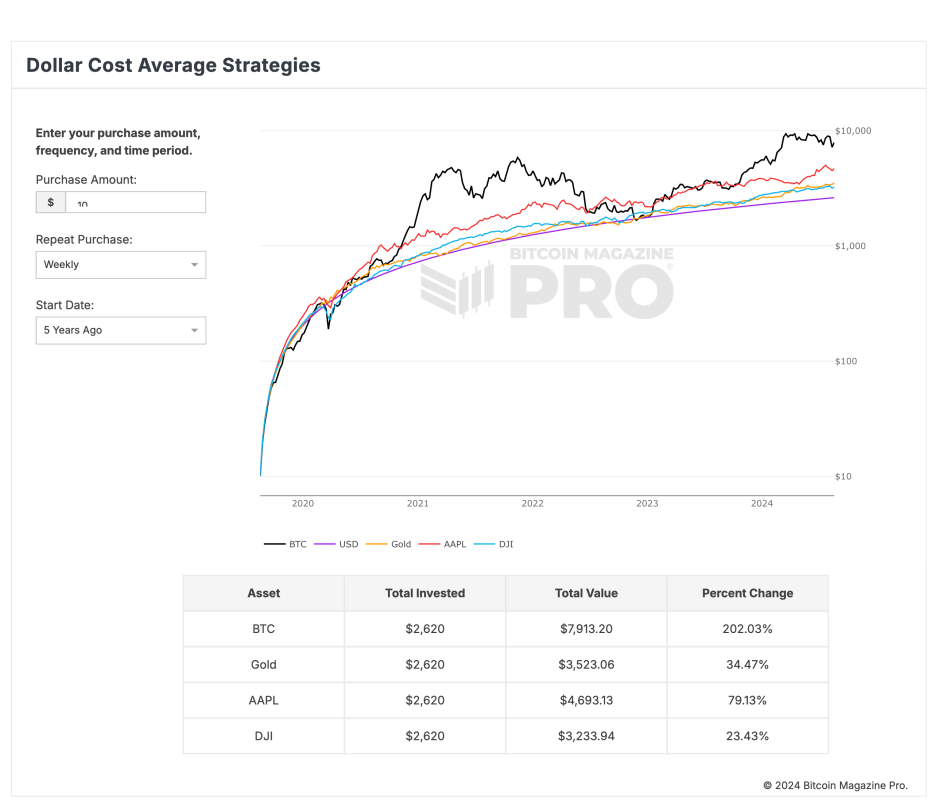

A recent analysis conducted by Bitcoin Magazine Pro highlights the effectiveness of dollar-cost averaging (DCA) when investing in Bitcoin compared to traditional assets such as gold, Apple stock, and the Dow Jones Industrial Average (DJI). The data demonstrates that consistently investing $10 weekly into Bitcoin over the past five years would have turned a total investment of $2,620 into $7,913.20, resulting in an impressive 202.03% return.

Comparative Returns of Different Assets

When comparing the returns of the same $10 weekly investment in different assets, the results are striking. Investing in gold yielded a return of 34.47%, growing the initial $2,620 to $3,523.06. Apple stock performed well with a 79.13% return, turning the $2,620 investment into $4,693.13. On the other hand, the Dow Jones showed the lowest return, with a 23.43% increase, growing the investment to $3,233.94.

Bitcoin as a Superior Long-Term Investment

This data emphasizes Bitcoin's potential to be a top-performing asset for investors to include in their long-term investment strategies. The concept of dollar-cost averaging, which involves investing a fixed amount regularly regardless of price fluctuations, has proven to be particularly effective with Bitcoin. This approach allows investors to steadily accumulate wealth over time.

Benefits of Dollar Cost Averaging (DCA) into Bitcoin

Saving $10 a week into Bitcoin through DCA provides an affordable and accessible entry point for individuals looking to invest in Bitcoin. This strategy is especially attractive for beginners who may be hesitant to invest large sums upfront or are still familiarizing themselves with the volatile nature of the Bitcoin market. By investing a consistent amount regularly, investors can incrementally increase their Bitcoin holdings, mitigating the impact of market volatility and fostering a long-term investment mindset.

Utilizing the Dollar Cost Average Strategies Tool

The Dollar Cost Average Strategies tool offered by Bitcoin Magazine Pro enables users to explore different investment strategies to optimize their Bitcoin investments over various timeframes. By comparing Bitcoin's performance with other assets like the US dollar, gold, Apple stock, and the Dow Jones, the tool illustrates Bitcoin's potential as a superior store of value within a diversified investment portfolio.

For in-depth insights, detailed information, and access to Bitcoin Magazine Pro's data and analytics, interested individuals can visit the official website for more information.

Frequently Asked Questions

What proportion of your portfolio should you have in precious metals

First, let's define precious metals to answer the question. Precious metals refer to elements with a very high value relative other commodities. This makes them highly valuable for both investment and trading. Gold is currently the most widely traded precious metal.

But, there are other types of precious metals available, including platinum and silver. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

The general trend is for precious metals to increase in price with the overall market. That said, they do not always move in lockstep with each other. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. Investors expect lower interest rates which makes bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors choose safe assets such Treasury Bonds over precious metals. They are more rare, so they become more expensive and less valuable.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. You should also diversify because precious metal prices can fluctuate and it is better to invest in multiple types of precious metals than in one.

Is the government allowed to take your gold

The government cannot take your gold because you own it. It is yours because you worked hard for it. It belongs to you. However, there may be some exceptions to this rule. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. Also, if you owe taxes to the IRS, you can lose your precious metals. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

How is gold taxed in Roth IRA?

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

These rules vary from one state to another. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you to delay withdrawals until April 1. New York is open until 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

irs.gov

bbb.org

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads and Example. Risk Metrics

How To

Tips for Investing In Gold

Investing in Gold is one of the most popular investment strategies worldwide. This is because there are many benefits if you choose to invest in gold. There are several ways to invest in gold. Some people prefer to buy gold coins in physical form, while others prefer to invest in gold ETFs.

Before you buy any type of gold, there are some things that you should think about.

- First, verify that your country permits gold ownership. If so, then you can proceed. You can also look at buying gold abroad.

- The second thing you need to do is decide what type of gold coins you want. You have the option of choosing yellow, white, or rose gold.

- Thirdly, it is important to take into account the gold price. It is better to start small, and then work your way up. You should diversify your portfolio when buying gold. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- Lastly, you should never forget that gold prices change frequently. Keep an eye on current trends.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: $10 Weekly Bitcoin DCA Strategy Outperforms Traditional Assets by 202% in 5 Years

Sourced From: bitcoinmagazine.com/markets/10-weekly-bitcoin-dca-yields-202-return-outshines-traditional-assets-over-5-years

Published Date: Wed, 14 Aug 2024 20:00:00 GMT