taken out from your IRA. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs allow you to withdraw funds tax-free when you turn 59 1/2 while Roth IRAs charge income taxes upfront but let you access those earnings later without paying additional taxes.

Once you have completed these calculations, you need to open your brokerage account. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. Avoid unnecessary fees by opening an account with your debit card, rather than your credit card.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Before you choose one, weigh the pros and cons.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. But you will have to count each coin separately. However, individual coins can be stored to make it easy to track their value.

Some people prefer to keep coins safe in a vault. Others prefer to store their coins in a vault. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

cftc.gov

bbb.org

How To

The best place to buy silver or gold online

First, understand the basics of gold. Gold is a precious metal similar to platinum. It's very rare, and it is often used as money for its durability and resistance. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

Two types of gold coins are available today: the legal tender type and the bullion type. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They cannot be used in currency exchanges. A person can buy 100 grams of gold for $100. Each dollar spent by the buyer is worth 1 gram.

Next, you need to find out where to buy gold. If you want to purchase gold directly from a dealer, then a few options are available. First off, you can go through your local coin shop. You could also look into eBay or other reputable websites. You might also consider buying gold from an online private seller.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. Private sellers typically charge 10% to 15% commission on each transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This option can be a good choice for investing in gold because it allows you to control the price.

Another option for buying gold is to invest in physical gold. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. It is important to keep your physical gold safe in an impenetrable box such as a vault, safety deposit box or other secure container.

You can either visit a bank, pawnshop or bank to buy gold. A bank can offer you a loan for the amount that you need to buy gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks often charge higher interest rates then pawnshops.

A third way to buy gold? Simply ask someone else! Selling gold is simple too. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————-

By: Jeroen van Lange

Title: The 16-Year Bitcoin Cycle: A Comparative Study with the Internet Bubble

Sourced From: bitcoinmagazine.com/markets/the-bitcoin-16-year-cycle-and-its-correlation-to-the-internet-bubble

Published Date: Tue, 10 Oct 2023 14:08:41 GMT