American Hartford Gold makes it easy to set up and fund your precious metals IRA. They offer several convenient ways to deposit your funds. They also offer account rollover services. You can even use the company's free silver delivery service. There are no IRA fees at American Hartford Gold.

American Hartford Gold offers free silver

American Hartford Gold is one of the nation's largest gold retailers and delivers more than $1 billion in precious metals every year. With an A+ BBB Rating and a 5-Star Trustpilot Rating, the company offers investment grade gold and silver at competitive prices. What's more, it offers a free silver buyback commitment with no back-end fees.

American Hartford Gold is a family-owned company with the mission to help families and individuals diversify their wealth through precious metal investments. Their products range from physical precious metals to innovative Gold IRAs. Additionally, they offer extensive information on the precious metals market and their historical value. The company also offers free educational resources, which educates investors on the importance of precious metal investments.

Free IRA rollovers

When it comes to Gold IRA rollovers, it is important to work with a qualified custodian. GoldCo partners with a number of well-known IRA custodians. The process generally takes two weeks. However, the timeframe for a rollover may vary depending on the amount of funds and the application process. A specialist can help you with all the details.

Other benefits of American Hartford Gold IRAs include free set-up, free retirement account rollovers, and no fees. They even offer free shipping to their depository facility and waive storage fees for up to three years. There is no minimum contribution requirement with this IRA, and you do not need to maintain a minimum balance. American Hartford Gold also has regular promotions that may save you money on account maintenance.

Free delivery of precious metals

If you're looking for a reputable and reliable IRA provider, look no further than American Hartford Gold. The company offers a comprehensive service that includes everything from IRA setup to delivering your precious metals. They also provide storage services and expert advice. IRA customers can choose between gold or silver coins, as well as both.

This company has been around for over two decades and is a family-owned business. It prides itself on offering the highest-quality gold and silver products. It is dedicated to satisfying every customer, from new investors to seasoned investors. Their experienced staff will help you make the right decision by sharing the latest market data and historical perspectives. They have an A+ rating from the Better Business Bureau and a comparable satisfaction rating from many customer review sites. By investing in gold and silver, you'll be building your future economic security.

Frequently Asked Questions

What are the fees for an IRA that holds gold?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

To diversify your portfolio you might need to pay additional charges. These fees will vary depending upon the type of IRA chosen. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

Most providers also charge annual management costs. These fees range between 0% and 1 percent. The average rate is.25% annually. These rates can be waived if the broker is TD Ameritrade.

How does a gold IRA work?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

Physical gold bullion coin can be purchased at any time. You don't have to wait until retirement to start investing in gold.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold holdings won't be subject to taxes when you pass away.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. It is not required that you include your gold in the final estate report because it remains outside your estate.

To open a gold IRA, you will first need to create an individual retirement account (IRA). Once you've completed this step, an IRA administrator will be appointed to your account. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. The minimum deposit required for gold bullion coins purchase is $1,000 A higher interest rate will be offered if you invest more.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

However, if you only take out a small percentage, you may not have to pay taxes. However, there are exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

It is best to not take out more than 50% annually of your total IRA assets. If you do, you could face severe financial consequences.

Is gold a good choice for an investment IRA?

Gold is an excellent investment for any person who wants to save money. It can be used to diversify your portfolio. There is much more to gold than meets your eye.

It has been used as a currency throughout history and is still a popular method of payment. It's often referred to as “the world's oldest currency.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It's hard to find and very rare, making it extremely valuable.

The supply and demand for gold determine the price of gold. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. Gold's value rises as a result.

On the other hand, people will save cash when the economy slows and not spend it. This results in more gold being produced, which drives down its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you have gold to invest, you will reap the rewards when the economy expands.

You'll also earn interest on your investments, which helps you grow your wealth. You won't lose your money if gold prices drop.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

finance.yahoo.com

irs.gov

bbb.org

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Guidelines for Gold Roth IRA

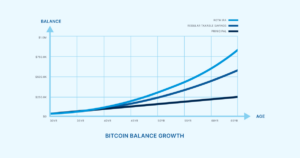

The best way to invest for retirement is by starting early. It is best to start saving for retirement as soon you can (typically at age 50). It is essential to save enough money each year in order to maintain a steady growth rate.

You can also take advantage of tax-free savings opportunities like a traditional 401k (k), SEP IRA (or SIMPLE IRA). These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. This makes them great options for people who don't have access to employer matching funds.

The key is to save regularly and consistently over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.