Inflation Rates Exceeding 100% in Four Countries

Drawing upon the latest statistics, ten nations are grappling with inflation rates surpassing 40% as of October 2023, while four countries are enduring inflation rates in excess of 100%. A look into the data curated by the International Monetary Fund’s World Economic Outlook reveals that the Venezuelan bolivar is weathering significant inflation at a rate of 360%, closely followed by the Zimbabwean dollar at a rate of 314.5%.

Venezuela: The World's Highest Inflation Rate at 360%

As of October 2023, data from the International Monetary Fund highlights that Venezuela is experiencing the world’s highest inflation rate at 360%. Situated at the northern tip of South America, the country has long been at the top of global inflation charts, with the Venezuelan bolivar persistently struggling against diminishing purchasing power.

Zimbabwe's Dollar: Grappling With Triple-Digit Inflation

Zimbabwe’s dollar is also grappling with triple-digit inflation, registering at 314.5%, as per the IMF’s data. This landlocked nation in Southern Africa has been wrestling with escalating inflation for a considerable period.

Sudan: Enduring an Inflation Rate of Approximately 256.2%

In Sudan, nestled in Northeast Africa, the Sudanese pound is enduring an inflation rate of approximately 256.2%. For an extended duration, the country’s currency has been on a downward spiral, marked by significant devaluations and fluctuations in recent times.

Argentina: Economic Turmoil With an Inflation Rate Soaring to 121.7%

Meanwhile, in the southern hemisphere of South America, Argentina is facing its own economic turmoil with an inflation rate soaring to 121.7%. Argentina’s inflation saga is extensive, with a significant driver being the swift increase in money supply.

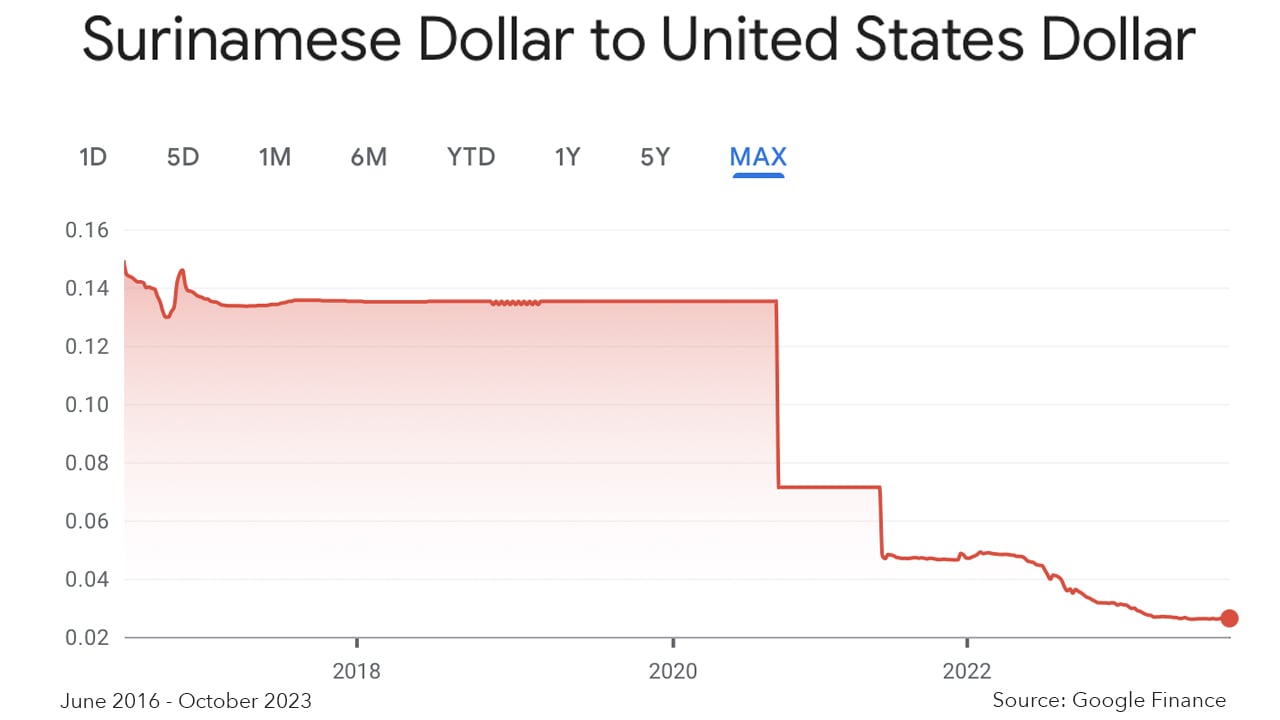

Suriname: Inflation Rate of 53.3%

On the other hand, Suriname, the smallest sovereign nation in South America, is experiencing an inflation rate of 53.3% as of October 2023. The inflationary pressures in Suriname stem from a myriad of factors, including rampant money creation, fiscal imbalances, and external disruptions.

Turkey: Contending With an Inflation Rate of 51.2%

Meanwhile, Turkey, straddling the borders of Southeast Europe and West Asia, is contending with an inflation rate of 51.2%. This economic challenge is fueled by Turkish President Recep Tayyip Erdogan’s unconventional stance favoring low interest rates.

Barter Systems and Digital Currencies as Refuge

Completing the list of the top ten nations grappling with the highest inflation rates are Sri Lanka (48.19%), Iran (47%), Haiti (43.6%), and Sierra Leone (42.9%), with Ghana closely following in the 11th spot, experiencing an inflation rate of about 42.2% as of October 2023. Residents in each of these countries are adopting various strategies to mitigate the effects of inflation.

These include engaging in barter systems, trading goods and services directly rather than relying on their weakening national currencies, and increasingly turning to digital currencies like bitcoin (BTC) and stablecoins. Numerous reports underscore the prevalent use of cryptocurrency in the regions most affected by inflation. In Venezuela, USDT is a popular means of settlement.

"Venezuela has had one of the worst ever hyperinflation rates at over 1 million percent," one citizen told Chainalysis in an October 2023 report. "Cryptocurrency, particularly stablecoins, has helped many Venezuelans overcome this."

Both the general populace and financial institutions in Zimbabwe are increasingly exploring crypto assets. In Argentina, economic uncertainty has led residents to lean on crypto assets and stablecoins, while in Sudan, there has been a noticeable shift toward digital currencies. Additionally, besides the U.S. dollar, the Turkish lira is gaining traction as one of USDT’s leading trading pairs globally. These borderless financial assets offer individuals a viable alternative, empowering them to preserve their wealth against an inflating fiat currency.

What do you think about the ten countries with inflation above 40%? Share your thoughts and opinions about this subject in the comments section below.

Frequently Asked Questions

How is gold taxed by Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

The rules governing these accounts vary by state. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. You can delay until April 1st in Massachusetts. New York has a maximum age limit of 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Is buying gold a good way to save money for retirement?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion bar is the best way to invest in precious metals. But there are many other options for investing in gold. Research all options carefully and make an informed decision about what you desire from your investments.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you are looking for cash flow from your investment, buying gold stocks will work well.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs may include stocks that are owned by gold miners or precious metals refining companies as well as commodity trading firms.

How much tax is gold subject to in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. Gold is not subject to tax when it's purchased. It is not considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

Gold can be used as collateral for loans. Lenders look for the highest return when you borrow against assets. Selling gold is usually the best option. This is not always possible. They might just hold onto it. They may decide to resell it. The bottom line is that you could lose potential profit in any case.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. It is better to leave it alone.

How much are gold IRA fees?

An Individual Retirement Account (IRA) fee is $6 per month. This includes the account maintenance fees and any investment costs associated with your chosen investments.

To diversify your portfolio you might need to pay additional charges. The type of IRA you choose will determine the fees. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

In addition, most providers charge annual management fees. These fees vary from 0% to 11%. The average rate is.25% per year. These rates are usually waived if you use a broker such as TD Ameritrade.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- How do you keep your IRA Gold at Home? It's not exactly legal – WSJ

investopedia.com

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

How To

Three ways to invest in gold for retirement

It's important to understand how gold fits in with your retirement plan. There are several options to invest in precious metals if your employer has a 401k. You may also want to consider investing in gold outside of your workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. You may also want to purchase precious metals from a reputable dealer if you don’t already have them.

These are three easy rules to remember if you invest in gold.

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, invest in cash. This will protect you from inflation and help keep your purchasing power high.

- Physical Gold Coins: You should own physical gold coins, not just a certificate. Physical gold coins are easier to sell than certificates. Physical gold coins don't require storage fees.

- Diversify your Portfolio. By investing in multiple assets, you can spread your wealth. This can reduce market volatility and help you be more flexible.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: 10 Nations Grapple With Soaring Inflation, Surpassing 40% and Shaking Economies

Sourced From: news.bitcoin.com/from-venezuelas-360-to-ghanas-42-10-countries-worldwide-feel-the-sting-of-inflation/

Published Date: Sun, 29 Oct 2023 18:30:28 +0000